2023 Cattle and hog outlook update: Markets show two different price trajectories

This is the third and final quarterly update to our 2023 Outlook for cattle and hogs published in January. Over the last two weeks, we updated our Outlooks for dairy and major crops.

The 2023 drought will ensure diminished margins for some western livestock producers, but the overall cattle outlook is positive as strong global and domestic demand bolsters consumption even in the face of high beef prices. Production, given the small beef herd, will struggle to keep up to that demand. For the hog sector, profitability will continue to be challenged by lower prices. Domestic consumption growth will provide a much-needed boost as pork’s prices will lure more consumers than either beef or chicken, but with drought-induced feed costs rising, the next three months aren’t likely to get any easier than they’ve been recently.

Prices: Two trajectories for two sectors

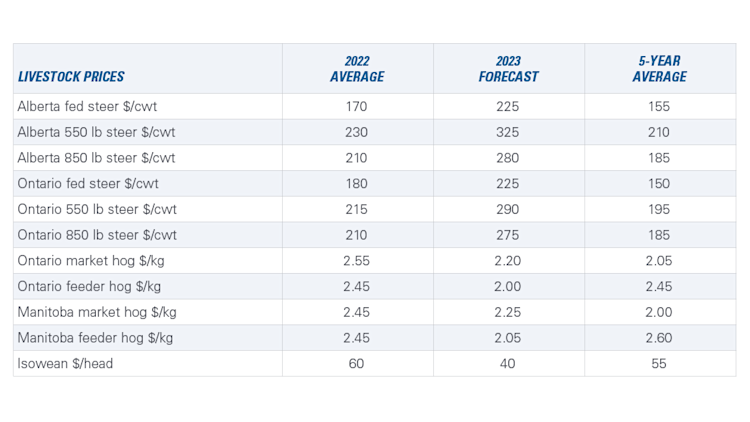

Some good news: prices expected for the next three months (the outlook period) have either stabilized or risen since our August outlook for the cattle and hog sectors. Forecasted cattle prices are, on average, a whopping 33% higher year-over-year (YoY) and 50% higher than their five-year averages for each class as demand remains strong and supplies tighten. Our projected feeder hog prices (Ontario and Manitoba) haven’t changed since August and are still well under last year’s prices and the five-year averages. Isowean prices also continue to lag YoY and the five-year average.

Table 1: Prices stop falling for hogs and continue to rise for cattle

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations

Cattle sector margins forecasted to be positive

Cow/calf sector profitability will continue to be robust throughout the outlook period, given the underlying strength of prices. There’ll be more pressure on cattle sector profitability in areas where the drought impacted feed grains. That also holds true for finishing feedlots who may see pressure from U.S. feedlots for Canadian feeder cattle, pushing those prices higher. Given the strength in demand, however, feedlot margins should be positive throughout the outlook period.

Isowean margins continue to see heavy pressure

Isowean profitability turned negative in 2022, but 2023 has been particularly challenging with falling prices and increased expenses. Producers who have weathered the storm can look ahead to 2024 when margins are expected to take a jump in the right direction.

This year, we’re monitoring the North American drought’s impact on U.S. and Canadian cattle herds, red meat demand and input costs as the most significant forces on livestock profitability.

About those feed costs

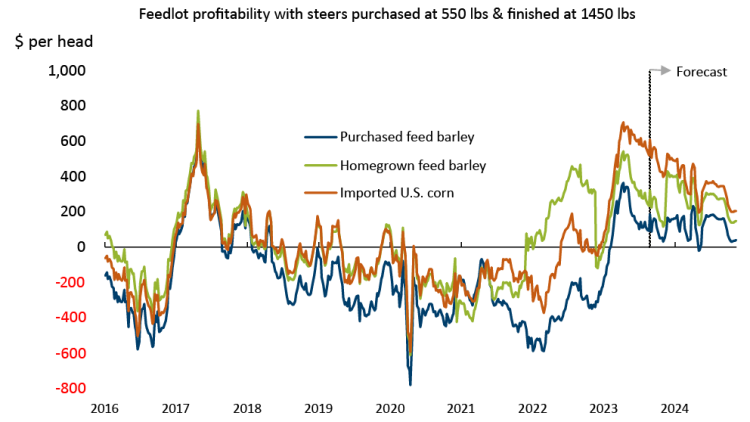

The trend we pointed to in our August update of feedlots’ early spike in corn imports has stabilized as a longer-term trend. Canadian imports of U.S. corn destined for western operations have continued, and as of September, are just below the record imports of the 2021-22 crop year.

