2026 crop outlook: export momentum key to prices given abundant supplies

Prices for grains, oilseeds, and pulses have been falling for most crops over the past several years largely due to global trade uncertainty and improved production. Globally, there are ample supplies for most grain and oilseeds, as many countries benefited from optimal growing conditions last year. The situation was no different domestically as Canada produced a record 107 million tonnes in 2025. Considering uncertainties with regards to trade and market access, farmers are, not surprisingly, wondering about prospects for profitability.

In this outlook, we look at the key factors that will drive prices and present our forecasts for the 2026-27 crop year.

Ample supplies limit price forecast for 2026–27

Commodity prices for the 2025-26 crop year have declined year-over-year for nearly all crops. The downward price pressure is expected to continue into the 2026-27 crop year (Table 1). Abundant supplies due to record grain and oilseed production along with trade uncertainty and market access challenges will limit prices for the new crop year keeping them all well below the five-year average. Record production means higher carry-out stocks at crop year end and that has added pressure to prices.

Table 1: Crop Prices ($/tonne) for new crop year under pressure and below five-year averages

Cash crop | 2024-2025 (actual) | 2025-2026 (forecast) | 2026-2027 (forecast) | 5-Year Average |

|---|---|---|---|---|

Corn (ON) | 240 | 240 | 245 | 270 |

Soybeans (ON) | 525 | 520 | 515 | 610 |

Canola (SK) | 630 | 615 | 585 | 735 |

Peas (SK) | 410 | 300 | 290 | 430 |

Lentils (SK) | 810 | 520 | 490 | 800 |

Spring wheat - (SK) | 290 | 260 | 255 | 345 |

Feed barley (AB) | 250 | 245 | 240 | 295 |

Durum (SK) | 340 | 290 | 275 | 440 |

Sources: Statistics Canada and FCC calculations

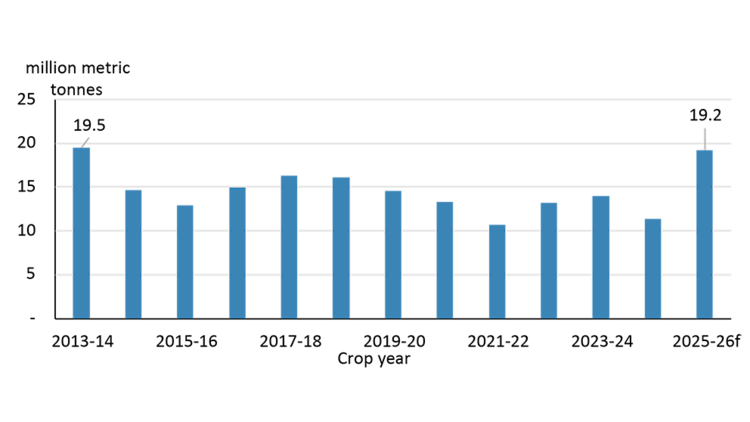

Canadian ending stocks expected to surge

In Canada, most principal field crop ending stocks are projected higher for the 2025-26 crop with the exception of corn and soybeans. Combining all Canadian grains and oilseeds together, crop year ending stocks are expected to surge to levels not seen since the bumper crop of 2013-14 (Figure 1).

Figure 1. Canadian crop year ending stocks expected to surge to levels not seen since 2013-14

Source: Statistics Canada

Corn ending stocks are expected to be similar to last year while soybean ending stocks are projected to decline slightly due to production challenges in Eastern Canada. Demand remains high for many crops, including wheat, and while wheat exports have been strong so far this crop year the expected increase in carryover will likely continue to weigh on prices limiting upside into the 2026-27 crop year.

Peas and lentils face the potential for record high ending stocks – 70% higher than previous highs – due to a 30-40% jump in production year over year from strong yields, in addition to trade barriers. Canadian pea prices have remained under pressure from restricted access to both China and India due to tariffs. The recent removal of the 100% Chinese tariffs on peas is a positive development, but regaining access to India remains critical to reducing high year-end stocks and preventing further price declines. Canadian pulses still face significant market access challenges in India. Peas with higher tariffs at 30% will see more uncertainty and weaker prices while lentils, at a 10% tariff into India means exports will still move, but at lower prices.

For canola, increased production and losing the Chinese export market for a portion of the crop year means stocks relative to use have increased since last year, which has weighed on prices. Ending stocks are still expected to rise on increased supply.

While Canadian ending stocks affect aspects of local prices, global supply and demand fundamentals have an even bigger impact on pricing. In fact, U.S. ending stocks are a major factor that determines Canadian prices for major crops.

Unless exports to China materialize U.S. soybean ending stocks will rise

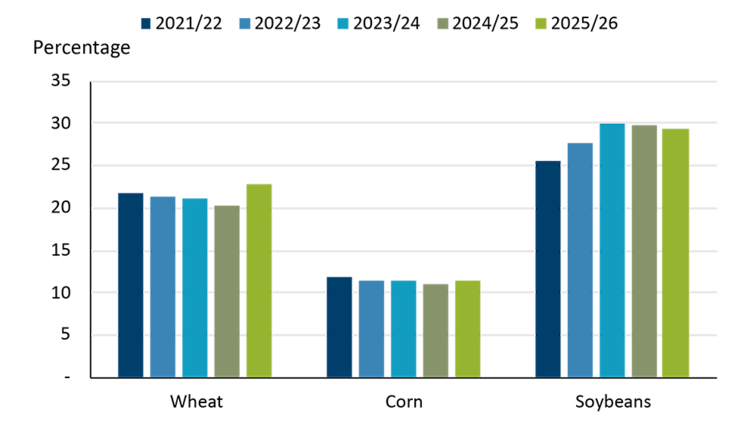

Stocks-to-use ratios for the three major global crops (corn, soybeans and wheat) from the latest World Agricultural Supply and Demand Estimates (WASDE) report released by the USDA provide valuable insights on the market (Figure 2). Currently there are minimal global production concerns for most commodities.

