Can Canadian agriculture handle trade and supply chain disruptions?

Global supply chains remain on high alert amid changing U.S. trade policy. The imposition, then reduction of American tariffs on China’s goods, are disrupting vessel bookings and rerouting shipments, compounding problems brought by the Red Sea conflict i.e., rerouting around Africa. So much so that there are real concerns among importers and exporters about port congestion, unstable freight rates, stock piling, panic buying and ultimately unpredictable logistics and costs. Those challenges could indeed dent the bottom line of Canadian importers and exporters of agricultural products. But there are also opportunities which we highlight in this report, for those who can adapt to this rapid evolution of global trade.

Current environment and lessons learned

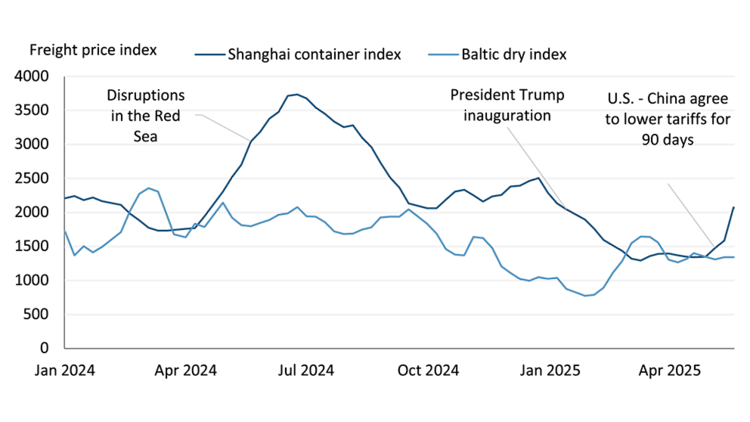

Over the past year, freight rates responded unevenly to global trade disruptions. Container shipping rates have shown high sensitivity to trade policy shifts and consumer demand, while dry bulk freight rates have remained more stable, driven by consistent, commodity-specific demand such as agricultural products (Figure 1).

Figure 1. Ocean freight rates trends amid global supply chain disruptions

Sources: Bloomberg, FCC Economics

A 90-day lowering of U.S.-China tariffs (e.g. 30% on China and 10% on U.S.) has temporarily boosted global shipping activity as importers rush to front-load Christmas orders (normal ordering typically occurs between August and October). The Shanghai container price index has risen 40% since mid-May and is expected to trend higher. This surge risks overloading the system, echoing the panic-driven stockpiling seen during the pandemic.

The pandemic exposed critical vulnerabilities in global supply chains, leading to widespread shortages of essential goods and prompting a reassessment of the just-in-time inventory model. In today’s climate of trade uncertainty, companies are adapting again by stockpiling inventory, diversifying markets, and revising shipping strategies to mitigate risk. These shifts are particularly impactful in agriculture, where stable logistics and predictable costs are vital for long-term resilience and competitiveness.

Implications for Canadian agriculture

Canada’s agriculture sector is deeply integrated into global trade, with both the U.S. and China playing pivotal roles. The U.S. serves as a benchmark for agricultural pricing; soybeans are the perfect example since China is the world’s largest buyer, usually making up more than 60% of global imports. So, when China changes how much it buys from the U.S., it affects the prices of Canadian oilseeds. If China decides to buy more from South America, demand for U.S. soybeans will drop and could lead to lower prices.

When tariffs were at their peak, trade between the U.S. and China was essentially halted, affecting global agricultural flows. Canadian producers, reliant on stable trade routes and competitive pricing, faced increased uncertainty. The extent of supply chain vulnerability depends on trade diversification of each Canadian agriculture sector. Exporters and importers are increasingly cautious, stockpiling goods and delaying shipments to hedge against future disruptions.

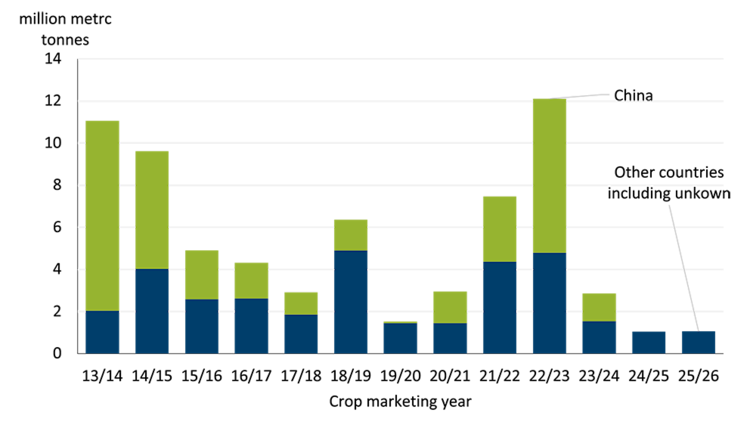

There’s some good news this crop year, because U.S. grain export sales have outpaced last year’s levels. However, it’s the new crop forward sales (the crop just planted) for 2025-26, especially soybeans, that are already lagging with zero sales to China compared to other years around May 29th (Figure 2). While last year as of May 29th, there were also no forward sales for the new crop, however forward sales did materialize later.

