New crop outlook has improved since the start of the year

Over the past six months, grain and oilseed producers have experienced a period marked by significant news about global supply chains and U.S. trade relationships but generally stronger-than-expected prices. Weather conditions have, as usual, been unpredictable across the country: while some producers have faced yet another year of drought, many others are anticipating favourable crop yields. Since last January’s outlook, crop margins have improved, though for most producers they remain close to breakeven levels.

Cash prices have strengthened since January outlook

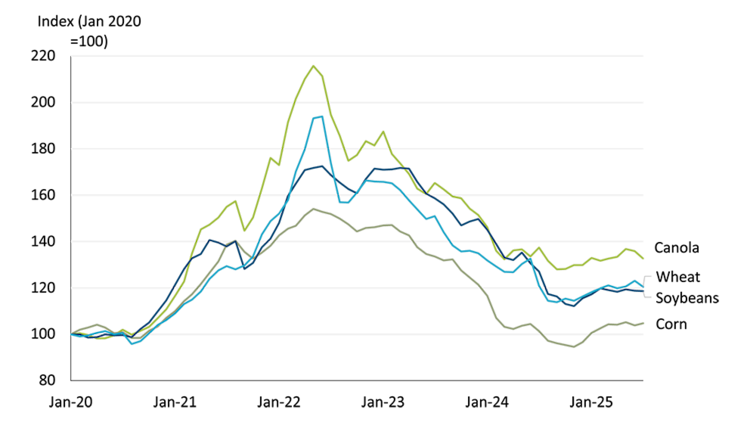

For western producers growing canola, strong Canadian exports and positive news from U.S. government biofuel incentives have improved expectations for current and future demand, supporting prices. As the 2024/25 crop year concludes, market dynamics beyond tariffs and geopolitical factors have emerged as more significant influences on pricing of other crops. Overall, cash prices have strengthened since January; although they remain well below the peaks observed in 2022, current levels continue to exceed long-term historical ranges (see Figure 1).

Figure 1: Cash crop prices have strengthened since the start of 2025

Sources: Statistics Canada, FCC Economics

In its July 2025 WASDE report, the USDA lowered its forecast for both 2025/26 global production and ending stocks of wheat, partially based on lower crop expectations for Canada. Global ending stocks for wheat excluding China, continue to be tight and are at a nearly 20-year low. However, U.S. stocks remain well supplied which is keeping a lid on U.S. futures prices.

Global soybean markets remain well supplied, but a big shift is occurring within the U.S. due to government policies on biofuels as well trade policy with China, the world’s largest importer of soybeans. The biofuel policy is driving higher soybean crush in the U.S. as they need to produce more soybean oil, with the expectation that 2025/26 industrial use exceeds food consumption for the first time ever.

Corn production is forecast to jump this year thanks in part to a large crop in Brazil, but higher consumption is expected to lead to ending stocks roughly unchanged year over year.

Overall, it’s looking like an average crop year in Canada

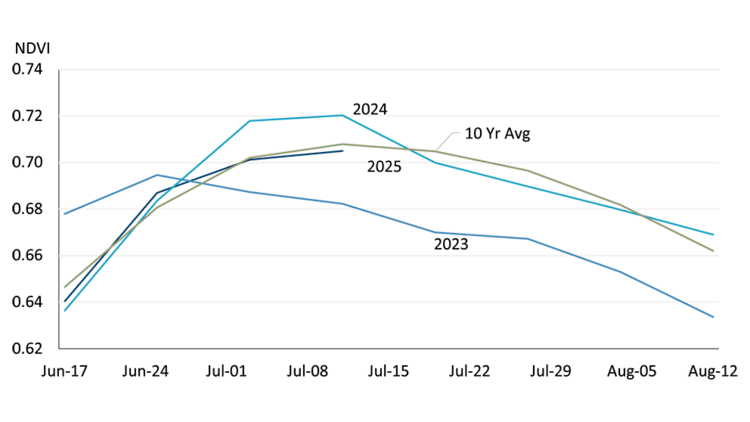

Current Prairie weather conditions resemble those recorded in early July of the previous year, though there are notable differences in this year's July weather. The Normalized Difference Vegetation Index (NDVI) is used to assess vegetation density via satellite imagery in the Prairies, with higher values indicating increased vegetation density or stronger growth trends (Figure 2). The curve's shape provides additional insight; after crop emergence, an appropriate combination of heat and rainfall is required for optimal flowering duration, which is associated with higher yields. Last year at this point, NDVI data suggested high crop potential, but reduced summer rainfall limited overall yields.