Figure 2: Global stocks-to-use ratios for corn, soybeans and wheat

Source: United States Department of Agriculture

The global wheat stocks-to-use ratio is expected to rise because of strong worldwide supply, driven by higher production from major exporters like Canada. At the same time, weaker demand from key importers could limit price increases.

Despite strong global production of corn and soybeans, solid demand has allowed stocks for 2025/26 to remain in line with last year for both commodities. The U.S. achieved record corn yields and production. Soybeans also had record yields, supporting significant production. Global corn stocks-to-use are expected to finish the crop year slightly above last crop year. Even though global soybean ending stocks are projected to decline at the end of the crop year, they remain above the 5-year average.

Our 2026 top trends blog highlighted the relationship of exports on ending stocks and crop prices. The export pace of commodities will provide greater insight into the potential size of ending stocks for commodities in the current crop year, influencing prices this year.

Trade developments and exports key trends to monitor in 2026

Trade developments could influence our 2026 price projections. A possible trade deal between the U.S. and China might help stabilize agricultural markets boosting exports and prices. If agreements are reached early in the year, they could strengthen commodity markets and support growth in the sector.

For example, the recent trade agreement between Canada and China which will take affect by March 1st will give the canola sector a significant reprieve from tariffs. While the deal would still see tariffs of 15% on canola seed, down from 76%, the elimination of the 100% tariffs on canola meal is a positive trade development. Canadian processors were previously forced to discount their prices in order to find alternative export markets.

With the reduction in canola tariffs, we could see some additional exports to China moving Canada closer to the 8 million tonne export target projected by AAFC this crop year. Without the Canada-China trade agreement Canadian exports would likely only reach 6.5 million tonnes as the current export pace is 20% below target. The fulfillment of Chinese purchases going forward of both canola seed and canola by-products will be important to keep ending stocks from increasing above current projections and will keep prices supported.

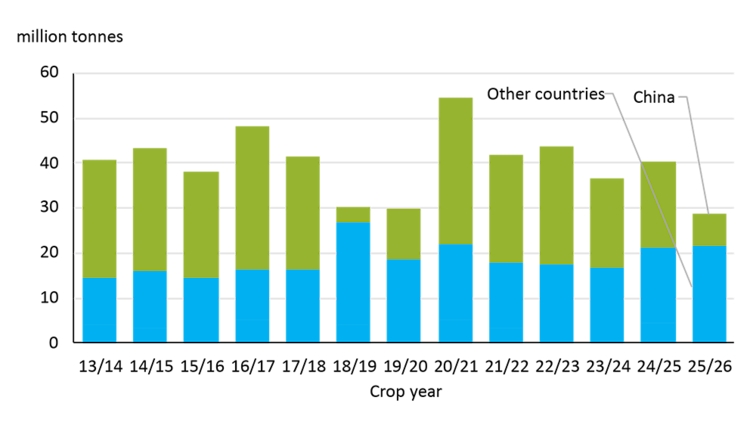

In the U.S., corn exports are doing well, but soybeans are underperforming as export commitments remain well behind last year’s pace (Figure 3). While China has bought some U.S. soybean cargoes, a formal U.S.-China deal remains absent. Unless exports to China materialize U.S. soybean ending stocks will increase pressuring oilseed prices.

Figure 3: U.S. soybean sale commitments and exports to China continue to lag historical levels

Source: USDA

Export pace for both Canadian and U.S. crops will be a major driving factor for where ending stocks finish the current crop year. Monitoring exports and ending stock estimates can be valuable for price and farm revenue expectations this year. It also allows producers to make incremental sales when marketing opportunities present themselves. While farm prices and revenue are expected to be restrained the expense side of the equation is also important.

Managing costs will be more important than ever

On the expense side, crop inputs are expected to remain elevated, putting producers in negative territory for margins. Profitability projections for nearly all grain, oilseed and pulse crops across Canada are below break-even levels while many crops are showing large losses per acre (e.g. barley and peas in Manitoba). However, outcomes will largely depend on individual crop yields, as well as operating and land costs.

Knowing and managing cost of production is critical as increased on-farm inventory reduces and delays cash flow. Farmers would do well to focus on the things they can control and should not underestimate the incremental efficiencies from small improvements. For example, renegotiating land rents that are up for renewal could be considered. Communication with input suppliers on needs e.g., target yields and appropriate fertilizer and chemical rates, is also crucial for producers.

Bottom line

Large carryover stocks for most crops are expected to keep prices under pressure into the 2026–27 crop year. Uncertainty around global trade and market access adds more complexity to the price outlook. Watching how exports progress will be important as it will influence how the price projections outlined above evolve throughout the year. More importantly, it can create pricing opportunities and help set expectations for the year ahead, including spring planting decisions. Understanding and managing cost of production will be more important than ever to protect profitability.

Leigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.