2023 Cattle and hog outlook update: feed costs and demand strength lead profit uncertainty

This is the second quarterly update to our 2023 Outlook for cattle and hogs published in February. Over the last two weeks, we updated our Outlooks for dairy and major crops.

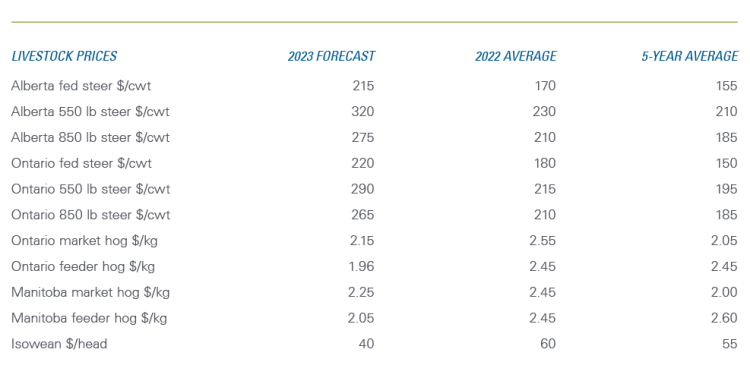

Prices for fed steers in Ontario and Alberta have continued to gain since our May outlook update. Our forecasts for each price category are also higher year-over-year (YoY) and significantly higher than their respective five-year averages. Prices for live hogs have similarly improved since May except for Manitoba feeder hogs and isoweans, bringing some relief to eastern producers. However, they’ve not yet returned to the levels we had initially forecasted in February.

Table 1: Prices continue to rise for cattle; hog producers see a turnaround in the downward trend

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations

Hog margins still facing pressure: Cattle sector is in a good spot

As good as cattle margins were in 2022, they will improve in 2023. Cow-calf operations will easily surpass the five-year average, while feedlot profitability should return to the black throughout 2023 after five hard years. Isowean margins continue to face pressure, especially in the East, as do eastern farrow-to-finishers. Western farrow-to-finish operations should expect positive returns, although they will fall short of the five-year average.

In February, we identified a shrinking North American herd, red meat demand, and escalating feed costs as three factors to monitor throughout 2023.

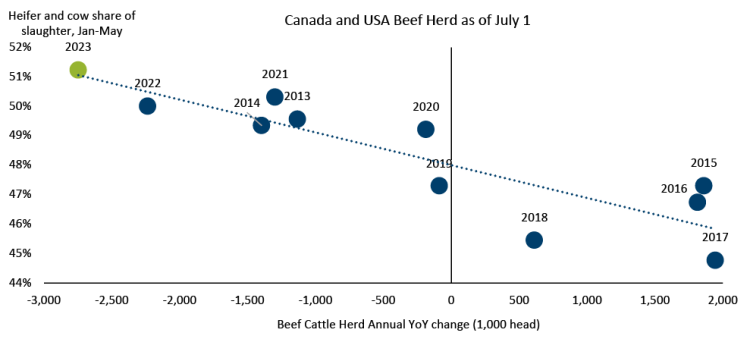

North American drought conditions adding to herd size woes

Our February outlook showed a year-over-year decline in the North American cattle herd as of January 1. As of July 1, the U.S. herd on feed is estimated at 13.1 million head (a 2% year-over-year decline) and the Alberta/Saskatchewan herd on feed at 910 thousand head (a 7.7% decline year-over-year but in line with the 5-year average). The 2.9% decline in the overall size of the North American beef herd as of July 1 is the biggest year-over-year drop in the last 30 years, as cows and heifers continue to show up in an increasing percentage of total cattle slaughter (Figure 1). The USDA estimates that the U.S. herd will decline by 3.0%, and the Canadian herd will shrink by 2.2% year-over-year in 2023.

Figure 1: Another year-over-year dip in the North American cattle herd

Source: Canfax, Statistics Canada, USDA, FCC Calculations

Western soil moisture lacking

Soil moisture across the prairies is well below normal for July 24rd. While many Saskatchewan crops continue to look good, Manitoba and Alberta especially are seeing some challenging conditions with repercussions for Canada’s livestock sectors.

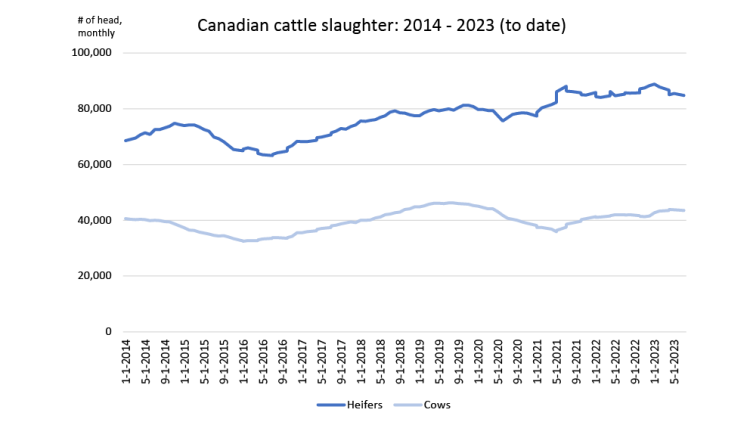

Dry periods can accelerate slaughter as cow-calf producers balance lower their own feed supplies while minimizing purchased feed at elevated prices. In this situation, they’re likelier to send more heifers to feedlots rather than retain them, which is what happened during the drought of 2021 (Figure 2). Cow slaughter also picked up during the period.

