Farm equipment outlook 2026: used equipment and livestock support modest sales growth

The farm equipment market has been slowing for several years due to declining crop prices and rising operating costs, which have squeezed farm profits. Reduced profitability, combined with high equipment prices, has constrained equipment sales. The big question is: how long will the weakness persist and where are the opportunities?

In this outlook, we look ahead to the coming year with sales projections for new and used equipment and highlight trends in Canada’s agricultural implement manufacturing sector. While the industry remains in a downturn, trade uncertainty adds another layer of complexity. Ongoing negotiations and potential tariff changes could influence commodity markets and farmer confidence, shaping purchasing decisions in 2026. Despite these challenges, we identify areas of opportunity.

New equipment sale weakness expected to persist

New farm equipment sales are expected to finish this year below 2024 levels across most categories. Combine sales are currently tracking on par with last year while 100 HP and 4WD tractor sales have fallen 10% - 20%, signaling overall weakness heading into year-end.

We anticipate this softness will continue into 2026 (Table 1). New farm equipment unit sales are projected to remain soft as farmers feel the pressure of tighter profitability due to low commodity prices, high equipment prices, and market uncertainty stemming from geopolitical and trade issues. Categories like low-horsepower tractors that ended the year stronger are largely the result of additional units being directed to the Canadian market.

Table 1. New farm equipment sale projections: weakness persists

Equipment type | 2025 relative to 2024 | 2026 relative to 2025 | 2026 relative to 5 Yr Avg |

|---|---|---|---|

< 40 HP | 4.8% | 3.1% | -13.9% |

40 - 100 HP tractors | 5.9% | -4.7% | -18.6% |

100+ HP tractors | -10.9% | -5.6% | -19.5% |

4WD tractor | -13.2% | -1.6% | 3.0% |

Combines | -2.2% | -6.7% | -13.5% |

Sources: AEM, FCC Economics

Equipment manufacturers face rising costs and shrinking demand

Canadian agricultural implement manufacturing sales fell sharply in 2025, at least based on the first nine months which showed sales down 18% compared to last year. We expect Canadian manufacturing sales to keep declining, ending the year below $5.2 billion. New orders so far in 2025 are down 16% compared to the same period last year.

Manufacturers are caught in a tough position. Elevated equipment prices have reduced demand, yet they also face rising input costs from tariffs on steel and aluminum. This combination leaves little flexibility on pricing and adds pressure to maintain profitability and sales.

Overall, farm equipment purchases have shifted from being driven by wants to being driven by needs, as many farm operations focus on cost efficiency—either by keeping equipment longer or exploring options in the used market.

Rising interest in used equipment spurs modest growth

In recent years, used equipment inventories have been rising. In 2025, sales were uneven—some categories saw strong results for part of the year, while others remained weak throughout. Stronger used sales were driven by early arrivals of new equipment, which boosted trade activity, and by farms looking for more affordable upgrades. For example, the surge in new combine deliveries in September resulted in increased trade activity for used combines; sales are up 18% year-to-date.

Our projections for the remainder of 2025 and into 2026 show that the outlook for used equipment remains more positive than new equipment across most categories (Table 2). Used combine sales are expected to finish 2025 above 2024 levels, although still below the five-year average. Meanwhile, sales of used seeding and planting equipment have declined, and are expected to fall 10% by the end of the year.

Table 2. Used farm equipment sale projections: modest growth

Equipment type | 2025 relative to 2024 | 2026 relative to 2025 | 2026 relative to 5 Yr Avg |

