Top economic charts to monitor in 2026

As we begin 2026 with new challenges, including slower economic growth, geopolitical uncertainties and rising trade barriers, here are our top charts to help make sense of the economic environment for the agriculture and agri-food sector, from producers to consumers.

Canada’s main engine of economic growth under pressure

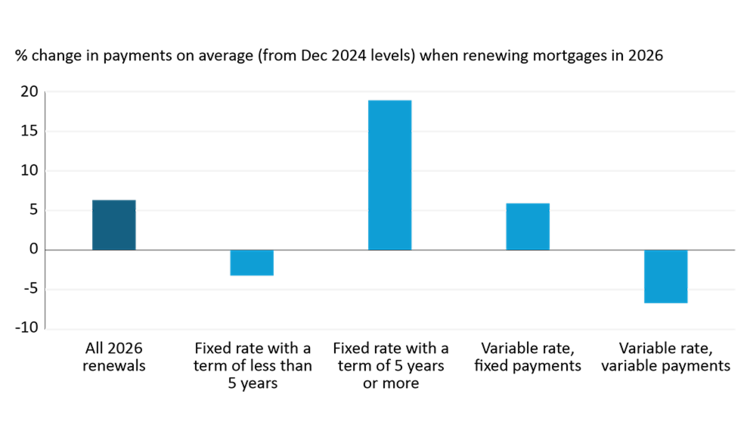

Consumption spending, which accounts for about 60% of Canada’s GDP, looks vulnerable amid slow population growth, a rough labour market, and record high debt. The burden of debt servicing, which already absorbs more than 14% of household disposable incomes, is unlikely to improve much considering a large share of households renewing mortgages this year will be doing so at higher rates than at origination. According to the Bank of Canada, the average monthly mortgage payment will be 6% higher than December 2024 levels for households renewing in 2026. But for households renewing their 5-year fixed rate mortgages (which is the most popular product in Canada), the payment increase will be almost 20% (Figure 1), which will sap spending power. Simply put, look for Canada’s main engine of growth to gear down this year.

Figure 1. Many households will face higher payments after 2026 mortgage renewal

Sources: Bank of Canada, FCC Economics

Can exports bounce back amid America’s trade war?

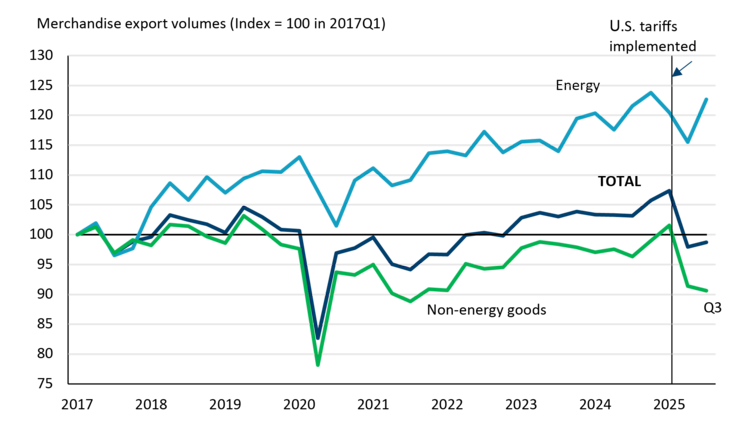

Even though the vast majority of our goods are compliant with the Canada-U.S.-Mexico agreement (CUSMA) and therefore exempt from America’s reciprocal tariffs of 35%, exports slumped after tariffs were imposed last April and have not recovered. In the third quarter last year, non-energy export volumes were still down roughly 11% compared to just before American tariffs were implemented (Figure 2). Exporters of tariffed goods like steel, aluminum, and copper were, not surprisingly, hit hard. But even producers of CUSMA-compliant goods e.g., farm, fishing and intermediate food products, and consumer goods, saw exports drop markedly.

CUSMA is scheduled for review later this year and a positive outcome is far from guaranteed, especially in light of threats from the White House to let the trade deal expire. In the meantime, uncertainties brought by America’s trade war will continue to weigh on Canada’s economy by restraining business investment and exports. The U.S. economy, which absorbs more than 70% of our exports, will also be watched closely by Canadian businesses. If, as we expect, U.S. GDP growth softens in 2026, the resulting slowdown in American demand should impact even exporters of CUSMA-compliant goods.

Figure 2. Exporters of non-energy goods hammered by America’s trade war

Sources: Statistics Canada, FCC Economics

In light of ample supplies, who will buy Canadian grains and oilseeds in 2026?

