U.S. policy impacting biofuel potential in Canada

Biofuel production and consumption have experienced fluctuations over the past century, dating back to the era when Henry Ford’s Model T was capable of operating on ethanol. Although biofuels have periodically declined in popularity, the implementation of the Renewable Fuel Standard in the U.S. in 2007 initiated a renewed phase of building biofuel production facilities. In addition, biofuel production supports the demand for agricultural commodities, including crops such as corn, wheat, soybeans, and canola.

In Canada and the U.S., there are three liquid fuel categories that biofuels compete into and substitute for. The largest market is gasoline, followed by diesel, and then jet fuel. All these markets are well supplied with fossil fuels but substituting and blending biofuels can help improve fuel quality and reduce greenhouse gas emissions. U.S. biofuel policies will continue to play a large role in determining where Canadian biofuels are consumed, as well as which feedstocks are utilized. We will investigate each of these markets and identify watch items for Canadian agricultural producers.

Canada's ethanol growth driven by imports

Ethanol is frequently incorporated into gasoline formulations, representing a significant and established sector within the biofuels market. It typically remains cost-competitive with conventional gasoline and serves to improve octane ratings in final fuel blends when combined with lower-octane gasoline.

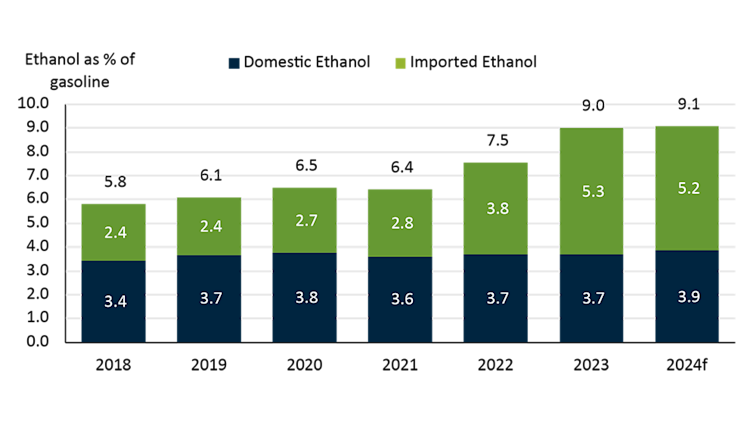

Canadian ethanol plant production through May decreased by 1% compared to the previous year, although output during that period has increased by 14% since 2021. The growth in ethanol production is attributed to improved efficiency, resulting in more ethanol produced per tonne of grain, with total grain use rising by 8% over the same interval. In the last year, ethanol accounted for 9.1% of the gasoline pool consumed in Canada, meaning that, on average, there was 0.091 litres of ethanol in each litre of gasoline (see Figure 1). Since 2018, the proportion of Canadian ethanol in the gasoline pool has remained largely unchanged, reaching 3.9% last year. Imported ethanol now represents a larger portion, with over 5% of ethanol blended into gasoline in Canada coming primarily from the United States.

Figure 1: Growth of ethanol’s share in Canadian gasoline is increasingly coming from imports

Sources: USDA Foreign Agricultural Service GAIN, FCC Economics

Since Canadian ethanol plants have been unable to meet domestic consumption, growing demand in other parts of the world will likely be met by producers in the U.S. Since Canada’s Clean Fuel Regulation (CFR) will continue to reduce the carbon intensity required in gasoline until 2030, additional ethanol – which helps reduce the carbon intensity – will be required. If ethanol production in Canada were to double, the country would continue to rely on imports from the United States; however, this increase in production would require an extra 4 million tonnes of grain.

Biofuels that replace fossil diesel are the current market darlings

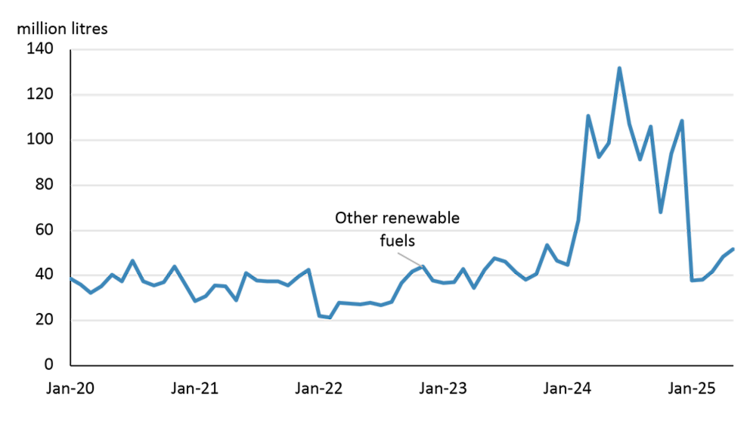

Biodiesel and renewable diesel facilities in Canada have recently experienced significant market volatility. Last year, domestic production increased notably within the ‘other renewable fuels’ category (see Figure 2), coinciding with the commissioning and subsequent ramp-up of two new renewable diesel plants. However, as the new year commenced, both U.S. and Canadian facility run rates declined sharply due to ongoing uncertainty regarding the U.S. blender tax credit, prompting the industry to adopt a cautious approach while awaiting further developments.