|---|---|---|---|

< 40 HP | 12.8% | -2.1% | 1.2% |

40 - 100 HP tractors | -4.1% | 2.8% | -22.1% |

100+ HP tractors | -0.8% | 1.7% | -4.7% |

4WD tractor | -7.3% | 2.3% | -7.3% |

Combines | 12.8% | -0.1% | -7.8% |

Forage harvesters | 0.0% | 3.0% | 16.4% |

Balers | 33.2% | 1.6% | 17.1% |

Seeders/planters | -10.6% | -1.3% | -17.9% |

Sources: IronSolutions, FCC Economics

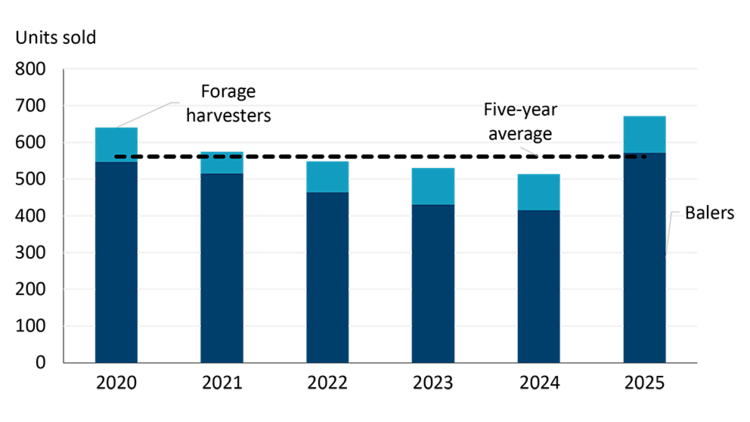

The bright spot in the used equipment market is rising demand for forage and haying equipment. Used baler sales are up over 30% in 2025, and forage harvester sales have remained steady for the past three years (Figure 1). Imports of balers and forage harvesters (though trade data doesn’t separate new from used) also point to strong interest, with baler imports up 5% and forage harvester imports up 23%, signaling upgrades in livestock operations, particularly in eastern Canada.

Figure 1. Sales of forage and haying equipment rising on strong cattle outlook

Sales illustrated are year-to-date through 11 months of the year

Sources: IronSolutions, FCC Economics

Looking ahead to next year, several factors could influence our forecast and farmers’ buying decisions.

Trends to monitor in 2026

1. Progress on global trade

Several trade developments will heavily influence the farm equipment market next year. A key factor is the review of the Canada–U.S.–Mexico Agreement (CUSMA), set to begin in July 2026. While there has been talk by the U.S. of letting CUSMA expire, renewal efforts are expected to gain momentum as the White House seeks visible progress before the November mid-term elections. If history is any guide, negotiations eventually lead to a trade deal. A revised CUSMA could bring positive changes, such as lower tariffs on steel and aluminum—critical input costs for farm equipment manufacturing. Another major factor is a potential trade framework between the U.S. and China, which could stabilize agricultural markets, boost U.S. soybean exports and farm-gate prices, including in Canada. If favorable trade agreements emerge early in 2026, they will strengthen commodity markets, restore farmer confidence, and drive investment decisions in equipment. However, if progress on the trade front stalls, the downturn in the equipment industry could persist.

2. U.S. equipment sales

The slowdown in U.S. equipment sales can’t be overlooked. One of the main factors that influenced sales and early delivery of equipment in Canada is the continued weakness of the U.S. farm equipment market. South of the border, sales of new equipment are down 25% to 40% compared to 2024. As a result, more equipment is being redirected to Canada, often arriving earlier than originally planned.

We’ve seen this pattern over the past two years: Canadian sales seem strong at certain points in the year, but it’s largely due to lower U.S. demand. If U.S. demand changes, it could affect our projections as manufacturers adjust.

Bottom line

The Canadian farm equipment market is set for another year of weak sales, with demand hampered by tight margins resulting from continued low crop prices and high input costs. While used equipment sales are expected to outperform new equipment, overall growth will remain modest. Improved trade conditions could further restore confidence and provide farm operations with greater certainty, encouraging more investment in equipment.

That said, record-high cattle prices and strong livestock outlook are creating opportunities for the farm equipment market. Beyond forage equipment, livestock producers may begin upgrading tractors and combines after years of delaying purchases. If cattle prices and revenues remain strong, the livestock sector is an area of opportunity for the equipment industry to improve sales beyond our projections. If additional sales materialize, equipment inventory levels could normalize by the end of 2026, paving the way for a recovery in equipment sales the following year.

Leigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.