Figure 2: Dry periods and price signals drive changes in slaughter numbers

Source: Statistics Canada

On the other hand, high prices in 2014-15 served as a signal to retain cattle to build a stronger herd, visible as a drop in cow and heifer slaughters between November 2014 and July 2016. But the extent of western dryness this year is keeping slaughter numbers strong, despite a small and shrinking North American cattle herd and price signals that might otherwise motivate heifer retention.

The reduced numbers have impacted beef production in both markets. Canadian beef production will fall 3.6%, and U.S. production will be cut by 4.0% YoY. Carcass weights are also lighter YoY across North America and lighter than they were in 2021. But with higher slaughters in the last two years, there are fewer cattle to keep meat processing plants running closer to capacity in 2023. It appears that younger cattle are being pulled from feedlots early to reduce underutilization.

Production declines needed to support hog sector as consumption wanes in North America

With the ongoing shuttering of five pork processing plants, Canadian pork production is forecasted to be down 2.9% YoY. Unsurprisingly, our pork exports are also forecasted to drop 8.0% YoY. On the other hand, hog exports are expected to increase 50% YoY, destined for U.S. processing which the USDA pegs at 1.4% higher YoY. Global pork production will stabilize this year at last year’s levels, with a minor increase for China (1.1%) that will keep production at pre-African Swine Fever levels. Taken together, Canadian hog prices aren’t likely to rebound without a contraction in U.S. production, and that’s unlikely to happen in the near term. And this is occurring even as the North American industry grapples with California’s Proposition 12, which implies that pig and pork sales in the state must come from animals housed in cages larger than the currently used gestation crates.

Global consumption will also flatten this year, with a 1.3% increase in China’s consumption offsetting declines in Brazil, the E.U. and the U.K. Japan and South Korea will see no YoY changes. It remains very strong, though, at 8.1% higher than the previous five-year average (2018 – 2022).

The North American outlook isn’t as rosy, though, as the U.S. is expected to see a 1.9% YoY decrease in pork consumption which will more than offset an expected 9.4% bump in Canada. Here at home, despite a favourable price differential, pork is facing an uphill battle (Figure 3).

Figure 3: Demand for beef exceeds consumption levels while pork struggles to boost either

Sources: Statistics Canada, AAFC, and FCC calculations

FCC Economics’ red meat demand indices show that consumers’ preferences for beef are still strong.

Recent increases in pork consumption levels have resulted from favourable price swings at the retail level. Despite its low prices and the relatively higher prices of beef and chicken, pork demand is finding it hard to regain the vigour exhibited before the pandemic.

With feed costs, volatility is the word

As far as profitability is concerned, the good news is that current feed costs have not taken off from the heights of 2022 feed costs. But it’s a bit of a guess as to where they’ll end up. Recent volatility has produced downturns and price gains in response to the news. First, South America’s record corn crops are alleviating some fears. Second, there’s the uncertainty arising from the Black Sea region, where Ukrainian grains may not have a safe passage for export. Third, North American dryness and drought conditions produce more uncertainty.

Table 2: Recent price gains wipe out prior improvements in feed costs ($/tonne)

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations

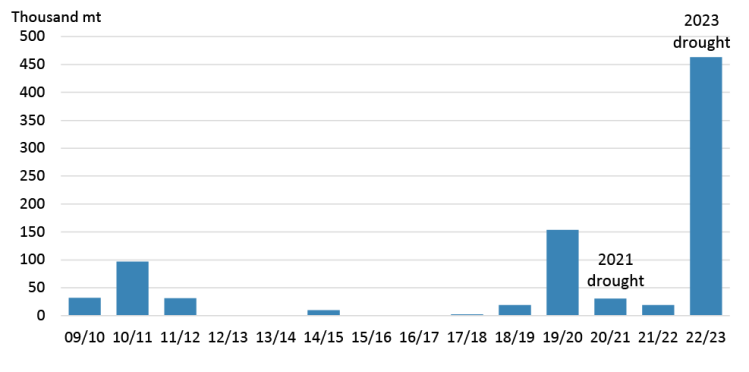

Feedlots are more proactively sourcing feed grains compared to the last drought in the 2021-2022 crop year (Figure 4). That year, Canada imported 3.7 million tonnes (mt) of corn from the U.S. This year, feedlots are jumping on the expected drought-induced feed grain shortage much sooner. Canada has already purchased over 450,000 mt of corn for delivery at the start of the new crop year in September, with deliveries already showing up.

Figure 4: U.S. new crop corn sales to Canada (as of July 20)

Sources: USDA FAS Export Sales, Market Year (MY) is Sep/Aug

Bottom line

Perhaps the largest factor weighing on Canadian red meat sectors is the weather. Drought conditions in North America have led to feed costs creeping up again after trending down throughout most of 2023. With such good current prices, they’re also keeping cattle slaughter rates higher than we’d expect. For their part, the hog sector must contend with rising costs and lowered prices.

Martha Roberts

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.