There’s a direct link to feedlots’ bottom lines. In 2023, it costs more to use homegrown feed (barley) than imported corn (Figure 1). While these costs don’t include the import costs of transportation, they also discount the savings that the use of corn enables. Feeding properly processed corn can use up to 10% fewer pounds per day relative to barley use. There’s some relief in the extra supply of off-grade, non-feed crops made available from the drought but, overall, the use of Canadian crops as feed will suppress margins.

Figure 1: Drought makes imported corn the feed of choice

Sources: CanFax, Statistics Canada, CME, FCC calculations

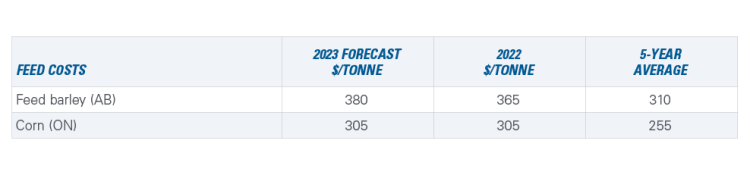

Ontario corn prices have also risen from our August outlook update but remain at 2022 average prices. At that price, they’ll be well in excess of the five-year average, applying more pressure to hog margins.

Table 2: Ontario corn prices remain elevated

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations

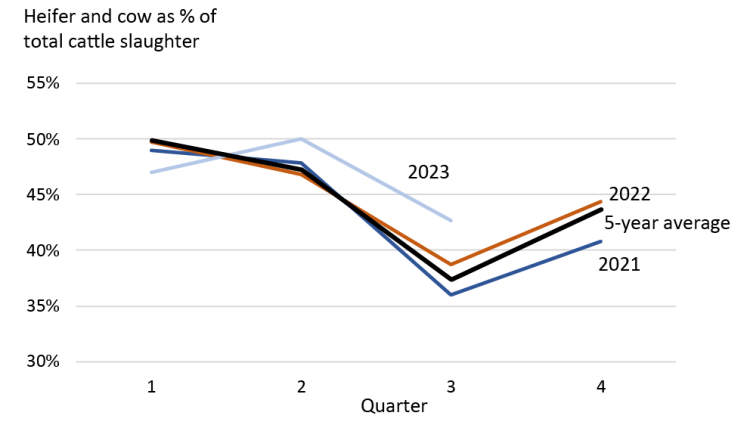

North American beef herd continues to shrink

The 2023 drought has led the cattle sector to cull more, despite the strength in markets. While the strong prices we’re seeing now are normally associated with heifer retention and herd rebuilding efforts, the dryness across the U.S. Midwest and the Canadian prairies has prompted increased herd liquidation since 2021. Heifer and cow slaughter has trended generally higher each year as a percentage of total cattle slaughter (Figure 2).

Figure 2: Heifer and cow culls higher in 2023 than recent historical trends

Source: AAFC

Lower beef production hampers supplies

As noted in August, the upward trend in slaughter produced an initial bump in beef production — and record U.S. production in 2022 — that has since turned into lower numbers of slaughter-ready cattle. In 2023, Canadian and U.S. beef production is down YoY as a result.

As of September 30, the year-to-date Canadian beef production (fed and non-fed) was down 6% YoY and the U.S. was down 2%. It may very well not pick up in the next two years for either country as there will likely continue to be more reasons to cull than to not cull. Even when it’s time to reverse the trend, it’ll be neither quick nor simple to get more cattle on North American operations.

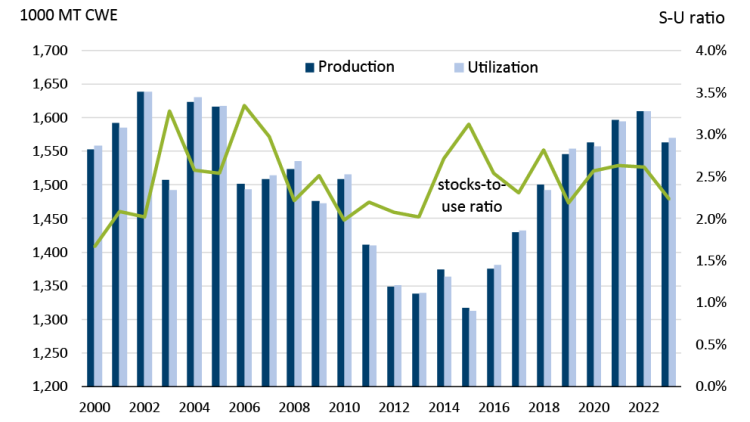

The drag on production will help to lower Canada’s beef stocks-to-use ratio (ending stocks/utilization) this year to 2.2% (Figure 3). That’s lower YoY and compared to the five-year average (2018 – 2022) and one of the lowest five-year average levels since the early 2000s.