Currently, average NDVI readings in the three prairie provinces are at average levels, suggesting yield potential that may fall within or slightly above the usual range. Satellite data provide estimates for specific moments in time. Rainfall in July has been greater than the previous year, and continued precipitation could improve crop outcomes compared to last year. These readings represent aggregate data, but some regions within the Prairies continue to experience drought conditions, which is affecting both hay and grain crops. Feed quality and availability in these areas may present challenges during the upcoming winter.

Figure 2: Continued showers and more cool weather will support crop conditions in the Prairies

Sources: GIMMS Global Agricultural Monitoring, FCC Calculations

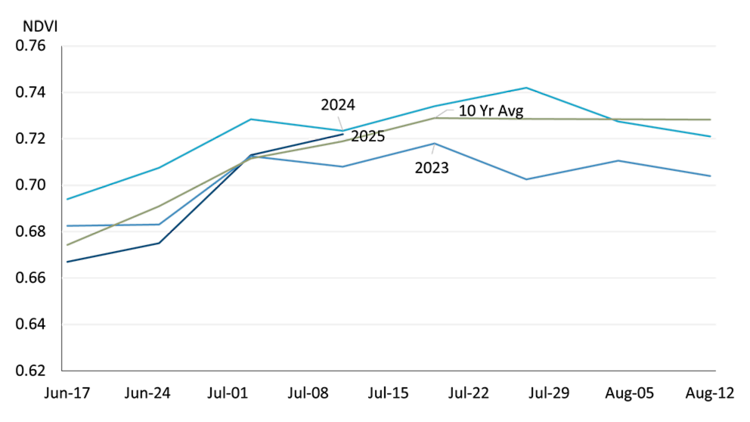

Ontario and Quebec have encountered distinct challenges to date, primarily due to excessive moisture during planting that resulted in significant delays. This is evident when reviewing their NDVI trends compared to historical data in Figure 3 as early season readings were considerably lower than normal. However, subsequent periods of heat and rainfall across most regions have supported corn and soybeans in progressing toward typical development stages. With the winter wheat crop displaying favourable conditions at harvest, weather over the next month will be critical in guiding the late-planted crops through pollination. Nevertheless, average to above-average yields remain attainable.

Figure 3: Crop conditions in Quebec and Ontario catching up after slow, wet planting

Sources: GIMMS Global Agricultural Monitoring, FCC Calculations

Crop margins will get a boost from any yield improvements

The revenue outlook for the 2025/26 crop rotations – including canola/wheat in the west and corn/soybeans in the east – has improved compared to our January forecast. This improvement is primarily attributed to slightly stronger pricing, as cost structures have remained relatively stable and yield projections are average across the major provinces. While anticipated margins are higher than those recorded last year, they continue to fall below the five-year average. For many producers, especially when considering land costs, projected returns are expected to be at or near breakeven. It should be noted that actual results may improve should yields – or marketing opportunities – exceed our model’s baseline assumptions.

Bottom line

The current crop year shows a more positive outlook than last year. Despite various challenges, such as differing weather conditions across regions, overall prospects have improved. Cash prices have increased since January, influenced by global supply projections and market factors, which has impacted margins favourably for grain and oilseed producers. The Prairie regions have experienced better rainfall and cooler temperatures, leading to higher vegetation density readings and the potential for average or above-average yields. In Ontario and Quebec, after initial planting delays, the possibility of strong yields remains if favourable weather persists.

Justin Shepherd

Senior Economist

Justin Shepherd is a Senior Economist at FCC. He joined the team in 2021, specializing in monitoring agricultural production and analyzing global supply and demand trends. In addition to his speaking engagements on agriculture and economics, Justin is a regular contributor to the FCC Economics blog.

He grew up on a mixed farm in Saskatchewan and remains active in the family operation. Justin holds a master of applied economics and management from Cornell University and a bachelor of agribusiness from the University of Saskatchewan.