CPTPP: A launch pad for Canadian exports

Throughout May, FCC Ag Economics will explore the CPTPP and how it’s expected to intersect with the red meats and processed food sectors. We also looked at Malaysia, a little-known market and competitor for Canadian producers.

With North American hog slaughter and production up, Canada will depend on the strength of export demand to keep prices from dipping further in 2018. They may become more volatile, as China and the U.S. grapple with ongoing trade discussions, but Canada has one key advantage in what may be a bumpy road ahead.

Canada’s participation in the CPTPP is expected to increase our market share on food products currently in high demand within these markets, at the expense of U.S. and/or European exporters whose exports will be less competitively priced once CPTPP is ratified. That’s especially good news for Canada’s hog and pork sectors.

Canada is the CPTPP’s largest food exporter

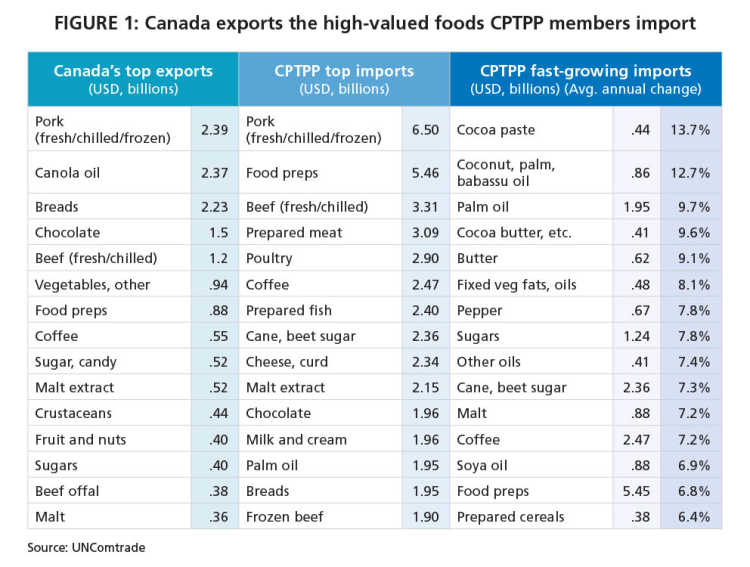

Canada exported foods worth US$19.1 billion (or 20% of the group’s total food exports) to the world in 2016. Fresh/chilled/frozen pork exports and canola oil were the biggest sellers.

But while Canada exports many foods that are neither bought in large amounts among CPTPP countries nor are growing quickly there, several Canadian food exports are in demand there – and that demand is growing (Figure 1).

CPTPP countries imported more fresh/chilled/frozen pork than any other food in 2016. And their large imports of fresh/chilled and frozen beef are good news for Canada: each is a Canadian export specialty.

CPTPP a chance to grow Canada’s pork and beef exports

Japan and Mexico together accounted for 84% of total CPTPP fresh/chilled/frozen pork imports in 2016. Mexico, not surprisingly, sourced 86% of those imports from the U.S., and 14% from Canada.

That same year, Japan’s fresh/chilled/frozen pork imports from Australia, Mexico and Chile accounted for 12% of their total pork imports, and 21% of their pork imports came from Canada.

Canadian pork producers have a chance to grow that market share once CPTPP is ratified, at the expense of two of our largest competitors. Japan’s pork imports from U.S. and European producers totalled three-quarters of all their pork imports in 2016 – but their exclusion from CPTPP will mean Canadian producers can offer products that are more competitively priced.

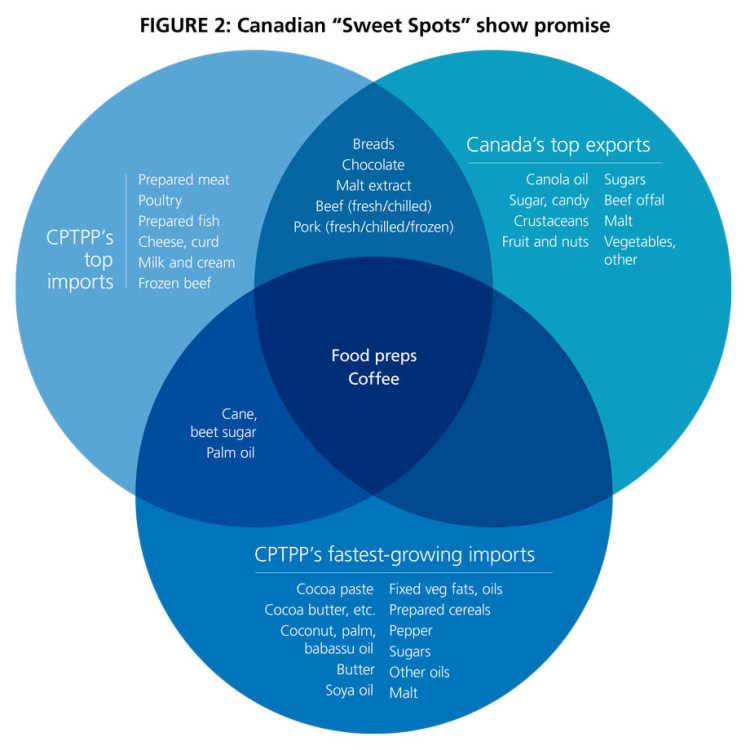

Canada’s food export sweet spots

Canada has two trade sweet spots - food preparations and coffee (figure 2). They count among Canada’s top exports, CPTPP’s top-valued imports and the signatory groups 15 fastest growing imports.

A look at foods with potential

Other CPTPP country imports that aren’t necessarily top-valued foods, are growing quickly1. Of the 25 food imports that grew at least 5% on average each year between 2007 and 2016, fats, oils and sugars account for 10, reflecting a broad trend underlying export growth in many developing markets.

CPTPP imports of malt, prepared vegetables and fruits and nuts are also growing quickly. None of these foods are currently a top-valued import among signatories, but each represents a food with potential for Canadian exporters. They all count among Canada’s 15 top-valued exports.

Breads, pastries and cakes, chocolate, and malt extract are also some of Canada’s highest-valued exports and counted among the CPTPP’s highest-valued exports in 2016.

CPTPP food trade valued at US$171 billion in 2016

Food trade values of CPTPP signatories come from partnerships with some of the world’s largest food traders, and of real interest, several markets undergoing changing consumer demand. That’s great for Canada.

We need to further diversify food exports, about 38% of which went to the U.S. in 2016. The CPTPP’s preferential access may offer Canadian exporters an excellent opportunity to grab market share in Asia away from U.S. and European exporters. Our production of the foods that are in demand, both within CPTPP markets and more globally, are a key strategic advantage in achieving our goal of being a leader in agri-food exports.

1 The top 25 fastest-growing exports include HS codes 1803, 1513, 1511, 1804, 405, 1515, 904, 1702, 1512, 1701, 1107, 901, 1507, 2106, 1904, 1108, 2103, 1901, 1905, 2101, 1902, 2004, 1602, 2008, 1806

Martha Roberts

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.