2026 Broiler and egg outlook: Soaring demand for protein, high beef prices underpin sector outlook

In looking ahead to 2026, shifting consumer preferences toward protein‑rich foods are creating new opportunities for broiler and egg producers. Strong demand—and higher prices for other meats (namely beef) —is pushing more consumers toward chicken, meaning additional production will be needed. In this year’s broiler and egg outlook, we break down what this means for pricing and production in the months ahead.

Would you like the chicken or the beef?

It’s 5:15 p.m. on a Tuesday night, somewhere between work, school, and kids’ dance class. Supper needs to be quick, so you grab a fajita kit out of the pantry. But what meat to use with the kit – chicken breast or ground beef? Taste preferences aside, if you were looking to stretch your dollar, frying up ground beef would have been the more cost-friendly choice historically. That is no longer the case.

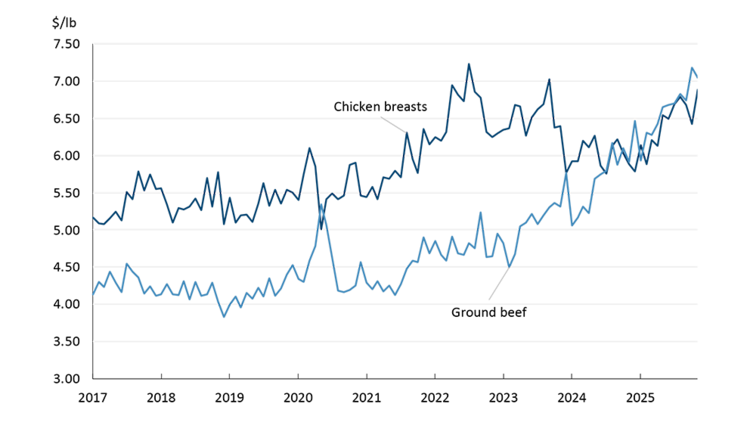

Prior to 2021, ground beef was approximately $1.00/lb. cheaper than chicken breast. And while the price of both items has increased in the last five years, since mid-2024 the price of ground beef has caught up to – and in some recent months, surpassed – the price of chicken breasts (Figure 1).

Figure 1: Ground beef is now just as expensive as chicken breasts

Source: Statistics Canada, FCC Economics

The astonishing increase in beef prices has been well chronicled, but less discussed is how the rise in beef prices has created additional demands on the broiler sector as consumers substitute chicken for ground beef.

All else being equal, economic theory would dictate that a sharp rise in demand would lead to higher prices. Indeed, this has played out in recent inflation data, where fresh or frozen chicken prices increased 6.7% on average in the final three months of 2025 after increasing 0.9% on average from January to September. Remarkably, this rate of price growth was still well below the rate of beef price increases (17.1% on average during those three months).

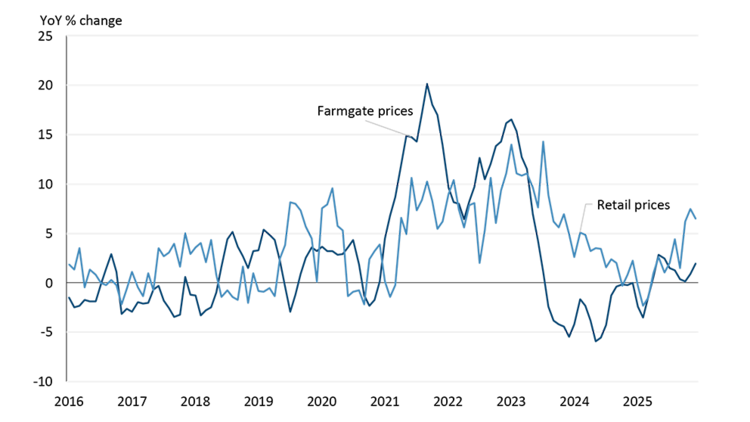

Producer prices are largely influenced by the cost of production, particularly key inputs such as feed. As these input costs fluctuate, so too do the prices paid to producers. At times, this can result in noticeable differences between producer and retail price trends. For example, there are periods when retail prices rise independently of producer prices (Figure 2), suggesting that factors beyond farm-level costs — such as processing, distribution, or retail margins — may be contributing to consumer price increases. Conversely, there have also been times when producer prices have grown more rapidly than retail prices, often reflecting rising input costs. These dynamics highlight the complex relationship between farm-level economics and end-market pricing.

