Top 3 takeaways from the 2018 FCC Farmland Values report

Canadian farmland values increased at an average annual rate of 6.6% in 2018. This is the lowest growth rate recorded since 2010. Trends varied across the country, highlighting the truly local nature of the farmland market.

Table 1. Average annual change in 2018 farmland values (by province)

| 2018 | 2017 | |

|---|---|---|

| Canada | 6.6% | 8.4% |

| B.C. | 6.7% | 2.7% |

| AB | 7.4% | 7.3% |

| SK | 7.4% | 10.2% |

| MB | 3.7% | 5.0% |

| ON | 3.6% | 9.4% |

| QC | 8.3% | 8.2% |

| N.B. | 1.8% | 5.8% |

| N.S. | -4.9% | 9.5% |

| P.E.I. | 4.2% | 5.6% |

| N.L. | N/A | N/A |

I draw three main conclusions from the FCC 2018 Farmland Values Report.

1. Beware the average

The pace of increase in farmland values slowed in 2018 at the national level. This is also true at the provincial level, with British Columbia the only province bucking the trend. There, the increase in land values was significantly stronger than last year.

There was a noticeable trend in 2018 land transactions: in many regions, lower-valued farmland recorded higher-percentage increases than the land with above-average values. These subtle patterns tell a story about price trends that a simple average, as seen in Table 1, can’t account for.

2. Farmland: They’re not making it anymore

Many have cautioned about the effects of a limited supply of farmland, a fact that contributed to fewer 2018 transactions, and higher average prices.

Supply is critical to land values. However, the two most significant drivers of those values are farm income and interest rates. We estimate that cash receipts declined 1% in 2018, which, coupled with higher farm expenses, led to a decline in net income. Interest rates climbed in 2018 with an average gain of 75 basis points. Softer income and higher borrowing costs usually weaken the demand for land more than what we saw last year. The unusually strong demand may have been prompted by the need for efficiency gains made possible by adding acres, especially of less expensive farmland.

3. No two regions are alike

The importance of local trends in land supply, farm income and interest rates shows up clearly in the value of land transactions at the regional level. Of the 51 regions reported in the FCC study, eight regions recorded an average annual increase of more than 10%. At the other end of the spectrum, eight regions showed little or no annual change. Four regions in Nova Scotia and New Brunswick recorded a decline.

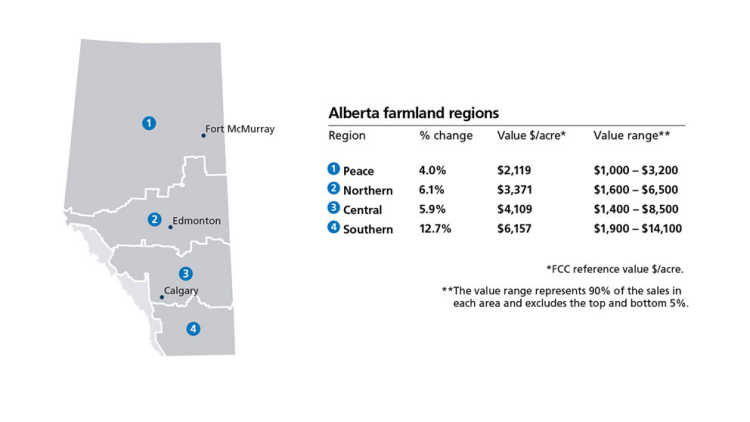

Alberta as an example

I’m highlighting Alberta’s result here, because it serves as an example of the regional variation in the growth of values.

Alberta farmland values increased 7.4% on average in 2018, following a 7.3% increase in 2017. Several factors explain variations across the province:

There was strong demand for farmland throughout southern Alberta, mostly for irrigated land suited for potato production.

The oil and gas industry showed some signs of recovery at the beginning of 2018, heightening demand for land temporarily, which then softened.

Smoke from B.C. wildfires throughout much of the summer and significant harvest challenges in the fall reduced the number of transactions in the Peace region.

Farm income supports farmland values

Farm income and land prices go together. I expect the trade issues that loom large in 2019 will bring more volatile commodity prices and pressure farm income. Here’s a positive trend: interest rates probably aren’t going to rise.

Here’s a positive trend noted in FCC Farmland Values Report: interest rates probably aren’t going to rise. See what else ag economist @jpgervais is predicting.

Now is the time for producers to assess their overall financial positions in light of those pressures and adjust business plans to reflect them. A focus on increasing productivity will be key in managing the changing economic landscape.

For more information about the trends in farmland values for your region, watch our video or download the full report. And don’t forget to sign up for my Facebook Premiere video on May 3, so you can ask me your questions live.

Get the full farmland values story now.

Jean-Philippe (J.P.) Gervais

Executive Vice President, Strategy and Impact and Chief Economist

J.P. Gervais is Executive Vice President, Strategy and Impact and Chief Economist at FCC. His insights help guide FCC strategy, monitor risks and identify opportunities in the economic environment. In addition to acting as an FCC spokesperson on economic matters, J.P. provides commentary on the agriculture and food industry through videos and the FCC Economics blog.

Prior to joining FCC in 2010, J.P. was a professor of agricultural economics at North Carolina State University and Laval University. J.P. is a Fellow of the Canadian Agricultural Economics Society. He obtained his PhD in economics from Iowa State University in 1999.