Preliminary outlook: Possible cost pressures in 2026 reinforce drive to find efficiencies

While harvest is far from being done across the country, it’s not too early to start thinking about profitability for next year. Prices and expenses are always top of mind for farmers. Although input costs have decreased from their peak in 2022, they have remained elevated and are once again trending higher. Unlike 2022, when rising crop input costs were offset by strong commodity prices, 2026 is shaping up very differently. Crop prices are forecast to trend in the opposite direction, squeezing margins and impacting productivity. This pressure is compounded by global trade disruptions, including the tariffs on Canadian canola and peas by China.

With margins under pressure, managing costs is more important than ever. While trade and geopolitical issues are largely out of your control, focusing on what is within your control can make a difference. Decision aids, agronomic advice and other value-added support from input suppliers can help farmers make better decisions, improve efficiency, and boost revenue.

Below is our first look at the factors impacting the crop input market for 2026, which is intended to help farmers plan for the year ahead.

Crop input costs expected to rise again in 2026

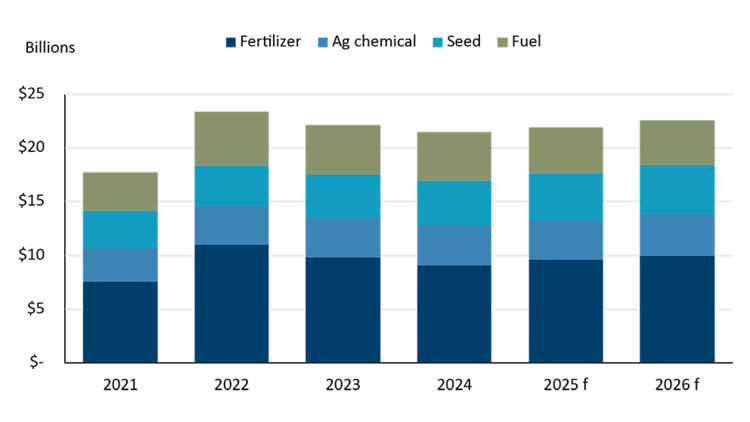

Canadian farmers are expected to spend $22.5 billion on crop inputs in 2026 (Figure 1). This could make 2026 one of the most expensive crop years, potentially rivaling the record set in 2022. Expenditures on chemicals and seeds are rising due to inflationary pressures. Fuel is the only cost expenditure projected to decline. However, fertilizer, the largest expense category, is forecasted to reach nearly $10 billion driven by elevated prices and is the focus of our analysis.

Figure 1: Canadian crop input expenditures expected to remain elevated in 2026

Sources: Statistics Canada and FCC Economics

Fertilizer prices remained elevated

Fertilizer prices have been rising over the summer, even though this is usually a quiet time when prices tend to drop. Nitrogen fertilizer has stayed high across North America because U.S. farmers planted a lot more corn, estimated at 97.3 million acres, up 7.4% from last year. This increase has driven up demand for nitrogen, especially for summer top-dressing.

On the global market, strong demand has also pulled nitrogen into other markets including Europe. Phosphate prices remain high as global supply is tight. India has been driving much of the summer demand for urea and phosphate.

In contrast, in Canada, high fertilizer prices have kept summer demand low. Many farms delayed purchases for next year, instead taking a wait-and-see approach amid market uncertainty. Retailer summer fill programs were quiet due to limited price incentives. As global demand stays strong and supply tight, fertilizer costs may remain high, just as crop prices are expected to fall, putting more pressure on farm margins.

Increased production could pressure crop prices

U.S. farmers are on track to harvest a record-breaking corn crop this year, thanks to record yields and expanded acreage. Despite improved grain and oilseeds prices earlier in the summer, the increased production, along with the loss of Canadian canola and pea export opportunities to China, and the impact of U.S.–China tariffs, are expected to put downward pressure on commodity prices. As prices fall, farmers may become more cautious with planning for next year’s acres and inputs, with reduced cash flow and profitability in mind.

Crop price ratios

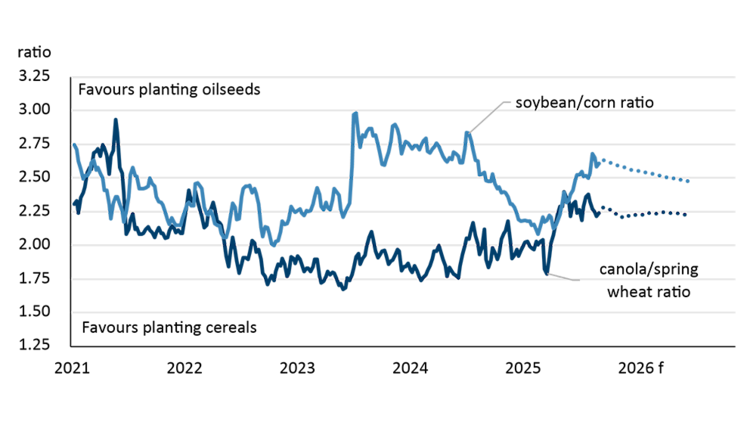

Crop prices ratios such as soybean-to-corn and canola-to-wheat reflect the current state of supply and demand. Essentially, it’s a market signal to help farmers make planting decisions. Higher ratios favour planting oilseed (canola or soybeans) acres while a lower ratio favour planting cereals (corn or wheat).