The ratio accounts for lower utilization as well, with both domestic consumption and exports trimmed. Already trending down, it could near the lows of 2000 in 2024, suggesting beef prices have not yet reached their peak. While high prices will undoubtedly deter some consumers, Canadian consumer preferences for beef remain strong, outpacing consumption.

Figure 3: Canadian beef in low supply

Source: USDA

* Production includes imports; Utilization includes domestic use and exports

In a similar response to North America’s lack of moisture, Argentina’s drought has sent the country’s beef production into high gear. In fact, global beef production is forecasted up for 2023 based on higher slaughter in several regions due to widespread drought conditions. In the European Union, high input costs are forcing liquidations.

There remains global demand for beef, with non-U.S. domestic consumption expected to rise 1.3% YoY. Notably, China, the world's second-largest beef consumer behind the U.S., is forecast to grow 3.0% YoY as the country’s burgeoning middle class continues to develop a preference for what was once almost exclusively a western staple. There are downside risks though. According to the International Monetary Fund’s latest World Economic Outlook, global GDP growth will slow from 3.5% last year to 3.0% this year and 2.9% in 2024, a development that will weigh on consumption in the months ahead.

Pork production

Total global pork production is expected to stay flat this year, with U.S. (1.4%) and China (1.1%) expected to grow, offsetting losses in the European Union (2.9%) and the U.K. (14.4%).

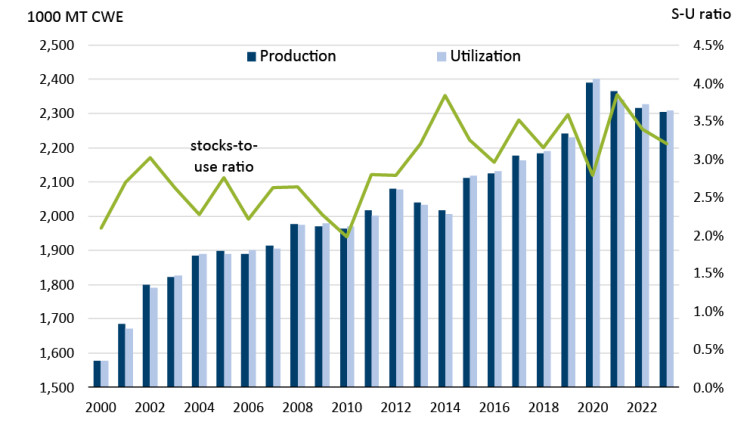

Canada’s pork stocks-to-use ratio shows the small YoY contraction in expected production – the latest year in a downward trend since the buying spree induced by the pandemic in 2020 and China’s African Swine Fever outbreak (Figure 4). The pork ratio, at 3.2%, is higher relative to beef.

Figure 4: China’s splurge-buying of Canadian pork may be over, but consumption shows resilience

Source: USDA

* Production includes imports; Utilization includes domestic use and exports

Production remains elevated compared to pre-2020 though, as does consumption, which will be fairly one-sided. Canada’s exports are expected to shrink 8.0% YoY as non-U.S. pork consumption is forecast to be the same as last year’s and U.S. pork consumption is expected to drop 1.9%. One bright spot: China’s pork consumption will likely expand 1.3% YoY.

Instead, this year’s total utilization for Canada will be supported by domestic use. Canadian pork consumption is slated to grow 6.8% YoY, thanks to the large differential in pork prices compared to chicken and beef, pork’s main competitors. Pork, in fact, was one of very few items in Canada’s Consumer Price Index basket that's had negative price growth in the last two years.

There’s good news mixed with some warning signs. Pork consumption has benefitted from that relatively favourable pricing, but it faces lacklustre demand. The FCC meat demand index (for beef, pork and chicken) shows that consumer preferences for beef and chicken exceed that for pork.

Bottom line

Beef’s elevated prices at retail and in food service will take a bite out of consumption this year, but not as much as you might think. The loss of production, a direct result of the small beef herd, will take another bite. It speaks to a coming year of solid returns for the sector. On the other hand, the hog and pork sector will benefit from a significant increase in domestic consumption, but that good news is tempered by expectations of a large dip in exports and the reality that Canadians are buying pork because it’s relatively less expensive.

Martha Roberts

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.