Canada’s farmland values in focus: 2025 mid-year report on growth drivers and regional dynamics

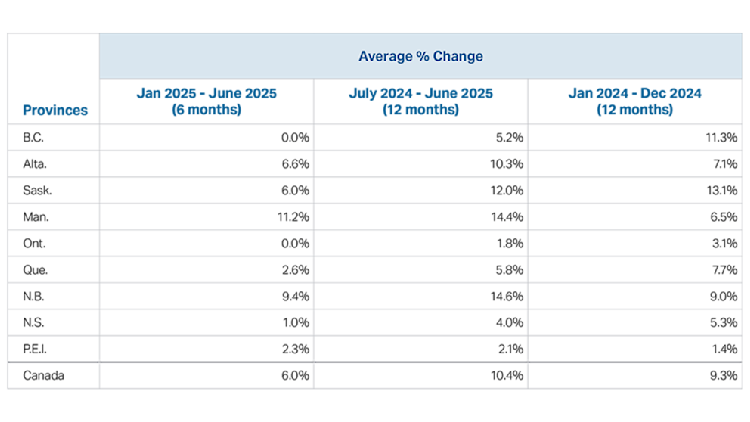

Canadian cultivated farmland values continued to reflect a complex mix of market forces in 2025, rising an average of 6.0% in the first half of the year and 10.4% year-over-year from July 2024 to June 2025 (Table 1), slightly outpacing the previous year’s gains. Regional dynamics remain a defining factor, with pockets of strong demand and limited supply driving much of the appreciation.

Manitoba led growth over the past six months with an 11.2% increase, followed by New Brunswick at 9.4% and Alberta at 6.6%. Saskatchewan matched the national pace at 6.0%, while Quebec recorded a more modest 2.6% gain, followed by Prince Edward Island (+2.3%), and Nova Scotia (+1.0%). In contrast, farmland values in both British Columbia and Ontario remained unchanged at 0.0%, underscoring the uneven nature of the market across the country.

Table 1: Average farmland values change in the first half of 2025 by province

Source: FCC calculations

Mid-2025 farm cash receipts hold steady

Farm cash receipts, interest rates, and overall supply of farmland are key drivers of farmland values. In 2024, Canadian farm cash receipts fell 1.6%, mainly due to a drop in grain and oilseed revenue, while livestock receipts rose. In the first half of this year, record cattle prices helped push cattle receipts up 18.3%, lifting overall mid-year farm cash receipts by 3.3%. In early 2025, grain and oilseed receipts increased slightly, though results vary by crop and region.

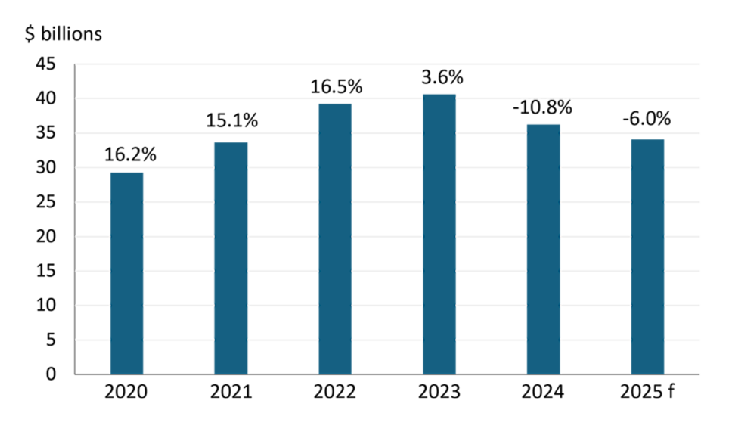

Despite improved grain and oilseeds prices earlier in the summer, increased production this year, along with the loss of Canadian canola and pea export opportunities to China, and the impact of U.S.–China tariffs, are expected to put downward pressure on commodity prices. As a result, receipts from grains and oilseeds are expected to fall 6% compared with last year (Figure 1). Easing interest rates and healthy balance sheets from record crop years in 2022 and 2023 provide underlying support to farmland values, even as grain and oilseed receipts moderate from recent peaks.

Figure 1. Grain and oilseed receipts expected to decline further

Sources: Statistics Canada, FCC Economics

Overall, farm cash receipts vary by sector across provinces and regions, and this variation is reflected in the mid-year farmland value results.

Across Canada’s fields: Where farmland values are rising — and where they’re holding steady

In British Columbia, values for cultivated dryland properties appear to have paused, with no change (0%) reported in the first half of the year. This contrasts with the 12-month provincial average, which shows growth of 5.2%. The six-month trend has been influenced primarily by softening values in the Kootenay region, while the Peace Region–Northern BC and Vancouver Island regions remain the key contributors to year-over-year gains. Market behaviour is characterized by longer exposure periods prior to sale and wider gaps between list and selling prices, as buyers exercise greater caution and sellers continue to adjust expectations.

