Canada’s economy poised to decelerate in 2026

After bringing down its overnight rate to 2.25% last October, the Bank of Canada suggested that its policy rate is now “at about the right level”. Markets have bought into the central bank’s argument, expecting no cuts to the policy rate through the whole of next year. We’re skeptical about that narrative given the significant downside risks that threaten to turn a 2026 economic slowdown into something worse. We unpack all of that in this edition of the Economic and Financial Market Update and explain the potential implications for inflation, interest rates, and the Canadian dollar.

GDP revisions push up 2025, but weak handoff threatens 2026

Thanks to upward revisions to historic data and a larger-than-expected increase in the third quarter, Canada is now looking at its GDP expanding roughly 1.7% in 2025. This is about half a percentage point higher than what most forecasters, including us and the Bank of Canada, had previously estimated for the year. But this is where the good news end.

Scratching beneath the surface of this Q3 GDP report reveals weakening economic fundamentals. Indeed, most of the 2.6% annualized growth registered last quarter came courtesy of collapsing imports - recall that GDP is calculated by taking domestic demand, adding exports to it and subtracting imports, meaning that when imports fall, GDP tends to increase. And part of the reason importers pulled back last quarter was the contraction of domestic demand.

Indeed, consumption spending fell in Q3 for the first time since 2021 amid declining employment which restrained disposable incomes. Business investment also fell in the third quarter, extending a slide that started earlier in the year, even before U.S. tariffs were implemented. Another red flag is the likelihood of a poor handoff from Q4 after Statistics Canada’s advance estimate for October GDP showed a sharp decline. That weakness is set to carry into 2026, especially if trade barriers remain in place.

No end in sight to trade woes

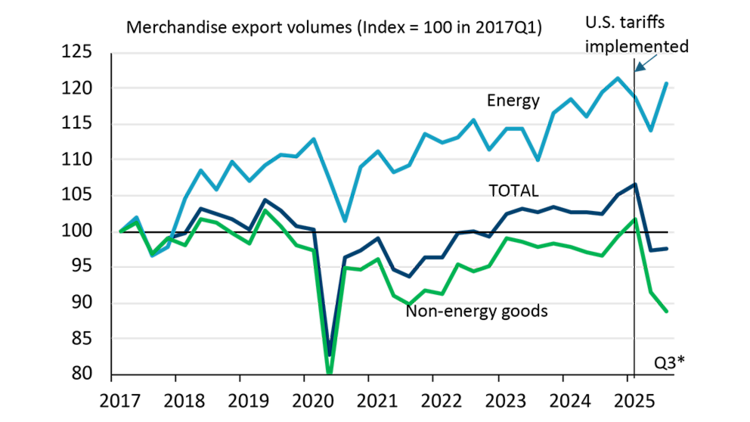

To be sure, America’s trade war is weighing heavily on Canada’s economy. Exports of non-energy goods have dropped sharply since U.S. tariffs came into effect last April (Figure 1). While the majority of our exports are compliant with the Canada-U.S.-Mexico agreement (CUSMA) and therefore exempt from America’s reciprocal tariffs of 35%, key industries including autos, steel, aluminum, copper and forestry continue to face tariffs as high as 50%. Those sectoral tariffs are beyond the scope being studied by the U.S. Supreme Court, meaning that even if the latter rules against the White House’s reciprocal tariffs, the above-mentioned industries are unlikely to see any immediate relief.

Even exporters of CUSMA-compliant goods will be under pressure next year if, as we expect, U.S. GDP growth slows down. As the impact of the AI investment boom fades, cracks formed by the White House’s policies on tariffs and immigration will become more visible stateside. The uptick in the U.S. jobless rate to a four-year high is just a preview of what’s to come. Despite Canada’s diversification efforts, America still buys more than 70% of our goods, meaning that any drop in U.S. demand will have repercussions on this side of the border. As such, look for Canada’s export volumes to remain weak next year, pulled down particularly by tariff-hit sectors like metal and forestry products which could once again more than offset any increases for energy producers.

Figure 1: Canadian exporters hammered by U.S. trade war

*Total exports are from Q3 national accounts, while energy and non-energy exports are estimated using July and August trade data

