Food and beverage manufacturing sales losing momentum: 2025 mid-year update

Each year we take a look back on our Annual Food and Beverage Report to provide an update on how sales and margins have progressed in the first half of the year. We have revised both our sales and margins estimates lower given the challenging trade and economic environment that food and beverage manufacturers are navigating.

Sales update

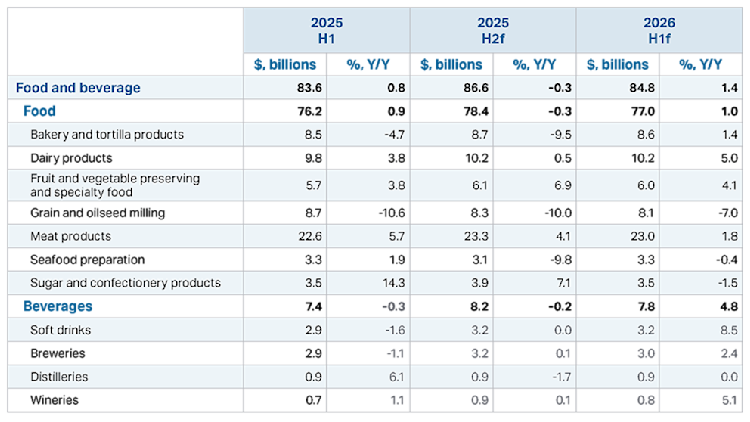

After a promising start to 2025, food and beverage manufacturers are beginning to feel the pinch of America’s trade war. Sales did manage to stay just above water in the first half of the year, increasing 0.8%, but that momentum isn’t expected to hold with a 0.3% drop expected in the second half (Table 1). FCC Economics now forecasts overall sales growth for 2025 to be restricted to just 0.2%, down from our April projection of 0.6%. If this holds, it will mark the lowest annual growth for the sector since 2005. Table 1 also shows how sales are expected to shift across key sub-sectors, highlighting the diversity within food and beverage manufacturing.

Table 1: Food and beverage manufacturing sales up in first half of 2025, with declines likely in second half

Note: Values rounded to one decimal place.

Sources: Statistics Canada, FCC Economics

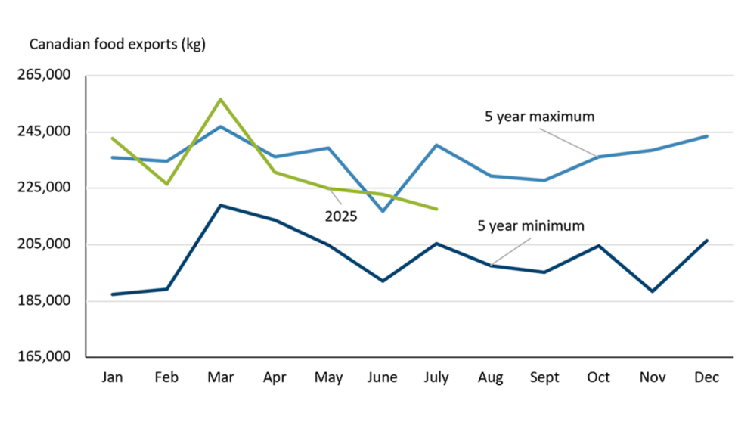

This downward revision should not be surprising given the impacts that tariffs are having on the economy and the trade landscape. Much of the sales growth seen so far is price-driven, that is sales are slowly trending up because of price increases while the volume of goods sold is declining. Partly explaining this, was the steady decline in export volumes of food and beverages beginning in March. After a stronger start, above the 5-year maximum for both January and March, export volumes are now trending closer to the 5-year minimum (Figure 1). At this point, the challenges facing food and beverage exporters do not seem to be easing and a further contraction of export volumes is not off the table.

Figure 1: Food and beverage exports are falling fast

Source: Canadian International Merchandise Trade Database

As we noted in the FCC Food and Beverage Report earlier this year, sectors with higher reliance on export markets face more headwinds than those selling primarily into the domestic market. This has already played out in some sectors. For example, dairy, which is largely driven by Canadian demand, saw positive sales early in the year. But grain and oilseed milling, which sends more than half its output abroad, is struggling. Tariffs from China on canola seed, meal, and oil, combined with biofuel policy uncertainty in the U.S., have dampened demand and prices, bringing sales down as a result.

