Managing costs key to protecting margins for food and beverage manufacturing

Profitability is always a balancing act between managing costs and driving sales. But in 2025, that balance is proving more delicate than usual for the food and beverage manufacturing sector. While fluctuations in weather and animal health are familiar challenges that influence commodity prices, political uncertainty is adding a new layer of complexity.

We’ve seen this before. During 2017 and 2018, tariffs on steel, aluminum, and softwood lumber sent shockwaves through the industry. More recently, geopolitical tensions like Russia’s war against Ukraine disrupted global grain markets. This year, manufacturers are grappling with both types of volatility, natural and political, making cost forecasting difficult.

Despite these headwinds, there’s some good news as many of the prices that spiked in recent years have now stabilized. Earlier this year we discussed sales and margin forecasts in the 2025 Food and Beverage Report and now we turn attention to costs.

Cost of doing business in 2025

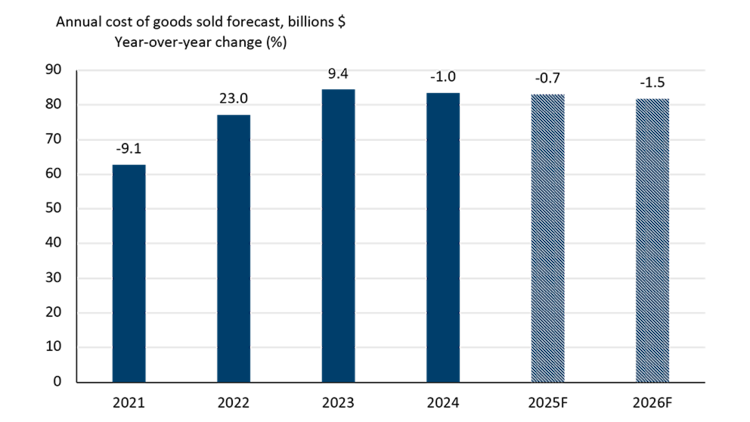

The food and beverage manufacturing sector experienced large increases in their cost of goods sold in 2022 and 2023, but these have since stabilized, albeit at a higher level. Some relief is projected again in 2025 and 2026, but costs remain high (Figure 1). With only a small increase in sales predicted for 2025 given strained household budgets and an uncertain trading environment, focusing on costs will be crucial to protect margins in the next two years.

Figure 1: Cost of goods sold stabilizing in 2025 for food and beverage processors

Source: FCC Economics

We have recently discussed the labour market, and shared our annual outlooks for key sectors including grains and oilseeds, dairy, cattle, and hogs. Since then, there have been two important developments:

Cattle prices continue to climb. The reason? Herd rebuilding is still in its early stages, meaning supply remains tight. As a result, prices for fed cattle are unlikely to ease anytime soon. On top of that, new U.S. voluntary country of origin labelling rules set to take effect in 2026 could pose export challenges for Canadian beef and pork, putting additional pressure on meat manufacturers.

Canola prices for last year’s crop have surged in 2025, driven by limited supply and robust export demand. The proposed Clean Fuel Production Credit, known more formally as the 45Z tax credit, in the U.S., which limits the use of non-North American feedstocks, could push up demand further for Canadian canola, though the bill still awaits approval. So, canola prices could remain high. On the flip side, soybean prices are expected to stay low thanks to ample supply.

That said, there are uncertainties with regards to China’s antidumping investigation which may conclude with tariffs applied to Canadian canola seed, which could then push down prices. The growing season is also a wildcard. Weather conditions in the coming months will play a decisive role in shaping production levels and, by extension, the prices processors will pay as we close out the year.

Three ingredients to monitor in 2025

Eggs

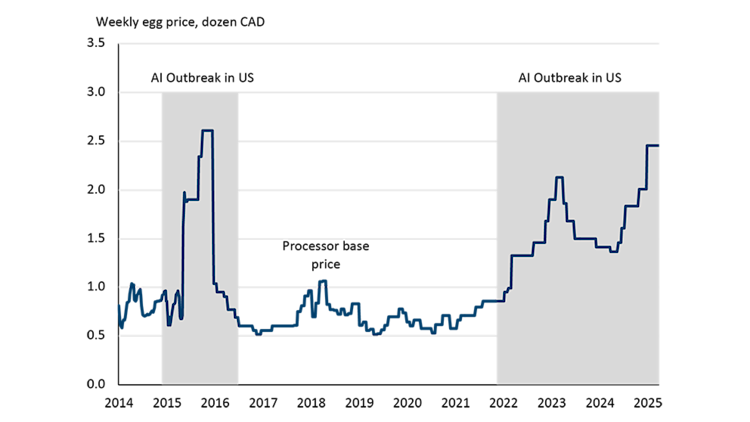

Canadian food processors face continued volatility in egg prices, driven largely by external pressures from the U.S. market. Since January 2022, U.S. egg prices have surged over 400% due to widespread Highly Pathogenic Avian Influenza (HPAI), which decimated commercial bird flocks and tightened supply. Although Canada has not experienced the same level of impact at the farm level from HPAI outbreaks, the ripple effects are still being felt in the processing sector.

This is because the base price Canadian processors pay for eggs is partially tied to the Urner Barry Egg Index, a U.S. benchmark. As a result, even with relatively stable domestic production, Canadian processors have seen significant price hikes. Since the beginning of 2024, the processors base price in Canada rose 63%, reaching an average of $2.46 per dozen (Figure 2).