Sources: Statistics Canada, FCC Economics

Domestic demand under pressure

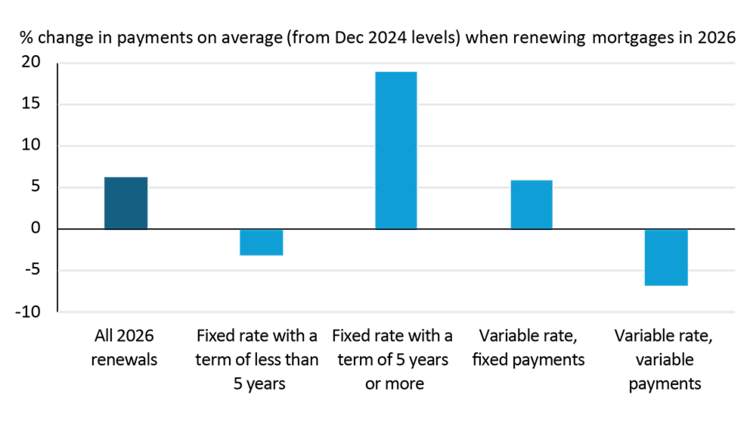

Perhaps more concerning for Canada is the state of the domestic economy. Consumption spending, which accounts for about 60% of GDP, looks vulnerable amid weak population growth, a challenging labour market, and record high debt. The burden of debt servicing, which already absorbs more than 14% of household disposable incomes, is unlikely to improve much considering a large share of households renewing mortgages in 2026 will be doing so at higher rates than at origination. According to the Bank of Canada, the average monthly mortgage payment will be 6% higher than December 2024 levels for households renewing next year. But for households renewing their 5-year fixed rate mortgages (which is the most popular product in Canada), the payment increase will be almost 20%, which will sap their spending power (Figure 2).

Figure 2: Many households will face higher payments after 2026 mortgage renewal

Sources: Bank of Canada, FCC Economics

The housing market is also under pressure from high interest rates. Resale home prices (national average of existing homes) fell again this year, extending a decline that started in 2023. This is making it harder for new builds, which tend to be less affordable than existing homes, to be absorbed by the market. Tight lending standards, rising material costs, and zoning restrictions (especially in urban centres) further complicate matters for builders. It’s no wonder that the Canadian Home Builders Association’s Housing Market Index sank to record lows in Q3, for both single-family home and multi-family home segments. That does not bode well for 2026 prospects in residential construction, which accounts for a sizable chunk of the economy (about 8% of GDP).

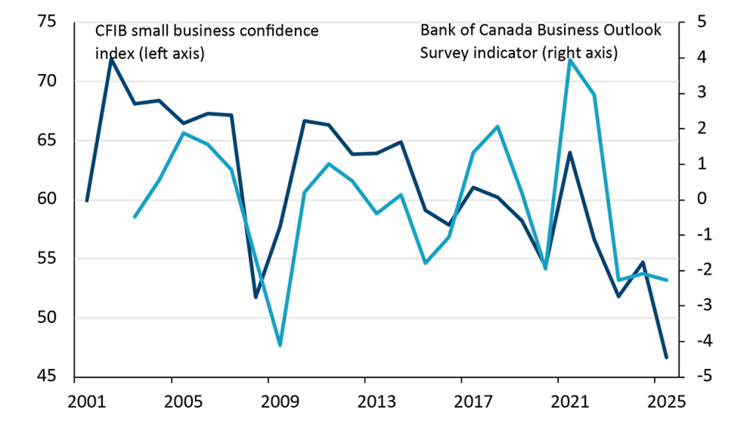

Non-residential construction and, more broadly, business investment are also not looking great heading into 2026 in light of trade-related uncertainties, U.S. fiscal advantages (which pulls foreign capital stateside), and expected challenges for corporate profits. According to the Bank of Canada’s latest Business Outlook Survey, the balance of opinion for investment intentions over the next 12 months is well below the long-term average. That survey, which samples about 100 firms, along with a broader survey of over 600 small businesses by the Canadian Federation of Independent Business (CFIB), highlight a historically low business confidence in Canada, casting doubts about a quick rebound in investment spending (Figure 3).

Figure 3: Very low business confidence does not bode well for investment rebound

Sources: Bank of Canada, Canadian Federation of Independent Business, FCC Economics

It's true that the federal government is stepping up to the plate with ambitious public projects that have potential to rekindle private business investment. But large-scale capital investment is not as straightforward as it sounds, and if history is any guide disbursements could take longer than originally planned. The Parliamentary Budget Officer just recently put the spotlight on the Infrastructure Bank and Department of National Defense to highlight how allocated public funds can go unspent. So, while business investment spending will eventually bounce back, stimulated by the federal government, as well as clarity on CUSMA (whose review will start on July 1st), we see that more as a 2027/2028 story rather than something that will materially boost next year’s GDP.

All in all, considering twin challenges on both the external and domestic fronts, we expect Canada’s real GDP growth to slow markedly to about 1.2% in 2026.

Implications for interest rates and the Canadian dollar

That would be below the economy’s estimated potential GDP growth, meaning the output gap (or excess supply) will widen. This is another way of saying inflation will moderate in 2026. We’re already seeing how excess supply weighs on prices in the labour market, with a declining job vacancy rate allowing the annual growth of wages and salaries (from the national accounts) to fall to just 3.1% in Q3, the lowest since 2020. That downtrend should extend into next year as job vacancy rates continue to fall due to reluctance by businesses to hire in a challenging economy.