Figure 2: Comparing the rise and fall of farmgate and retail poultry prices

Ontario producer prices only.

Sources: Statistics Canada, AAFC, FCC Economics

Looking ahead to 2026, with feed costs remaining low thanks to ample global supplies, the feed component of the farm-gate minimum live price should see little upward pressure. We are forecasting farmgate prices to remain in line with 2025 observed values (Table 1) though margins will remain positive given strong demand and aforementioned low feed costs.

Table 1: Farmgate prices likely to be flat, perhaps slightly lower, in 2026

Alberta | Ontario | |

|---|---|---|

2020 | 2.19 | 2.11 |

2021 | 2.48 | 2.40 |

2022 | 2.81 | 2.68 |

2023 | 2.96 | 2.77 |

2024 | 2.89 | 2.69 |

2025 | 2.85 | 2.69 |

2026f | 2.83 | 2.67 |

Dollars per kilogram

Sources: Statistics Canada, FCC Economics

Watch the 2026 FCC Economic Outlook for the broiler sector.

Avian flu could limit production to start the year

There are some concerns about underfilling of quota to meet this additional demand, and on that front, this winter’s battle against avian influenza might cause some issues, especially in BC. The disease began to rear its ugly head again last fall, and then in December, floods in the province caused further strain on producers in the area. These twin impediments to production caused the BC Chicken Marketing Board to alter quota arrangements to adjust to the difficulties.

As of January 29, the total amount of active cases in commercial flocks nationwide was down from mid-December (Table 2). However, cases in BC were essentially unchanged (down from 23 to 22) and up in Ontario (from 5 to 9). BC is Canada’s third largest chicken producing province, accounting for 14% of total Canadian production on average, while Ontario is the largest, accounting for 35%.

Table 2: Active cases of avian influenza in Canada

Province | Active cases – December 15, 2025 | Active Cases – January 29, 2026 |

|---|---|---|

Alberta | 6 | 1 |

BC | 23 | 22 |

Manitoba | 5 | 0 |

Ontario | 5 | 9 |

Quebec | 2 | 1 |

Saskatchewan | 3 | 1 |

Total | 44 | 34 |

Commercial flocks only.

Source: CFIA

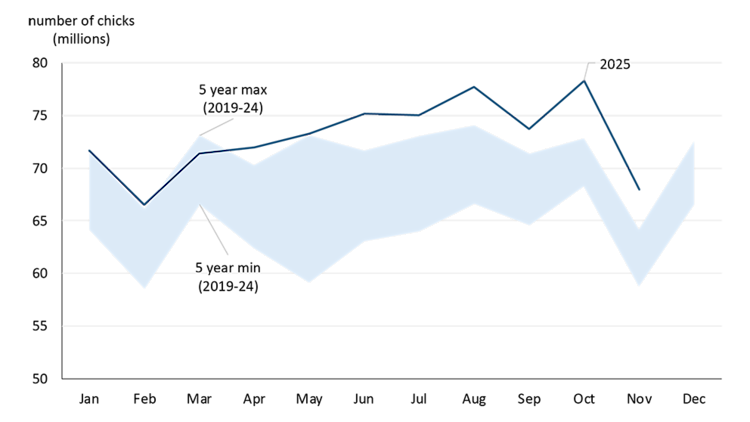

Prior to avian flu outbreaks in the fall, more chicks were placed for broiler production in the second half of 2025. There were four months where the number of chicks even surpassed 75 million, to reach a record high (Figure 3). Collectively, in the second half of 2025, 5.6% more chicks were placed into production than during the same time period in 2024, despite the seasonal fall in December. Assuming avian flu outbreaks are well controlled, this bodes well for production numbers in the first part of 2026.