Globally, there are ample supplies for most grain and oilseeds, as many countries have benefited from optimal growing conditions. This was no different domestically as Canada produced a record 107 million tonnes of grains and oilseeds this year, beating the prior record set in 2020 by nearly 7 million tonnes – nearly 16% higher than the 5-year average. Simply put, there is plenty of grain available globally, which begs the questions: who will buy Canada’s grains and oilseeds, and how will prices trend this year?

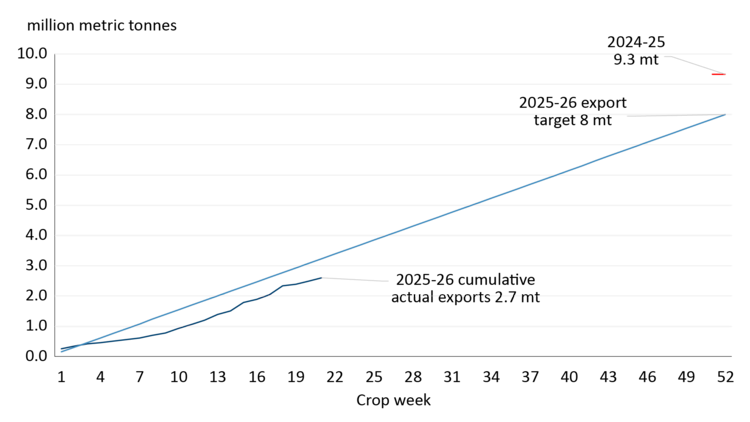

Canada exported 57.4 million tonnes in the 2024-25 crop year, but exports are expected to fall in 2025-26 to 55.3 million tonnes. While wheat exports to date have been strong, canola and peas are still struggling. This is due to the combination of increased global crop production and losing market access – recall that Canadian producers face ongoing tariffs from China on canola, canola by-products, and peas, and from India on yellow peas and lentils.

For example, canola exports are currently 20% below the average export pace for the year to reach the estimated 8 million tonnes AAFC is projecting this crop year. In fact, based upon current exports Canada may only export 6.5 million tonnes this crop year (Figure 3). While another canola crush facility will come online this year, Canada’s domestic users have limited ability to consume additional significant volumes.

Unless new foreign buyers show interest this year, exports will remain under pressure. Export trends will provide greater insight into the potential size of ending stocks for commodities in the current crop year, influencing pricing and offering early signals regarding farmers’ planting decisions for spring 2026.

Figure 3. Canola exports under pressure due to trade uncertainty

Crop year starts August 1st

Sources: CGC, AAFC, FCC Economics

Is this the year when the North American cattle herd size finally expands?

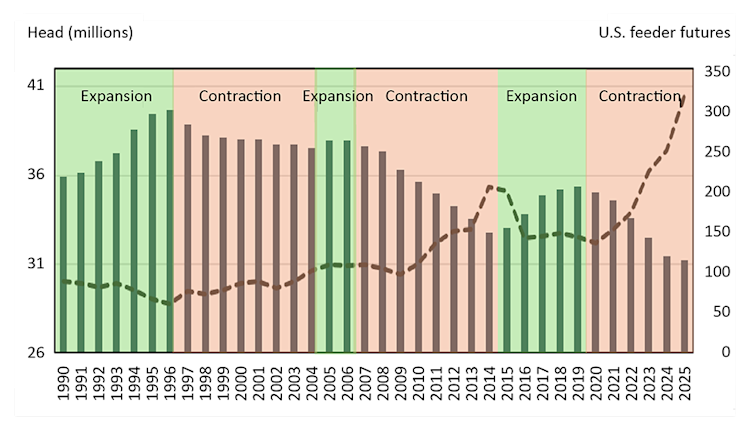

Tight supply pushed up cattle prices to record highs in 2025, and despite recent corrections, the market remains strong. High prices, abundant feed supplies, and falling feed costs are all boosting optimism in the industry. Yet, the question most often asked is, how long will cattle prices stay elevated and when will rebuilding of the herd occur?

Based upon historical cattle cycles (Figure 4), the cattle market should be nearing the end of contracting, which marks the bottom of the cycle and early stages of the expansion phase. We’ve already seen early signs that the Canadian herd may have stopped contracting, according to July 1, 2025, inventory numbers. However, the U.S. cow inventory is the main driver for overall cattle markets. The U.S. herd still appears to be in contraction phase. A leading indicator of potential rebuilding is the number of cows and heifers heading to slaughter relative to total cattle slaughtered. While we have seen easing of the number of Canadian heifers heading to slaughter, U.S. slaughter rates last year have not fallen low enough to signal herd expansion is underway.

There’s always a chance of a surprise. So, watch out for U.S. and Canadian herd numbers early this year for clues on whether or not an expansion phase has started. The first report of the year, released late January, will give the first clear signal of producer plans, especially around heifer retention and cow numbers. That said, even if rebuilding begins, that will start from a very low base given the North American herd remains at its lowest level in decades. As such, prices should stay high and well above the five-year average through 2026.

