2023 Dairy outlook update: Little margin improvement in 2023

This is the third of three quarterly updates to our 2023 Outlook for the dairy sector published in January. Last week, we updated our grains, oilseeds and pulses outlook, and next week, we’ll update the outlook for cattle and hog.

At the end of August, the P5 announced it was cancelling incentive days for the fall, signalling that the additional production was no longer necessary. There are now only two incentive days this fall in the P5 (the Western Milk Pool [WMP] also has two incentive days this fall). Strong year-to-date production, higher imports, and slowing demand are the reasons behind the cancellation.

The Canadian Dairy Commission (CDC) released its 2022 Cost of Production (COP) study this month. The results of the study, in combination with the National Pricing Formula (NPF), suggests a 1.8% farmgate price increase effective February 2024. This is not guaranteed. As per the process, industry stakeholders had until October 13 to notify the CDC if they wished to invoke the exceptional circumstance process. As of the time of writing, the Canadian Federation of Independent Grocers (CFIG) has already invoked this mechanism, meaning consultations with stakeholders – rather than strict adherence to the NPF – will determine whether a price increase is implemented. A final announcement should come in late October or early November.

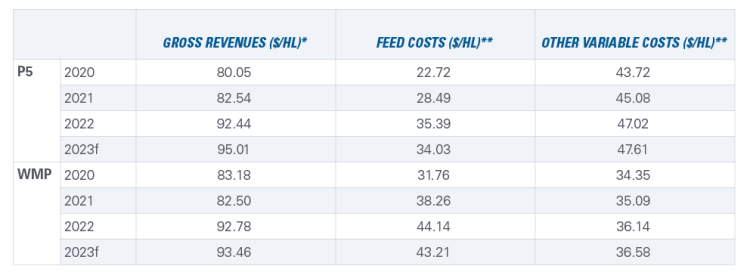

Blended milk prices have been flat in the last few months for the same reasons we highlighted in July. This has caused a slight downward revision in our dairy farm unit revenue forecasts (Table 1). Our costs forecasts remain essentially unchanged from our last update. When compared to 2022, revenue is slightly higher and feed costs are slightly lower. Interest rate costs in 2023 are higher than last year, putting downward pressure on margins.

Table 1: Estimates of dairy farm revenues and variable costs

Sources: Calculations by FCC based on the cost of production estimates from the Canadian Dairy Commission and Government of Alberta and data from the Dairy Farmers of Ontario, Les Producteurs de Lait du Québec, Alberta Milk, Statistics Canada and USDA.

We do not include capital and producer labour costs as these vary greatly between operations.

*Gross revenues are based on data reported by producer groups, which differ from Statistics Canada data used in calculating dairy receipts.

**The calculations use different definitions of cost categories for the P5 and WMP; therefore, values are not directly comparable.

Trends to watch in 2023

In January, we identified the following items as influential factors to monitor in 2023. Here’s a quick update on each item.

1. Elevated input costs

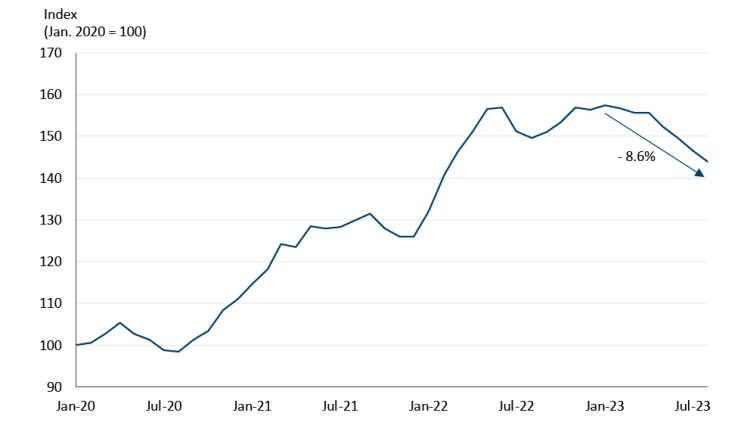

According to Statistics Canada, feed costs in the east have slowly moderated in 2023, down 8.6% since January. They are, however, still elevated - nearly 44% higher in August 2023 than in January 2020 when Statistics Canada began compiling the data.