Although forward sales could materialize later for 2025-26 this slowdown reflects broader uncertainty, and the current tariffs make the U.S. less competitive. Exporters are wary of committing to deals that could be upended if higher tariff rates resume after the 90-day period ends.

Figure 2. U.S. new crop soybean sales as of May 29th by marketing

Sources: USDA, FCC Economics

U.S. fees on Chinese vessels

Overshadowed by broader tariffs, the U.S. announced in April a new policy imposing shipping fees on vessels built in or operated by China. These fees, currently set at zero, are scheduled to increase starting in October 2025 and are expected to further disrupt global supply chains. The fees vary by vessel type. Cargo ships will be charged USD$50 per tonne, while container ships will pay either USD$18 per tonne or USD$120 per container, whichever is higher. For example, a 70,000-tonne Panamax vessel, which is the most common for U.S. grain shipments, could face fees of up to USD$3.5 million per visit to a U.S. port.

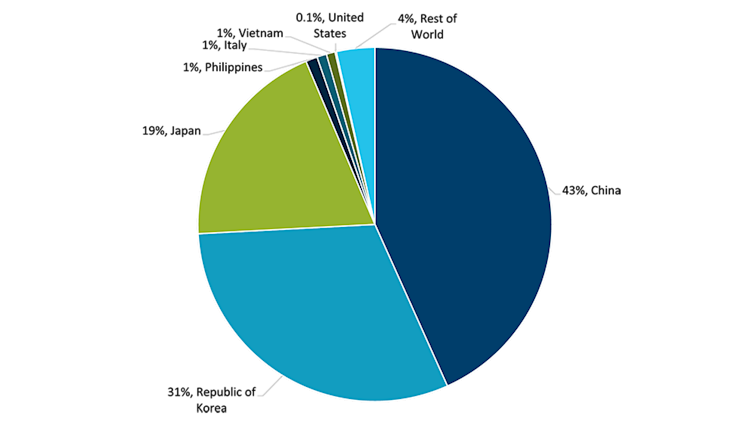

The U.S. government introduced this policy to support its domestic shipbuilding industry in response to China’s dominance in the sector. However, even if the U.S grows its ship building sector it is expected to remain a minor player compared to Chinese shipbuilding giants (Figure 3). In the short term, the fees will raise shipping costs, leading to higher prices for imported goods including the ever-important December holiday season. Overall, it will reduce competitiveness for U.S. exporters, especially in agriculture as increased freight costs are passed on to U.S. farmers through lower farm-gate prices.

Figure 3. China has dominated ship building (2019-2023 average)

Sources: UN Trade and Development

The timing of the fees on Chinese vessels is significant, coinciding with peak U.S. soybean export season. So, the new fees are expected to disrupt shipments during the busiest months, likely leading to further declines in new crop soybean sales.

From Canada’s perspective, this could be an advantage for both bulk grain and containerized agri-food exports. Ships may reroute to Canadian ports to avoid U.S. fees, potentially boosting Canadian export demand and competitiveness.

Opportunities: A silver lining for Canadian agriculture

Canadian exporters and importers of agriculture and food products face logistical hurdles, price volatility, and planning uncertainty. Yet, within these challenges lies a strategic opportunity. As U.S.-China trade volumes decline, Canadian exporters can leverage available vessel space and meet rising demand from Southeast Asia and the Middle East—regions actively seeking reliable, high-quality suppliers. Canada’s strong reputation for sustainably grown food positions it well to fill this gap. In a global market increasingly focused on stability, Canada is well-placed to emerge as a preferred source for agricultural and agri-food products. One area in Canada that is show a promising future is Controlled Environment Agriculture (CEA). While most fruits and vegetables are still imported, CEA is gaining attention and showing strong potential. Canada is already exporting more peppers, cucumbers, and mushrooms than it imports, and there’s room to expand other produce exports even further.

Trends to monitor

Several developments could shape the future of global trade and Canadian agriculture:

Escalation or de-escalation of U.S. – China trade relationship: Any escalation could worsen the global economic slowdown already underway, while de-escalation might stabilize markets and reduce costs.

U.S. Trade Policy Announcements: President Trump is expected to leverage this period of reduced tariffs to negotiate revised trade terms, potentially affecting Canada.

Export sales reporting for new crop marketing year: U.S. soybean sales to China significantly influence global oilseed prices. Shifts in these exports will impact Canadian crop pricing. Continued monitoring of new crop sale commitments remains important.

These trends have potential to reshape global shipping routes and trade flows. For Canada, this could mean both new opportunities and new challenges in accessing international markets, developments that will require careful monitoring by firms as they implement their strategies and contingency plans.

Bottom line

U.S. trade policy has disrupted global supply chains, introducing uncertainty, raising costs, and potentially straining shipping capacity. However, these challenges also create new opportunities for Canadian exporters especially given the volatility of U.S.-China trade and new fees on Chinese vessels at American ports. By leveraging Canada’s strong reputation in agri-food, the sector has a chance not only to withstand these disruptions but to enhance its global competitiveness. Seizing this opportunity will require ongoing vigilance and adaptability in a rapidly shifting trade environment.

Leigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.