Figure 4. North American cattle cycle: Cow inventory and feeder price relationship

Sources: Statistics Canada, USDA, FCC Economics

What will happen to Canadian hog exports under vCOOL?

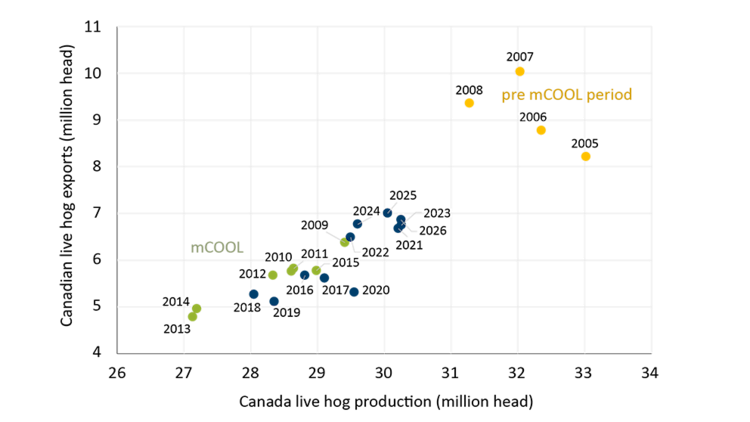

Canadian hog production depends heavily on exporting live animals to the U.S., from young piglets to market-ready hogs. This includes both hogs ready for slaughter and the nearly 1.5 million hogs and 3 million feeder pigs that are exported to the U.S. each year for finishing and processing. So, changes in U.S. meat labelling laws can have a direct impact on our industry. Effective this year, meat labels in the U.S. can only carry the “Product of USA” label if the animal was born, raised, and processed in the United States. This country-of-origin labelling rule is voluntary (i.e., vCOOL), so companies can choose not to use the label if they prefer.

This change replaces the old mandatory country-of-origin labeling (mCOOL) rules, which were scrapped after Canada and Mexico successfully challenged them at the World Trade Organization. When mCOOL rules were in place from 2009 to 2015, exports in 2009 dropped by more than 50% compared to 2008, partly because of those labeling requirements (Figure 5).

However, this time, we don’t expect the impact to be as severe as it was under mCOOL, but there could still be some effect. If American consumers prefer pork labeled as “Product of U.S.,” some U.S. hog finishing operations and processing plants could change how they procure hogs, which could also put pressure on Canadian prices.

The good news is, Canadian slaughter capacity has increased so we expect to export fewer live hogs this year as they are processed domestically. Diversifying beyond the U.S. remains important given the changing trade environment. Strong demand in Asia-Pacific—especially Japan—along with a favourable exchange rate should boost Canadian exports to non-U.S. destinations in 2026.

Figure 5. Could Canadian hog exports to the U.S. decline under vCOOL?

Source: USDA PSD

Can the demand for protein-heavy dairy be sustained?

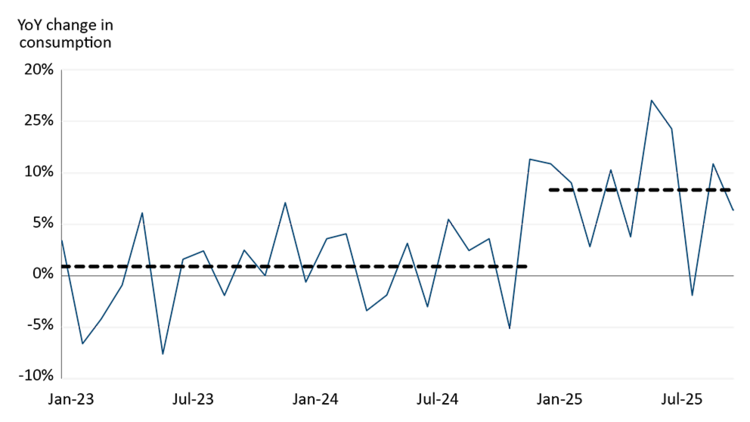

Sales of some dairy products saw a significant increase last year. This occurred despite the slowdown in population growth, which had been a major driver of sales between 2022 to 2024. So, what was behind the sales growth in 2025? A key driver is that consumers are seeking high-protein products. And it’s not just dairy products high in protein. In 2024, retail sales of high in protein packaged food products reached $1.39 billion, up 2.8% from the year before.

We’re keeping an eye on yogurt consumption metrics, which saw tremendous growth in 2025. Growth for the year averaged 8.3% in 2025, compared to 0.9% between 2023 and 2024 (Figure 6). The continued growth in demand for high protein dairy products, and for non-dairy products with added protein, resulted in regional milk pools adjusting their pricing structures for the upcoming year by placing a greater dollar value on the protein component of raw milk. How yogurt consumption evolves in 2026 will be an item to watch as bellwether for the sustainability of the ‘protein craze’.

