2026 Hog outlook: Second consecutive year of strong margins

After an unexpectedly strong 2025, things continue to look positive for the Canadian hog sector starting off 2026. Hog futures prices are near 5-year highs and are well supported. After several years of weaker demand and oversupply globally, the hog market has become more balanced. With lower feed costs relative to a few years ago, margins look to remain well supported for producers.

Disease continues to be a concern for producers all over the world, with many pork producing regions dealing with outbreaks of African swine fever (ASF), porcine epidemic diarrhea (PED), and porcine reproductive and respiratory syndrome (PRRS). If Canada can continue to keep PED and PRRS under control, and keep ASF out of the country, producers can feel optimistic given strong hog prices and manageable feed costs. In this outlook we examine what margins are expected to look like for the year ahead and what domestic and international demand looks like for Canadian pork.

Strong hog prices are being supported by cattle markets

For 2026, our forecasts for cash hog prices across the country are slightly above 2025 and well above their 5-year averages (Table 1). With cattle futures near record levels, this provides support for the hog market as a substitute protein. Demand for hogs is being fueled in part by domestic hog slaughter that increased in 2025 after multiple years of consolidation and is expected to be up slightly again this year. While live hog exports look to remain steady to the U.S. this year there is risk on the horizon as the Canada-U.S.-Mexico agreement (CUSMA) is up for review and voluntary country of origin labelling (VCOOL) came into effect on January 1. For now, these risks are being outweighed by the demand for Canadian hogs.

Table 1: Hog prices are expected to be above 5-year averages heading into 2026

Livestock prices | 2025 (actual) | 2026 (forecast) | 5-Year Average |

|---|---|---|---|

Ontario market hog $/kg | 2.65 | 2.80 | 2.45 |

Ontario feeder hog $/head | 110 | 115 | 100 |

Manitoba market hog $/kg | 2.55 | 2.70 | 2.35 |

Manitoba feeder hog $/head | 105 | 110 | 95 |

Isowean $/head | 70 | 65 | 60 |

Sources: Statistics Canada, AAFC, USDA, CME Futures, and FCC calculations

Hog margins are benefiting from lower feed costs

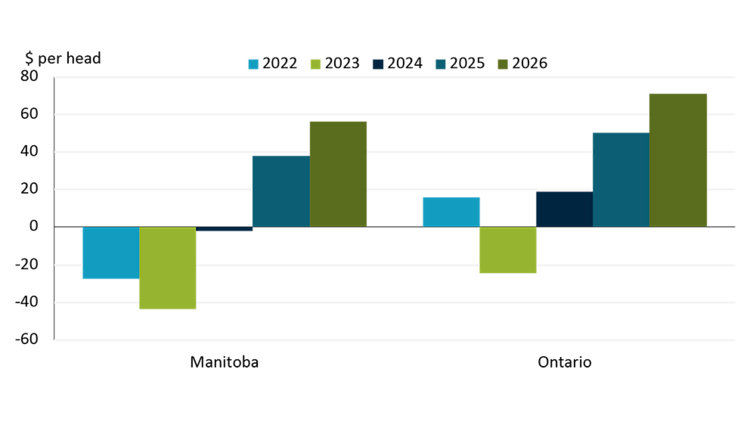

Record Canadian crop production last fall is pushing grains and oilseeds down. Feed grain prices, including wheat, barley, and corn, are expected to be steady or slightly lower, while oilseed prices are projected to decline due to high global stocks. Large domestic supplies and market access restrictions on Canadian pulses to India are likely to result in additional peas diverted to the feed market and utilized in hog rations. This drop means cheaper peas, soybean and canola meals for feed, with ample supplies expected to hold feed prices below the 5-year average throughout 2026. When we add in strong hog prices it suggests Manitoba and Ontario farrow to finish hog margins could reach their highest levels in five years (Figure 1).

Figure 1. Manitoba and Ontario farrow to finish returns look strong for the year ahead

Source: Statistics Canada, CanFax, Manitoba Agriculture and Resource Development, FCC Economics

Canadian pork prices are helping consumers choose it more often than a year ago

The price of pork at grocery stores is just one aspect to consider; it’s important to compare how it performs against alternative meats like beef and chicken. Since 2022, pork prices in grocery stores have increased by over 13%, but this rise pales in comparison to chicken and beef, whose prices went up nearly 22% and 38% respectively (see Figure 2). Because pork prices have risen more moderately, that meat has become a more affordable protein choice for Canadian shoppers.

