Why delayed investment threatens food and beverage manufacturing productivity

It appeared that Canada’s food and beverage manufacturers started 2025 ready to invest and expand. But trade tensions and new tariffs quickly shifted optimism to caution. Projects were paused, investment delayed, and uncertainty spiked. While this challenges operations today, it also has longer term implications as investment helps fuel productivity growth. The challenge now is turning this pause into an opportunity to improve efficiency, strengthen operations, and prepare for future growth.

Investment hopes were strong to start 2025

Heading into 2025, confidence across Canada’s food and beverage manufacturing sector was running high. Capital spending plans in both construction and machinery and equipment pointed to a year of investment growth. Food manufacturers were gearing up to spend 14% more than 2024, with a focus on machinery and equipment rather than new construction. Beverage manufacturers on the other hand were more cautious, projecting a modest 0.5% increase in spending, likely a reflection of the softening alcoholic beverage market.

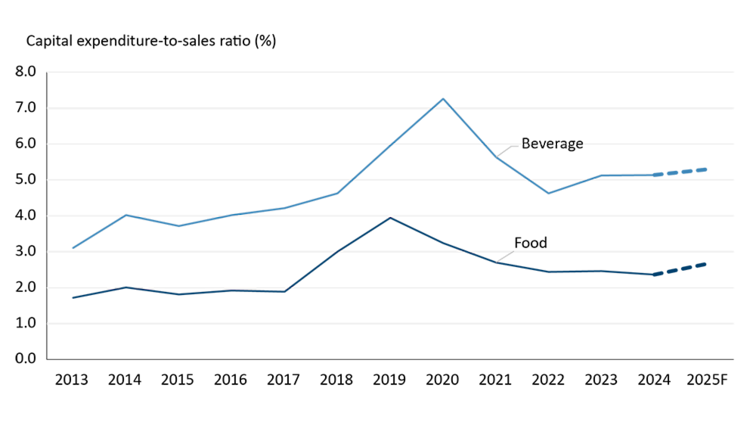

Our early year sales forecast showed mixed outlooks for both sub-sectors, with a small increase for food manufacturers and a decline for beverages. Together, these expectations suggested that the capital expenditure-to-sales ratio would edge slightly higher in 2025 (Figure 1).

Figure 1: Capital expenditure-to-sales ratio

Source: Statistics Canada and FCC Economics

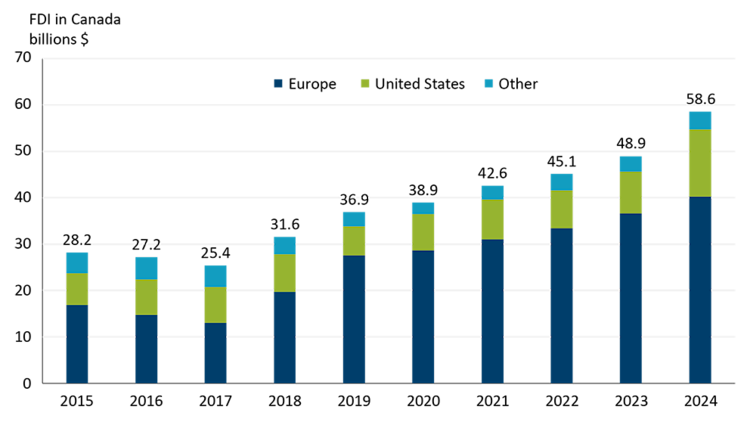

Adding to the optimism, the sector had just come off an impressive seven-year streak of foreign direct investment (FDI) growth (Figure 2). While inward FDI signals strong global confidence in the sector’s future, it can also raise concerns about the competitiveness of Canadian companies. Foreign-based multinational enterprises, however, bring important benefits. For instance, they connect the sector to global value chains and export opportunities and bring innovative and productive practices.

Between 2017 and 2024 FDI into food and beverage manufacturing soared 130%, more than three times the pace of the broader manufacturing sector. Not only were more dollars flowing into the sector, the food and beverage manufacturing sector was also steadily carving out a larger share of the total FDI in all manufacturing.

Figure 2: More foreign investment supports Canada’s food and beverage manufacturing sector

Source: Statistics Canada

Dominated by substantial inflows from Europe, FDI in this sector reached an impressive $58.6 billion in 2024, marking an almost 20% increase from 2023. The most recent data reveals that foreign multinationals accounted for 45% of food manufacturing sector revenue in 2022, 29% of jobs in 2023, and 36% of gross fixed capital in 2023. While FDI can introduce competition, it also delivers positive spillovers that align with the ongoing goals of Canada’s food and beverage manufacturing sector, namely innovation, productivity, and exporting value-added products.

Trade tensions and new tariffs quickly reshaped expectations in 2025

As we are near the end of 2025, the mood has changed. The optimism that opened the year has faded under the weight of tariffs, trade uncertainty, and rising costs. The Bank of Canada’s Q3 Business Outlook Survey shows businesses across the country are holding back on investment, citing uncertainty from tariffs and trade dampening their outlook. Food and beverage manufacturers are somewhat shielded from the U.S. tariffs compared to other manufacturing sectors like transportation equipment, but that does not mean they are immune. Trade remains uncertain, not just with the U.S., and impacts are being felt through rising input costs and disrupted trade flows.

What this means is that those strong capital expenditure forecasts from early 2025 are unlikely to materialize to the same magnitude. In fact, some have already fallen through. In January, a renewable-diesel and canola-crushing complex was paused, citing regulatory and political uncertainty. Some businesses closed beverage manufacturing facilities as the broader economic climate made operations no longer viable. Other businesses moved processing to the United States, another signal of how international pressures can shape company investment decisions.