Figure 6. Growth in yogurt consumption a bellwether for dairy protein demand

Sources: Canadian Dairy Commission, FCC Economics

Avian influenza threatens chicken supply

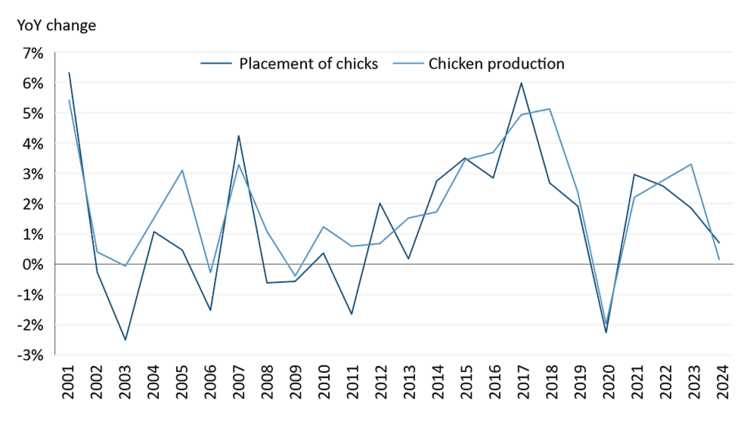

Chicken demand continues to rise, and quota issuance for the beginning of 2026 has already been announced, reflecting this increased demand. But potential roadblocks in filling that quota exist, especially in B.C. where avian influenza returned in the fall of 2025 and December flooding in the Lower Mainland wreaked havoc on poultry operations.

However, prior to this, the number of chicks placed in barns for broiler production had reached record highs. Naturally, the growth in chicks placed for broiler production and growth in chicken production are highly correlated with one another (Figure 7).

In November 2025, national chick placements were up 11.1% compared to November 2024, including 9.7% growth in B.C. However, this data was collected before avian influenza outbreaks occurred. By December, the B.C. Chicken Marketing Board was warning of hatching egg and chick shortages. It’s unclear at this point what the damage is to B.C. production and whether or not the rest of the country can make up for this lost production in 2026. Should production fall short of projected demand, especially at the beginning of the year, look for additional production announcements later this year.

Figure 7. Early chick placement determines future broiler production

Sources: AAFC, Statistics Canada, FCC Economics

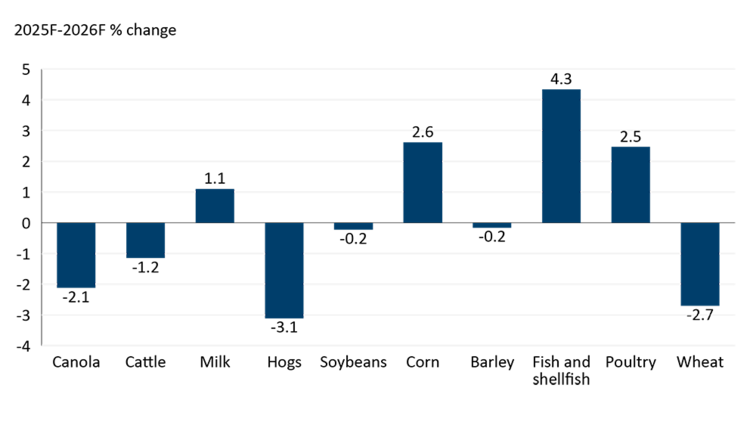

Easing costs bring opportunities to food and beverage processing

After years of rising costs, there is now relief in sight for Canadian food and beverage processors. Our forecasts show six of the top ten raw material inputs by value will see declining costs in 2026, while two others could rise more slowly than in 2025 (Figure 8). The biggest wins will go to processors reliant on hogs and cattle, but grain and oilseed users also stand to benefit. Together, these ten inputs account for roughly 40% of raw material costs, with canola, cattle, and milk topping the list at about 7% each. Adding to the optimism, the overall raw materials price index is expected to decline in 2026 and prices of other inputs such as cocoa, sugar, and natural gas are slowing, signalling broader-based cost relief.

Even then, costs remain high in comparison to five years ago and there are always risks they might move back up again e.g., via changing trade policies. Businesses that focus on strategic sourcing and productivity, will be in a better position to address those potential challenges.

Figure 8: Processors should record cost relief in 2026

Source: FCC Economics

Leigh Anderson, Senior Economist

Graeme Crosbie, Senior Economist

Amanda Norris, Senior Economist

Justin Shepherd, Senior Economist

Weakening Canadian economy has implications for interest rates and the Canadian dollar.