New survey explores how producers are managing risk

Risk is an inevitable part of farming. A recent FCC Vision panel survey investigated the risk concerns and management strategies of over 1,300 producers across Canada. Five major types of risks were studied: production, marketing, financial, legal and human resources.

Farm operators were most concerned about marketing (67% of respondents), production (60%) and financial (53%) risks, while less so with human resource and legal risks (31% and 23% respectively). And about half the producers are mitigating their risk concerns by developing relevant strategies.

Here are three notable takeaways about producers’ risk management strategies:

1. Commodity marketing – contracts more popular than futures

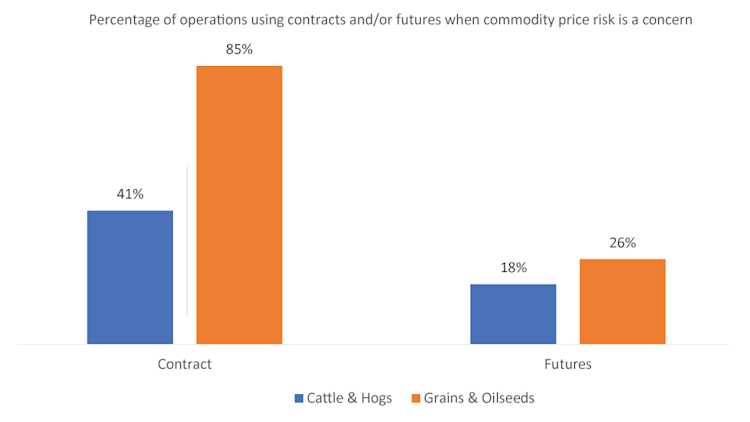

58% of respondents identified contracts as their strategy to mitigate commodity price risk – their most significant concern related to marketing. 15% reported using futures in the cattle, hog and grains and oilseeds sectors. And responses vary by sector: cattle and hog operations seem less likely to rely on futures and contracts than grains and oilseeds producers (figure 1).

Figure 1. Contracts are more popular than futures to mitigate price risk

Source: FCC Vision panel survey on risk management

2. Transition a major concern - but few farms have a plan

Transitioning farm operations was identified as a major concern for 44% of survey respondents. But according to Statistics Canada’s 2016 Census of Agriculture, only 8% of farm operators had a formal transition plan.

The FCC Vision survey paints a slightly more positive picture, with half of the respondents who identified transition planning as a concern said they have a plan in place. Overall, it’s an area that requires more attention.

3. Off-farm income is important to Canadian farm financial health

Working capital is the first line of defence against challenging financial conditions or changes in the operating environment. But nearly 65% of the respondents identified insufficient working capital as a financial risk concern for their operation.

Out of this group, approximately 45% relied on off-farm income as a mitigation strategy. Off-farm income is more frequent in the cattle sector (65%) vs. any other specific sector of operation (figure 2).

Figure 2. Off-farm income can mitigate the risk of insufficient working capital.

Crops include Grains & Oilseeds and Vegetable/Fruits/Greenhouse Sectors

Source: FCC Vision panel survey on risk management

Farm size also seems to affect the decision to rely on off-farm income. There were very few differences on risk perceptions related to working capital: 67% of farms with sales greater than $50K and less than $1 million vs 63% for larger farms with sales over $1 million identified this risk as a concern. However, smaller farms are more likely to use off-farm income to mitigate financial risk: 46% for smaller farms vs 16% of respondents with sales over $1 million.

Many options to manage risks, but finding the right strategy is vital

There are multiple types of risks in agriculture, and any single management strategy can address more than one. That’s why it’s imperative to build a plan that accounts for the intersections across types of risks. Farm Management Canada offers AgriShield - a risk assessment and planning platform that can help identify, assess and prioritize your farm risk and access resources and tools to help you manage it.

For additional information, including a summary of the main findings by sector, consult our FCC Vision survey results.

Yeon Zhoo

Agricultural Economist

Yeon is an Agricultural Economist at Farm Credit Canada. Prior to joining FCC in 2019, she studied at the University of British Columbia focusing on economics, policy analysis and business within agriculture. Yeon holds a Master of Food and Resource Economics degree from the University of British Columbia.