The Bank of Canada has stated that its 2.25% overnight rate is now “at about the right level” and markets have bought into that narrative, with the Overnight Index Swaps confirming that investors are expecting no cuts to the policy rate through the whole of next year. But if, as we expect, economic growth weakens materially, the central bank will have to bring down real rates of interest (the overnight rate minus inflation) into negative territory to prevent a downturn from turning into something worse. And to achieve that we estimate the overnight rate will have to fall to around 1.50% by end of 2026.

That should help push down the short end of the Canadian yield curve, although at the longer end we don’t see rates having a lot of room to fall (barring an outright recession). As we explained in an earlier edition of the Economic and Financial Market Update, Canadian bonds are highly correlated with U.S. Treasuries, and the latter’s yields are being kept elevated as investors demand a larger premium to compensate them for higher risks stemming from deteriorating U.S. public finances.

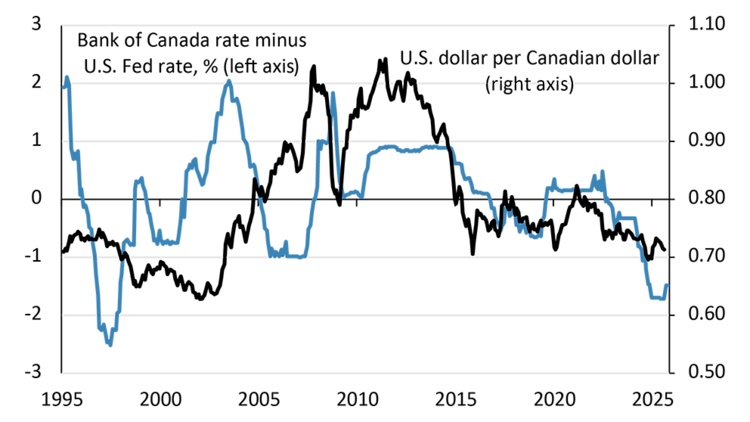

Given this outlook, there doesn’t seem to be much upside for the Canadian dollar in 2026. While the loonie is getting an assist from generalized U.S. dollar weakness, it continues to be saddled by yield disadvantage relative to the U.S. (Figure 4). Trade woes are also weighing on the currency by curtailing export revenues, limiting demand for Canadian dollars, and widening the current account deficit, the latter on track to surpass 1.5% of GDP in 2025. That’s the 17th consecutive year of deficit on Canada’s broadest measure of trade, and this streak of red ink is likely to extend through next year, especially if America’s trade war continues. All told, while it’s always tricky to make currency forecasts given the complex dynamics at play in the foreign exchange market, a trading range of 72-74 U.S. cents for the loonie seems reasonable for 2026 considering the projected path for interest rates in the U.S. and Canada.

Figure 4: C$ weighed down by yield disadvantage

Sources: Bank of Canada, U.S. Federal Reserve, FCC Economics

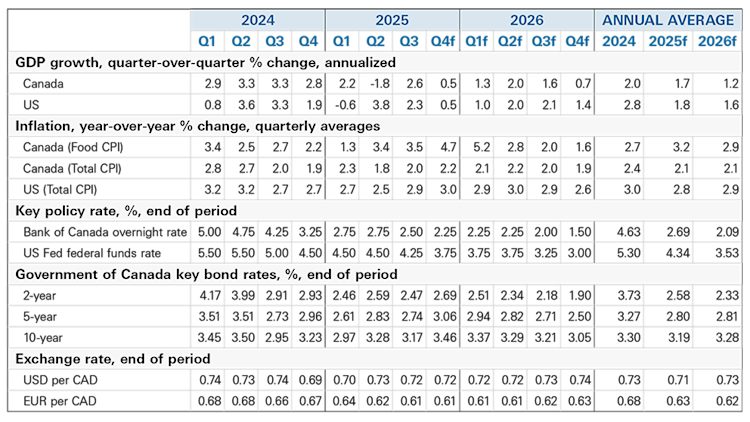

Summary of forecasts of key economic variables

Sources: Bloomberg, FCC Economics

Krishen Rangasamy

Manager, Economics, Principal Economist

Krishen Rangasamy is the Manager, Economics and Principal Economist at FCC. His insights and leadership help guide research on topics related to macroeconomics and agriculture, which FCC and external clients use to support strategy and monitor risk.

Prior to joining FCC in 2023, Krishen spent over fifteen years as a macroeconomic specialist on Bay Street, including at two major Canadian banks, where he advised trading desks and helped lead economic research and forecasting. He also regularly appeared on leading business TV channels and written media with his insightful commentaries on financial markets. Before going into investment banking, Krishen worked as an analyst in the energy industry in Western Canada. Krishen received his master of arts degree in economics from Simon Fraser University.