Cattle outlook 2026: Is this the year when the herd size finally expands?

Tight supply pushed up cattle prices to record highs in 2025, and despite recent corrections, the market remains historically strong. Strong prices, abundant feed supplies, and falling feed costs are all boosting optimism in the industry. Yet, the question most often asked is, how long will cattle prices stay elevated and when will rebuilding of the herd occur? In this outlook, we examine where we are in the current cattle cycle, an important indicator of how long high prices might last and share our price projections along with what the sector can expect in 2026 and beyond.

The cattle cycle: herd expansion and contraction and relationship to prices

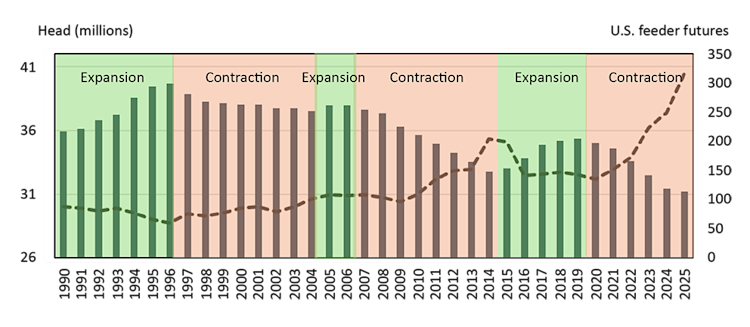

A full cattle cycle usually lasts 10 to 12 years, moving from expansion to contraction before starting over, though it can be a couple of years longer or shorter. During contraction, tight profitability leads producers to make cautious decisions and slow herd growth as more cows are culled than replaced. In expansion, improving prices and profitability encourage producers to retain heifers and grow their herds. Predicting the timing of peaks and troughs in the cycle is difficult because these phases can vary in length depending on market trends and economic conditions. Factors like beef demand, production costs, feed availability and pasture conditions e.g. drought, play a big role. The past few cattle cycles have been made longer and were heavily influenced by North American drought conditions (e.g. 2013), and black swan events like the BSE disease over the 2003 – 2005 period.

Based upon historical cattle cycles (Figure 1), the cattle market should be nearing the end of contracting, which marks the bottom of the cycle and early stages of the expansion phase. We’ve already seen early signs that the Canadian herd may have stopped contracting, according to July 1, 2025, inventory numbers. However, the U.S. cow inventory is the main driver for overall cattle markets. Because the U.S. did not release July 1, 2024, data, we don’t know if herd rebuilding has started south of the border. Looking at January 1st, 2025, U.S. numbers, the herd still appears to be in the contraction phase.

Figure 1: North American cattle cycle - cow inventory and feeder price relationship

Sources: Statistics Canada, USDA, FCC Economics

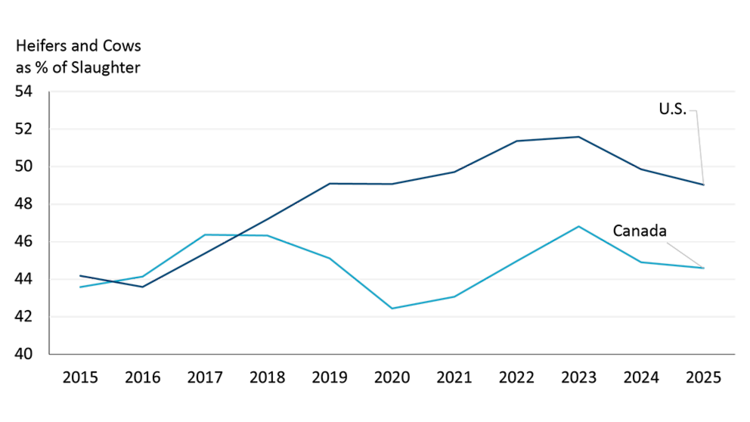

A leading indicator of potential rebuilding is the number of cows and heifers heading to slaughter relative to total cattle slaughtered. Combined cow and heifer slaughter rates need to decline below approximately 47% of total cattle slaughtered before the herd can grow again. While we have seen easing of the number of Canadian heifers heading to slaughter, U.S. slaughter rates through 2025 have not fallen low enough to signal herd expansion is underway (Figure 2).

Figure 2: Few signs of cattle herd expansion as U.S. heifer and cows slaughter remains elevated

Sources: Canfax, USDA, FCC Economics

This slaughter trend is critical because it directly influences cattle pricing dynamics, which are closely tied to herd inventory levels. U.S. feeder cattle futures have a strong negative relationship (-0.92 correlation) with North American cow inventory levels. In simple terms, when herd sizes go up, prices tend to go down, and vice versa. Historically, cattle prices usually peak in the first year of herd expansion. After that, prices either stay flat or decline slightly, followed by bigger drops two to three years into the expansion phase.