Currently, the crop price ratios are favouring planting oilseed over cereals. Even though the ratio currently favors oilseeds due to strong biofuel demand, future demand and acreage will depend on the trade disputes with China, both Canada and the U.S. Canola prices are expected to be pressured unless Canada’s trade issues with China are resolved before spring. On top of that, China hasn’t bought any new crop soybeans from the U.S. because of ongoing tariffs. If this continues, both soybean and canola prices could drop further, and crop price ratios may shift back in favor of planting more corn and wheat by spring (Figure 2).

Figure 2: Crop price ratios could favour planting cereals by spring planting

Sources: Barchart and FCC Economics

Since corn requires higher amounts of nitrogen fertilizers, any shift to increased corn planting tends to drive up demand for nitrogen fertilizers, pushing up fertilizer prices. Thus, as planting approaches monitoring the crop price ratio as a proxy for U.S. nitrogen fertilizer demand. U.S. corn acreage for 2026 will once again factor into nitrogen fertilizer prices.

Fertilizer to crop price ratios

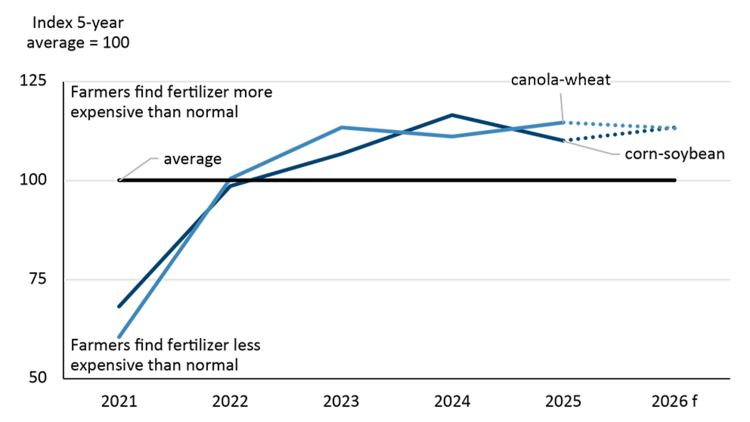

The fertilizer-to-crop price ratio measures the cost of fertilizer relative to the revenue farmers expect from their crops. A high ratio means fertilizer is expensive compared to crop prices. And conversely, a low ratio suggests fertilizer is more affordable. This ratio influences farmers’ input decisions on which crops to grow and how much fertilizer to use to maximize profitability.

Our projected fertilizer-to-crop price ratio is currently showing slight affordability declines for 2026 (Figure 3). Furthermore, there’s potential for crop prices to move lower, while fertilizer prices could continue to rise. This combination of downside risk for crops and upside risk for fertilizer means the fertilizer-to-crop price ratio could increase even further.

Figure 3: Fertilizer to crop price ratios remain elevated and could trend higher

Sources: Alberta farm input prices, Statistics Canada and FCC Economics

Global trade and geopolitics continue to influence the supply side of the fertilizer market. Russia’s war in Ukraine remains a key factor, especially for fertilizer. A peace deal could ease energy and fertilizer prices, helping restart European nitrogen plants. However, continued conflict would keep prices high. U.S. tariffs on Russia may raise nitrogen costs, especially in eastern Canada, which relies on UAN (Urea Ammonium Nitrate) fertilizer imports from the U.S., where Russia is a major supplier.

China has resumed limited exports of urea and phosphate fertilizers after years of restrictions. Even small volumes could ease global shortages, but it’s unclear if exports will increase further.

Enhanced uncertainties do not mean farmers should remain passive to external developments. They should focus on what they can control. Building strong relationships with input suppliers and agronomists is key. Many producers are now using economic decision tools to improve efficiency and productivity to protect profitability.

Practices like 4R Nutrient Stewardship involve applying the right fertilizer source, rate, time, and place are now used on over 25 million acres, or nearly 27 per cent of total cropland in Canada, helping reduce costs.

Economic thresholds help determine when inputs like pest or fungicide treatments are worth the cost, focusing on profitability rather than field appearance. Tools like fertilizer efficiency calculators (e.g., Manitoba Agriculture) guide optimal use and yield targets, while fungicide thresholds help weigh yield gains against input costs—avoiding unnecessary spending.

Aerial spraying is gaining ground due to its speed and reduced crop damage. While it is slightly more expensive per acre, it becomes cost-effective when accounting for trampling losses from ground equipment.

Together, these approaches reflect focusing on what you can control, where working collaboratively across the supply chain is key to maximizing returns. It helps with planning crop rotations, booking fertilizer and seed needs for next year, even when risks are high.

Bottom line

Canadian farmers are facing a challenging outlook for 2026, with the combination of elevated crop input costs and softening commodity prices squeezing margins. Global trade tensions, particularly with China, and geopolitical instability further cloud the outlook. In this highly uncertain environment, finding cost efficiencies and focusing on productivity gains are more critical than ever. Leveraging agronomic expertise, economic decision tools, and collaborative relationships with suppliers can help producers realize efficiencies and sustain profitability.

Leigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.