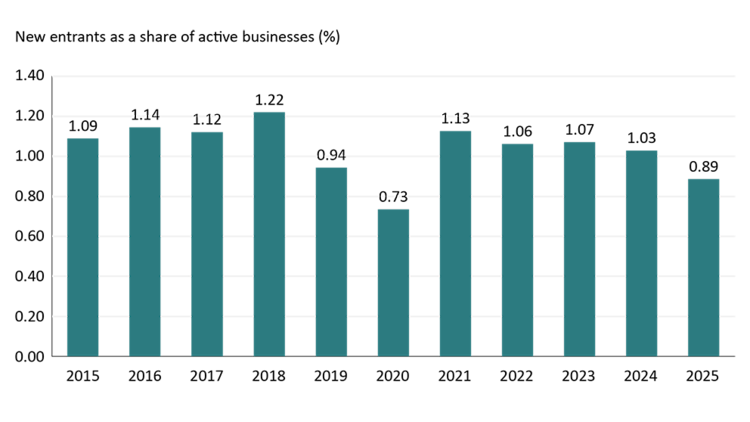

New business data from 2025 help to reinforce this expected slowdown as we wait to see how the actuals fared when data is released early in 2026. New entrants to food manufacturing (i.e., businesses with no prior employment in this industry) fell 14.9% in the first half of 2025, sliding back near 2019 levels. Just 370 new businesses were added so far in food manufacturing this year compared to an average 442 in the four years after the pandemic (i.e., 2021-2024). As a share of active businesses, this is the second lowest in a decade, only 2020 was lower (Figure 3).

Figure 3: New entrants down in first half of 2025

Source: Statistics Canada

The pullback in investment felt across the country does have longer term impacts. Uncertainty is keeping investment muted, and the longer it lasts, the greater the implications for long-term growth and productivity. The Bank of Canada warns that weak business investment today can slow productivity and stall future growth. This is something Canada’s food and beverage manufacturing sector, already grappling with flat productivity in recent years, can’t afford.

The cost of waiting on productivity

As we highlighted in our recent economic outlook, sustained productivity growth depends in large part on higher business investment. Therefore, the consequences of weaker investment extend far beyond the projects on hold this year. Each postponed project and delayed equipment upgrade could mean slower productivity gains going forward.

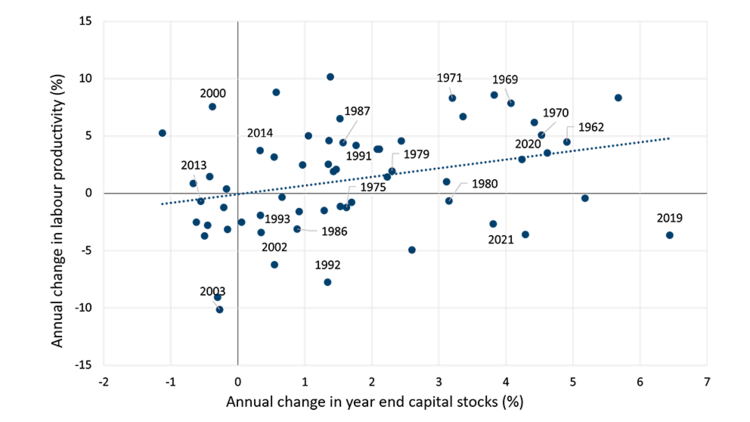

To illustrate, we can look back at the connection between capital stocks and productivity (Figure 4). There’s a lot of variability in the data, but over time, periods of higher capital stocks have supported stronger labour productivity in the food and beverage manufacturing sector. This is because modern machinery, advanced tools, and improved infrastructure allow workers to do more in less time. When tools are upgraded regularly, efficiency rises. However, because equipment and facilities wear out over time, continuously investing in new capital each year is essential to maintain and grow these stocks.

Figure 4: Capital stocks important for labour productivity growth in food and beverage manufacturing

Source: Statistics Canada

That’s why this year’s likely investment pause matters. With several major projects put on hold and overall capital expenditures likely to fall short of early-year expectations, the sector risks prolonging a period of stalled productivity growth. Every delayed project and deferred expansion can have a compounding effect. When firms hold off on upgrading machinery or adding capacity today, the capital stock falls, and productivity gains they would have realized are postponed. For a sector already with slow output per worker, the lost time matters. The tools food and beverage manufacturers need to compete globally including automation, digitalization, and energy-efficiency upgrades all rely on steady, predictable capital spending.

Bottom Line

There was strong momentum coming into 2025, but investment enthusiasm faded over time. It now looks like the sector will need to wait another year for growth in capital investment. But waiting has a cost. Delaying investment can push back productivity gains that help drive the sector’s competitiveness and growth in future years.

The slowdown also offers a window for preparation. If large capital outlays aren’t feasible right now, manufacturers can still focus on productivity in smaller, strategic ways. Reviewing operations, suppliers, and input costs or exploring new partnerships and markets can yield meaningful efficiency gains.

Amanda Norris

Senior Economist

Amanda joined FCC in 2024 as an Economist. She has expertise in the food and beverage industries, but also does research on supply management and consumer trends. Amanda comes from Agriculture and Agri-Food Canada where she amassed a wealth of economic, technical and industry knowledge through various positions including policy advisor, project lead and Economist.

Amanda holds a master’s degree in Food, Agricultural and Resource Economics from the University of Guelph. She is also a Board member of the Canadian Agricultural Economics Society where she promotes outreach and the importance of agriculture and food research.