Figure 3: Placement of chicks for broiler production surpassed 75 million several times in 2025

Source: Statistics Canada, FCC Economics

Imports account for approximately 11% of total domestic supply of chicken, a number that’s been relatively stable over the last several years. By volume, imports from Chile have been on the rise in the last two years with that country’s accession to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). In fact, 2025 was the first year that fill rates (that is, the volume of imports / volume of tariff-rate quotas) for chicken and chicken products under both the CPTPP and the CUSMA agreements were near 100%. Expect that to be the case again in 2026. But with chicken imports essentially capped by various trade agreements, further short-term increases in demand – if not met through further domestic production – may need to be met through stocks of frozen chicken. These stocks, when adjusted for population growth, are tight right now on a per capita basis, hovering near their lows last seen in 2020.

Egg production at record highs as population growth slows

It’s not just meat and dairy proteins that are seeing increased interest from consumers: eggs, too, are likely to continue to benefit from this boom, especially considering they are relatively cheap, versatile, and an accessible source of protein in comparison to meat sources.

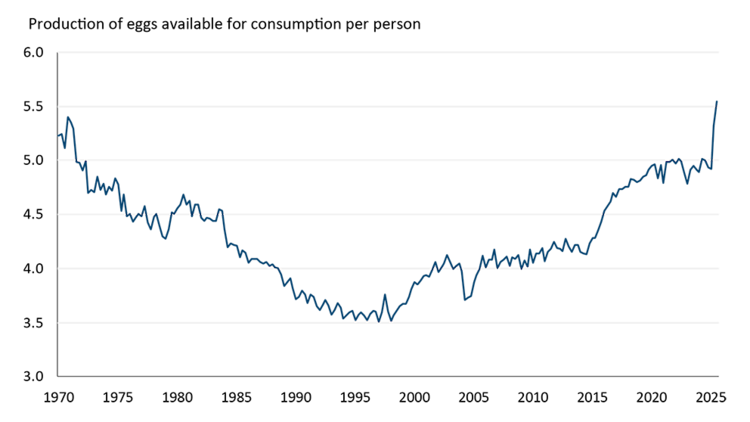

There has been a remarkable run of increased per capita consumption of eggs, which has seen a sharp reversal since the late 1990s. Production correspondingly increased to meet that demand (Figure 4). However, there was a significant jump in the second half of 2025. More specifically, the number of eggs available for consumption in Q3 2025 (5.54 dozen/person, up from 5.00 in Q3 2024) indicates a large increase in production amid slowing population growth. The fact that volumes of whole egg stocks in December 2025 were 432 mt – nearly twice as high as the recent average for that month – would seem to verify this observation.

So, it appears there will be two opposing forces playing out in the first quarter of 2026 that will be key for production prospects for the remainder of the year. While it appears there are plenty of eggs available as of December, we only have anecdotal evidence of the impacts of avian flu on the national layer flock (i.e., how production capacity was lost this winter) as of the time of writing. Quota allocation may be slowed or altered to begin the year if no significant production capacity was lost. Regardless, the longer-term outlook for egg consumption and production continues to be positive.

Figure 4: Increased egg production per person spiked at the end of 2025

Quarterly data.

Source: Statistics Canada, FCC Economics

Bottom line

Strong consumer demand for protein‑rich foods and historically high beef prices will continue to support Canada’s broiler and egg sectors in 2026. While avian flu and regional production challenges may constrain early‑year output, low feed costs, solid chick placements, and sustained appetite for eggs position the industry for steady growth. Meeting demand will hinge on stable flock health and consistent domestic production throughout the year.

Graeme Crosbie

Senior Economist

Graeme Crosbie is a Senior Economist at FCC. He focuses on macroeconomic analysis and insights, as well as monitoring and analyzing trends within the dairy and poultry sectors. With his expertise and experience in model development, he generates forecasts of the wider agriculture operating environment, helping FCC customers and staff monitor risks and identify opportunities.

Graeme has been at FCC since 2013, spending time in marketing and risk management before joining the economics team in 2021. He holds a master of science in financial economics from Cardiff University and is a CFA charter holder.

How cash flow tracking in the poultry sector can improve the bottom line and allow producers to capitalize on market opportunities.