Figure 2. Pork prices at Canadian grocers give consumers a reason to think twice

Source: Statistics Canada, FCC Economics

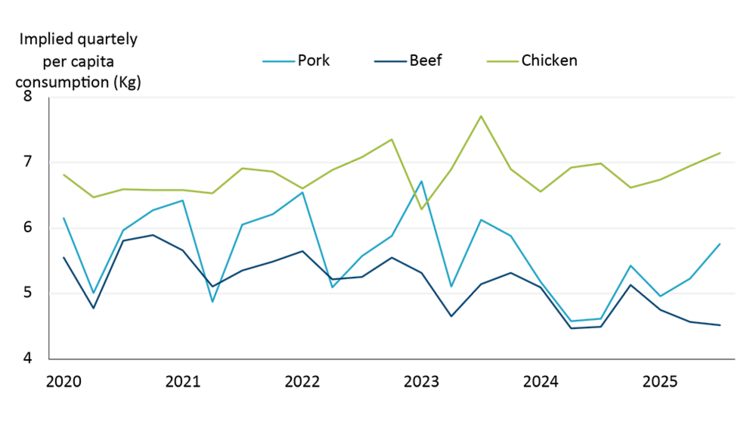

That at least partially explains the uptick in pork consumption last year, an encouraging development for producers (Figure 3). Provided pork prices continue increasing less than other proteins, it is reasonable to assume continued consumption.

Figure 3. Canadian started to increase their quarterly pork consumption in 2025

Source: FCC Economics

Canadian pork exports were down through first 10 months of 2025

The Canadian pork industry is heavily reliant on exports as over 60% of our pork production is exported. Through October of last year, Canadian pork processors exported 6% less than the 5-year average of 928 thousand metric tonnes (Table 2). This is highlighted by the large drop in shipments to China, part of which can be attributed to that country’s decision to impose a 25% tariff on Canadian pork. Despite recent announcements of tariff relief for other Canadian agricultural products, pork has not yet been granted a reprieve.

Continued success is being found however in Japan, Mexico, South Korea where Canada’s pork exports continue to grow at a solid pace. Trade to the U.S. continues to be strong and stable year to year, but as mentioned earlier, it remains a watch item for the second half of this year as CUSMA discussions start in earnest.

Table 2. Canadian pork exports are down slightly in 2025 relative to 5-year average

tonnes | 5-Year Average (2020-24) | 2025 relative to 5-Year Average |

|---|---|---|

U.S | 232 | -4% |

Japan | 171 | 43% |

Mexico | 103 | 44% |

China | 209 | -80% |

Philippines | 77 | -29% |

South Korea | 42 | 39% |

Rest of world | 94 | 9% |

Total | 928 | -6% |

Source: Statistics Canada, FCC Calculations

Bottom line

Unlike last year where trade concerns were an immediate issue that could potentially impact margins, this year we are expecting relatively smooth sailing through the first half of the year. Canadian hog production remains closely tied to exports to the U.S. and with disease impacts slowing herd growth stateside as well as restrained feed costs, it is creating strong margin opportunities. Canada’s pork producers continue to make strides in growing export markets in places like Japan, Mexico, and South Korea while remaining hopefully for changes in the 25% tariff rate from China. In other words, after weathering the storm of the past several years, hog producers are now in a good position to achieve solid profitability.

Justin Shepherd

Senior Economist

Justin Shepherd is a Senior Economist at FCC. He joined the team in 2021, specializing in monitoring agricultural production and analyzing global supply and demand trends. In addition to his speaking engagements on agriculture and economics, Justin is a regular contributor to the FCC Economics blog.

He grew up on a mixed farm in Saskatchewan and remains active in the family operation. Justin holds a master of applied economics and management from Cornell University and a bachelor of agribusiness from the University of Saskatchewan.

FCC Economics top charts to monitor impacting Canada’s agriculture and agri-food in 2026.