Cases of HPAI in the U.S. are starting to fall and the Urner Barry Egg Index has come down by 50% since the beginning of 2025. As such, one can expect processor prices to start to stabilize as long as a resurgence in cases does not result from the fall migration.

Figure 2: Processors’ price for eggs impacted by HPAI outbreaks in the United States

Source: Egg Farmers of Canada

Packaging

In food and beverage manufacturing, packaging serves many functions. It is essential for protecting products and getting them to market but also serves as a marketing tool. From cardboard and glass bottles to plastic wrap and aluminum, these materials are vital for the industry. In 2025, aluminum cans are in the spotlight as a result of ongoing tariffs on steel and aluminum in North America that are pressuring costs along the supply chain.

The largest impact of those tariffs is likely to be felt by beverage manufacturing. This is because metal containers accounted for approximately 6% of beverage manufacturers’ total cost of goods sold. That makes it their third-largest expense, trailing only wages and plastic bottles. In fact, beverage manufacturers are the single largest customer group for Canada’s metal can manufacturing industry. Food manufacturers come in second, accounting for 21% of demand. Together, these two sectors represent a staggering 96% of the metal can manufacturing industry’s revenue.

In anticipation of tariffs, Canadian manufacturers have been stockpiling, as evidenced by surging imports of aluminum cans which surpassed the total for all of 2024 in just the first four months of 2025. Stockpiling makes sense as aluminum cans have a long shelf life compared to many other inputs. But it’s not a perfect solution. Storing large volumes of cans requires significant space and can be costly, putting smaller producers or those without warehouse capacity at a disadvantage. Depending on the duration of tariffs, manufacturers are likely to be forced to purchase at a higher price when their stocks deplete.

Sugar

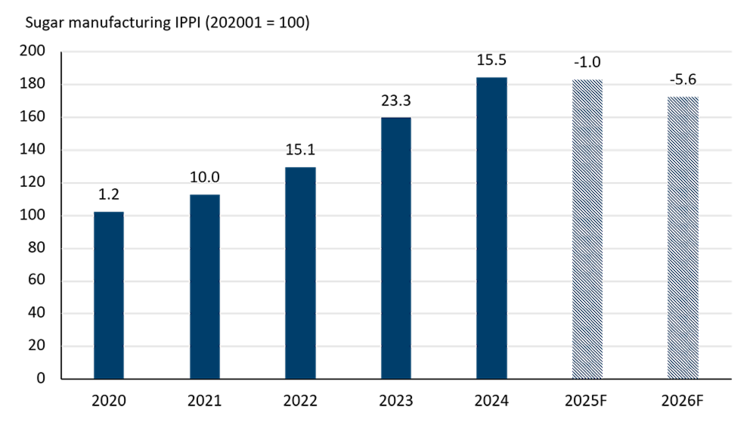

After two years of elevated sugar prices that raised costs across Canada’s food and beverage manufacturing sector, there are signs of moderation ahead. This relief is largely attributable to favourable weather conditions that have pushed global sugar production forecasts up according to the USDA’s May 2025 forecast. By mid-year, global sugar futures have declined 11.1% compared to the same time in 2024 and are down 23.2% from 2023 levels.

Given that approximately 90% of sugar used for refining in Canada is imported raw cane sugar, global market dynamics play a critical role in shaping domestic prices. The easing of world sugar prices is now being reflected in domestic pricing shown through the Industrial Product Price Index (IPPI) reported by Statistics Canada (i.e., an index of the price received by manufacturers). Following 5 years of year-over-year increases, we now expect the IPPI for sugar manufacturers to drop roughly 1.0% in 2025, with a further 5.6% drop expected in 2026 (Figure 3).

While sugar is primarily used in confectionery manufacturing, the impact of these price movements extends to every sub-sector of the industry. From baked goods to beverages or dairy, sugar is an input for every food and beverage manufacturing sub-sector in some way. Risks do remain as the growing season progresses around the world, but the current forecast offers a welcome reprieve after navigating years of rising costs.

Figure 3: Sugar prices starting to fall from highs

Sources: Statistics Canda and FCC Economics

Bottom line

As 2025 unfolds, food and beverage manufacturers are navigating a complex cost environment shaped by both familiar pressures and new uncertainties. While easing sugar prices and stabilizing egg markets offer some optimism for manufacturers, changing trade policy around the world as well as elevated prices for aluminum (courtesy of tariffs), canola oil, and cattle warrant continued vigilance. Strategic sourcing of inputs and boosting productivity through practices to reduce waste or use inputs more efficiently will help position businesses to succeed at a time when sales growth is set to be challenged both at home and in export markets.

Amanda Norris

Senior Economist

Amanda joined FCC in 2024 as an Economist. She has expertise in the food and beverage industries, but also does research on supply management and consumer trends. Amanda comes from Agriculture and Agri-Food Canada where she amassed a wealth of economic, technical and industry knowledge through various positions including policy advisor, project lead and Economist.

Amanda holds a master’s degree in Food, Agricultural and Resource Economics from the University of Guelph. She is also a Board member of the Canadian Agricultural Economics Society where she promotes outreach and the importance of agriculture and food research.