However, there is one potential bright spot so far this year and that is an uptick in per capita Canadian household expenditure on food and non-alcoholic beverages. This is a positive development given the earlier concern that slower population growth would cap demand for food and beverages.

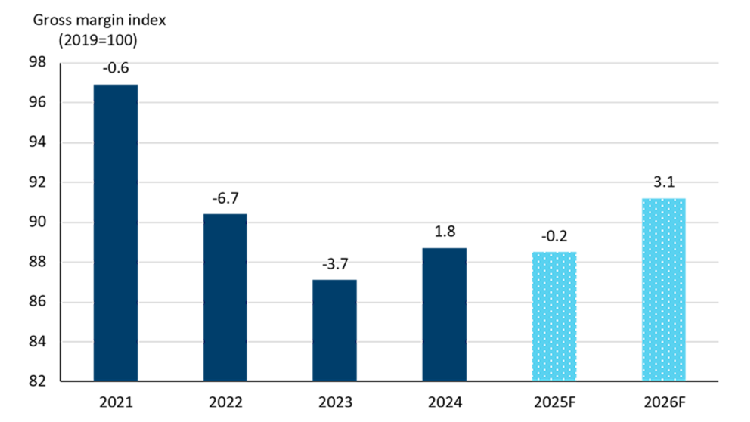

Margins pressured in the short term on falling sales

Margins started 2025 on solid ground, with expectations of a strong year driven by sales growth and easing input costs. However, the trade disruptions buck the trend. While higher prices helped offset falling demand in the first half of the year, it’s not likely enough to bring positive sales growth in the second half of the year. That, combined with raw material and labour costs that are taking longer to ease, suggests to us that 2025 margins will not improve from last year (Figure 2). That’s a significant downgrade from our prior forecast of a 5.8% increase for 2025 margins.

Figure 2: 2025 margins pressured by lower sales

Sources: Statistics Canada, FCC Economics

But we’re a bit more optimistic about 2026. A modest rebound in sales, paired with stabilizing or even falling input prices, could set the stage for recovery. Grain and oilseed prices are nearing five-year lows for many commodities. With strong corn production expected, large wheat supplies, and uncertainty in international canola markets, prices are expected to stay lower than what processors have seen in recent years. This is good news for sub-sectors that rely heavily on these inputs such as grain and oilseed milling, bakery, and beverage manufacturing.

However, not all sectors will benefit equally. Industries dependent on steel and aluminium should stay alert as stockpiles on packaging from before tariff implementation are likely to run low into 2026, and there’s no clear end in sight for those trade barriers.

There may also be some relief in the labour market. The job vacancy rate in food and beverage manufacturing fell to 2.8% in Q2 2025. This is the lowest for any second quarter since reporting began in 2015, a stark contrast to Q2 2022 when the job vacancy rate reached 6.6%. The unemployment rate for that sector also began to climb over the summer, reaching 9.4% in August 2025 (the highest in over four years), and the average offered hourly wage declined in Q2 2025 after three consecutive quarters of growth.

Together, these indicators point to a slightly more accessible labour market for food and beverage manufacturers. With more availability, wage pressures could soften, and businesses may find it easier and more cost effective to staff operations in the months ahead. That’s a positive sign for margins as we look towards 2026.

Bottom Line

The first half of 2025 brought mixed results for food and beverage manufacturers as they adapted to America’s trade war. Sales held steady early on but have since lost momentum, putting pressure on margins. While input costs are beginning to ease and could support profitability in 2026, market uncertainty remains high, and a strong recovery will still take time.

Amanda Norris

Senior Economist

Amanda joined FCC in 2024 as an Economist. She has expertise in the food and beverage industries, but also does research on supply management and consumer trends. Amanda comes from Agriculture and Agri-Food Canada where she amassed a wealth of economic, technical and industry knowledge through various positions including policy advisor, project lead and Economist.

Amanda holds a master’s degree in Food, Agricultural and Resource Economics from the University of Guelph. She is also a Board member of the Canadian Agricultural Economics Society where she promotes outreach and the importance of agriculture and food research.