Figure 2: Canada’s biodiesel and renewable diesel production fluctuates with U.S. policy

Sources: Statistics Canada, FCC Economics

Several policy changes have influenced the current environment, including the 45Z Clean Fuel Production Credit from the Inflation Reduction Act of 2022, legislation recently passed by the U.S. House of Representatives, and updates from the Environmental Protection Agency (EPA). The U.S. tax credit for biofuels has shifted from being granted at the point of blending to a producer-based model. This change excludes Canadian imports of biodiesel and renewable diesel, as only U.S.-produced biofuels now qualify. This adjustment may reduce opportunities for Canadian exports of these biofuels, leading domestically produced biodiesel and renewable diesel to seek alternative markets.

Canada exports more vegetable oil – mainly canola – to the U.S. for biofuel production than it uses domestically. In the past year, Canada used just over 1 million metric tonnes of vegetable oil for its own biodiesel and renewable diesel, but exported 2.8 million tonnes to the U.S. With remaining policy uncertainty, Canada's growing oilseed crushing industry will be watching for opportunities.

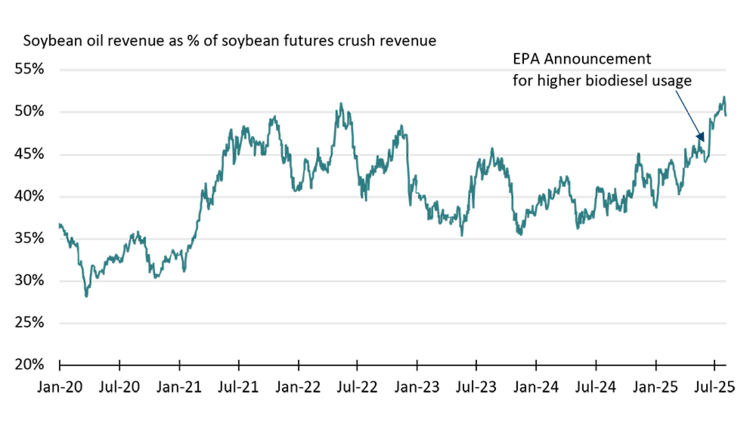

The EPA is also proposing to reduce Renewable Identification Numbers (RINs) by 50% for biofuels made from imported feedstock. As a result, U.S. biofuel plants using Canadian canola oil would earn 12 cents less per pound from RINs than those using U.S. soybean oil. Canadian canola oil could be redirected to other markets, such as human food, in the event of reduced U.S. biofuel demand. At the same time, the EPA announced higher-than-expected 2026 and 2027 blending targets, boosting North American oilseed markets. Soybean oil futures surged, and oilshare – soybean oil's share of crush revenue – reached a five-year high (Figure 3).

Figure 3: Soybean oil revenue as a % of soybean crush revenue hit a 5-year high on the EPA announcement

Sources: Barchart, CME Futures, FCC Economics

These considerations indicate that biodiesel and renewable diesel produced in Canada may face demand constraints as a result of prevailing government policies. Meanwhile, the USDA projects that more than half of U.S.-produced soybean oil will be used for biofuels. Both domestic and international buyers may turn to Canadian vegetable oil as an alternative. Canola oil, closely linked in price to soybean oil, will be supported from the higher demand for vegetable oils.

Sustainable Aviation Fuel slow to take off

Sustainable Aviation Fuel (SAF) is produced using methods like those for renewable diesel. These fuels are required to be compatible with existing aircraft engines without modification. Several facilities in the U.S. are increasing SAF production, while Canada does not currently have operational plants, though future development is anticipated. SAF production typically uses biodiesel feedstocks such as vegetable oils, representing a potential growth market for oilseeds.

Bottom line

U.S. measures aim to promote domestic biofuel production, which may decrease the demand for Canadian biodiesel and renewable diesel exports. Additional policy changes present both potential benefits and challenges for the use of Canadian canola oil in U.S. biofuel facilities. At the same time, higher U.S. blending targets have contributed to an increase in soybean oil futures, influencing Canadian vegetable oil prices. Looking ahead, the emerging market for Sustainable Aviation Fuel (SAF), which uses similar feedstocks, offers new growth opportunities for Canadian oilseed producers, though domestic SAF production facilities are still in early-stage development.

Justin Shepherd

Senior Economist

Justin Shepherd is a Senior Economist at FCC. He joined the team in 2021, specializing in monitoring agricultural production and analyzing global supply and demand trends. In addition to his speaking engagements on agriculture and economics, Justin is a regular contributor to the FCC Economics blog.

He grew up on a mixed farm in Saskatchewan and remains active in the family operation. Justin holds a master of applied economics and management from Cornell University and a bachelor of agribusiness from the University of Saskatchewan.