Alberta’s farmland values closely tracked national trends, with a 10.3% year-over-year increase consistent across the province. Over the past six months, the Peace and southern Alberta regions led the provinces growth with an overall 6.6% rise in values. In the Peace region, market activity has been influenced in part by land auctions, which appear to be elevating acreage costs in surrounding areas by broadening the buyer pool and fostering competitive bidding. In southern Alberta, irrigated land continues to set new price benchmarks, creating upward pressure on nearby dryland parcels. Strong cattle prices have supported notable feedlot expansions, further reinforcing demand for productive farmland in the region.

Cultivated dryland values in Saskatchewan continue to trend upward, with gains of 6.0% over the past six months and 12.0% year-over-year. A growing number of agricultural landlords are selling land to their tenants, while many operations are strategically purchasing land near their existing land base to improve operational efficiency. Expansion-minded producers are also leveraging equity in their current holdings to finance additional purchases. The increase in land values appears concentrated in premium-quality farmland, which is in high demand due to historically strong yields and limited supply. Most value increases are occurring in the northern and eastern regions, whereas the west-central and southwest areas are seeing slower growth, largely due to prolonged drought conditions in recent years.

In Manitoba, farmland values have increased 11.2% over the past six months, with the Parkland and Westman regions seeing the strongest growth. These gains are broad-based, with all regions showing increases, reflecting a robust provincial market that achieved a 14.4% annual rise. In Parkland, large grain operations are actively strengthening their land base. Historically, sales were limited, but steady upward pressure has been building, and recent transactions now reflect those cumulative gains. Strong demand combined with limited supply has created a highly competitive environment for land acquisition.

Cultivated farmland values have largely flattened (0%) in Ontario over the past 6 months, reflecting a market pause after several years of strong gains. Softer commodity prices, high input costs, and the fact that a significant portion of land has traded hands in recent years are collectively slowing demand across the province. These factors appear to be having a noticeable effect on market activity. As a result, values appear to be leveling off across much of the province, with gains of 1.8% over the year, reflecting a trend of diminishing affordability.

In the first half of 2025, Quebec farmland values increased by 2.6% and recorded a 3.1% gain over the past 12 months. Analysis of transactions suggests that the combined impact of rising interest rates in 2022 and 2023, declining grain prices, and expected lower yields is increasingly being felt, despite interest rates gradually falling since the summer of 2024. These factors have negatively affected the income of large-scale crop producers, limiting their investment capacity. While farmland values continue to rise, the rate of increase is more subdued than last year.

In southern New Brunswick, particularly in the dairy farming region, land values recorded strong increases fueling the provinces 9.4% gain. These gains reflect steady increases that have been building over time and are now supported by recent sales data. Part of this upward pressure is linked to inter-provincial and international farmer immigration. In this sector, low baseline rates mean that relatively small absolute changes translate into larger percentage increases.

Nova Scotian cultivated land values rose slightly over the last 6 months and 4% year over year. Western Nova Scotia, particularly the Annapolis Valley, has experienced a difficult growing season. Grain yields are weak, though corn and grass remain stable. Most producers are delaying major purchases until after harvest. Across the province, interest in irrigation is growing. Sales volumes remain low, consistent with trends in New Brunswick for the first half of the year.

Farmland values in Prince Edward Island increased by 2.3% in the first half of 2025, reflecting steady but modest gains. Limited supply and strong demand continue to drive competition, with many sales occurring between neighbouring producers to preserve local ownership. Ongoing drought and unusually dry conditions are raising production risks and prompting discussions around irrigation investment. The province continues to introduce measures to safeguard farmland from being lost to development.

Bottom line

Despite notable gains in certain regions, over the past six months, the overall range of sale prices per acre has increased only modestly, with the most significant shifts seen in the average price, reflecting a tightening of values. Provinces that experienced strong growth in recent years are now seeing a softening in farmland prices, while regions with previously more modest increases continue to see solid gains. Overall, the market appears to be stabilizing.

This report highlights the trends shaping farmland values nationwide — identifying where the market is showing resilience, where it is leveling off, and what to watch heading into 2026. For context on how these values compare to previous trends, please refer to our 2024 Farmland Values Report.

Whether sales in the second half of the year confirm these early trends remains to be seen. Stay tuned for our full 2025 annual report, coming March 2026, when we will review where the trends observed today are headed.

Article by: Megan Mailloux AACI, P.App, Business Intelligence Analyst