Figure 1: P5 feed costs easing, but still elevated, in 2023

Complete dairy cattle feed, Industrial Product Price Index

Source: Statistics Canada

Hay availability in the west remains an issue. The average hay price in Alberta is up 24% since January according to the government of Alberta, and is expected to remain elevated into 2024 until next year’s first cut. The average feed barley price is down 7% since January but remains elevated at $7.80/bu.

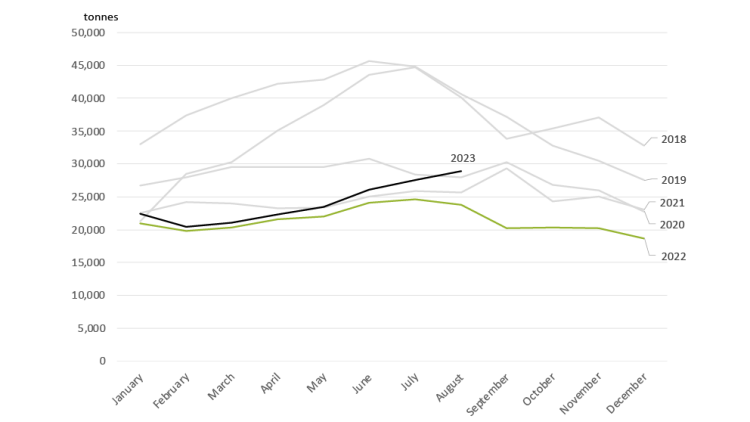

2. Butter stock levels

Butter stock levels are tied to required production: when stocks are low, more production is needed, and vice versa. Production has been strong this year: in the 12 months ending July 2023, total butterfat production was up 2.4% from the same period last year. August butter stocks were nearly 29,000 tonnes, close to a three-year high. For the first time since 2015, August butter stocks expanded from July levels. Fall is traditionally a time when butter stocks are drawn down. This should happen again in 2023, as the CDC forecasts December butter stocks between 22,000 and 23,000 tonnes.

Figure 2: August butter stocks near three-year highs

Source: Statistics Canada

3. Imports of dairy products

In September, a dispute resolution panel released its findings regarding Canada’s allocation of its tariff rate quotas (TRQ) under the CPTPP. The complaints brought forward by New Zealand were similar to the US complaints filed under the CUSMA. The CPTPP panel found in favour of New Zealand on some claims and in favour of Canada in others. Some changes to Canada’s TRQ allocations are expected to be implemented.

Butter imports under CUSMA and CPTPP have been strong since those agreements were enacted. The CDC reports that butterfat imports are up 16.7% Y/Y as of July 2023, largely due to the incremental increase in the volume of butter and cream imports. These incremental market access increases will end in 2024 (CPTPP) and 2025 (CUSMA); after 2025, the volume of dairy products permitted to enter Canada tariff-free will be increased by 1% per year, a much smaller rate than the annual increases currently being implemented during the phase-in period.

4. Retail price inflation

Is the price of butter starting to turn away consumers? Possibly. Given the storable nature of butter, sales are difficult to interpret – if there’s a sale on, consumers can stock up, for example. However, the most recent data from the CDC is not encouraging. Consumption of butter in the previous 12 months ending July 2023 was down 6.3% percent compared to the same period the year prior; this, despite Canada’s population having increased by 1.2 million during that time.

Overall, food inflation has decelerated in recent months, though the rate is still elevated. The price of margarine was up 8.2% Y/Y in August 2023, significantly lower than the 37.5% Y/Y rate in August 2022. August was the first time in many months that the increase in the price of margarine was lower than that of butter (8.6%).

Bottom line

The drive to replenish butter stocks we discussed in our January outlook has succeeded to the point where additional incentive days in the P5 are no longer required. Feed costs are slightly lower this year in some parts of the country, but interest payments are up, and it will be another tight year for producers. Margins in the WMP will be under extreme pressure especially in areas where feed is scarce.

Graeme Crosbie

Senior Economist

Graeme Crosbie is a Senior Economist at FCC. He focuses on macroeconomic analysis and insights, as well as monitoring and analyzing trends within the dairy and poultry sectors. With his expertise and experience in model development, he generates forecasts of the wider agriculture operating environment, helping FCC customers and staff monitor risks and identify opportunities.

Graeme has been at FCC since 2013, spending time in marketing and risk management before joining the economics team in 2021. He holds a master of science in financial economics from Cardiff University and is a CFA charter holder.