For example, in 2016, cattle prices dropped by 30% as cow numbers increased and the market expected plenty of future beef supply. Prices then stayed mostly flat for several years. Based on this pattern, cattle prices could remain relatively strong until at least 2027, possibly even into 2028. That said, short-term declines are possible—especially since prices have been very high recently.

For 2026, our forecasts show cattle prices easing from the elevated levels seen in 2025 but staying well above the five-year average (Table 1). Feeder cattle prices (550–850 lbs) are expected to dip in 2026 after hitting record highs in 2025 while fed steer prices are also expected to be softer but remain closer to last year’s levels.

Table 1: Cattle prices projected to remain strong in 2026

Livestock prices | 2026 forecast | 2025 estimate | 5-year average |

|---|---|---|---|

Alberta fed steer $/cwt | 280 | 295 | 220 |

Alberta 550 lb steer $/cwt | 480 | 555 | 345 |

Alberta 850 lb steer $/cwt | 390 | 430 | 285 |

Ontario fed steer $/cwt | 280 | 300 | 220 |

Ontario 550 lb steer $/cwt | 435 | 515 | 320 |

Ontario 850 lb steer $/cwt | 370 | 430 | 285 |

Sources: Statistics Canada, AAFC, USDA, CanFax, CME futures, and FCC calculations

Our forecast for price declines in 2026 need to be understood in the context of how high prices climbed in 2025. It doesn’t necessarily mean prices are weak – just that they’re coming down from last year’s peak. Recall that feeder cattle prices jumped 19% between July and October, right after the U.S. re-closed the Mexican border to cattle. Since peaking, prices have fallen 15% but are still 30% higher than 2024. There are several reasons for the recent drop in cattle prices. One is that markets expect the border might reopen for Mexican cattle imports, even though there is no official confirmation. Additionally, the U.S. recently dropped tariffs on Brazilian beef imports, though these imports remain minimal compared to overall U.S. beef supply, there will be some impact on U.S. cattle pricing. The recent news that one U.S. packing plant is closing, and another is cutting back to a single shift has caused cattle prices to decline. On top of that, concerns about softer consumer demand are weighing on prices. Feeder cattle prices represent future beef demand, while fed steer prices reflect current demand. Overall, prices are easing from 2025 peaks but remain strong compared to long-term averages, pointing to a continuation of a strong outlook for 2026.

Even with cattle prices projected to ease into 2026, abundant feed supplies will continue to support the strong profitability for cow-calf producers. Lower feed costs and a bigger drop in feeder calf prices compared to fed steer prices suggest feedlots could see better margins next year. In 2025, high feeder calf prices squeezed feedlot profits – even though fed cattle prices hit record highs, they didn’t rise as fast as feeder prices. That’s why 2026 could turn out to be a better year for feedlot operations.

While prices are projected to ease a bit in 2026, a few key factors could swing them either way and give us clues if the cattle contraction phase has reached its bottom.

Trends to monitor in 2026

1. January 1st and July 1st North American herd inventory levels

There are few signs that North American cow inventories will show expansion early in 2026. Still, the U.S. and Canadian herd numbers on January 1 and July 1 will be key to seeing if an expansion phase has started and if it’s continuing mid-year. The January report will give the first clear signal of producer plans, especially around heifer retention and cow numbers. If rebuilding is underway, beef supply forecasts could rise and pressure our price projections outlined in Table 1.

The July report will confirm whether the trend holds. A bigger herd by mid-year would point to more beef supply by the end of 2026 and into 2027. However, if contraction continues prices could once again trend higher.

2. Re-opening of the U.S. border to imports of Mexican cattle

The potential reopening of the U.S. border to Mexican cattle imports is a key factor for feeder cattle prices and remains something to watch. If imports resume, added supply could push prices lower. If the border stays closed, feeder prices could rise.

3. Consumer demand

Another trend to monitor is consumer demand. Beef demand has held up well despite higher prices, but it remains a key watch item because changing consumer preferences and substitution to other meats have potential to affect the market.

Bottom line

The Canadian cattle sector is set for another year of strong prices and profitability, supported by tight herd numbers and solid demand. While the bottom of the contraction phase of the cattle cycle should be nearing its end, we don’t anticipate major herd rebuilding in 2026. Any expansion will likely be gradual, keeping prices well supported for the next few years. Even if rebuilding begins, the North American herd remains at its lowest level in decades which will support prices. Based on past cattle cycles, prices should stay high—well above the five-year average—through 2026 and into 2027.

Leigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.