COVID-19 impacts on Canadians working in agriculture and agri-food

The Bank of Canada lowered its overnight interest rate by 50 basis points from 0.75% to 0.25% on March 27. The following article was written prior to this unscheduled rate decision.

Over the next several weeks, FCC Economics will help you understand the rapidly evolving business environment due to COVID-19. With the costs to families continuing to climb and potentially unprecedented associated economic costs, central banks around the world are now working together to find ways to halt the damage.

In this post, I’ll explain several tools – both conventional and unconventional – the Bank of Canada (BoC) has available to mitigate the biggest economic risks facing Canadians today. Keep an eye on these in the weeks ahead. The government of Canada, which works independently of the Bank, is also helping with its own measures.

How interest rates can moderate a pandemic’s economic impacts

The economic damage from COVID-19 will include layoffs and supply chain disruptions, leading to expected declines in spending, business investment and exports. To slow this, banks use conventional tools to make it easier for households and businesses to access money and spend it. And an easy way to do that is lower interest rates. It brings immediate relief although it often takes over a year to feel the full effect.

Get comfortable with the following terms, so you can anticipate and respond to a quickly evolving interest rate environment.

Overnight rate: The rate banks charge each other on daily loans.

Policy rate: The BoC sets a target for the overnight rate used by financial institutions (FIs). This target is the policy rate. The BoC cut the policy interest rate from 1.25% to 0.75% on Friday, March 13, to help weaken the economic impact of the coronavirus outbreak and plummeting oil prices. Underscoring the threat posed by the disease outbreak, the cut was the second in just over a week.

Prime rate: The rate of interest commercial banks use to set the rate on variable loans and lines of credit. Each major financial institution (FI) has its own prime rate. When the policy rate changes, an FI can change its prime rate by a similar amount – although they don’t always do so.

Interest rates and you

Borrowers’ interest rates can also vary for other reasons. The rates you pay on variable rate loans will differ from your fixed-rate loans because an FI faces different risks with each fund source. When changes occur in financial markets – as is happening now – the rates charged to borrowers fluctuate.

There’s no correct answer as to which rate is better. Interest rates on variable-rate loans are stated as a percentage above or below the prime rate. How much above or below prime depends on your own borrowing situation, but that adjustment will be fixed for the loan term. The prime rate may subsequently vary.

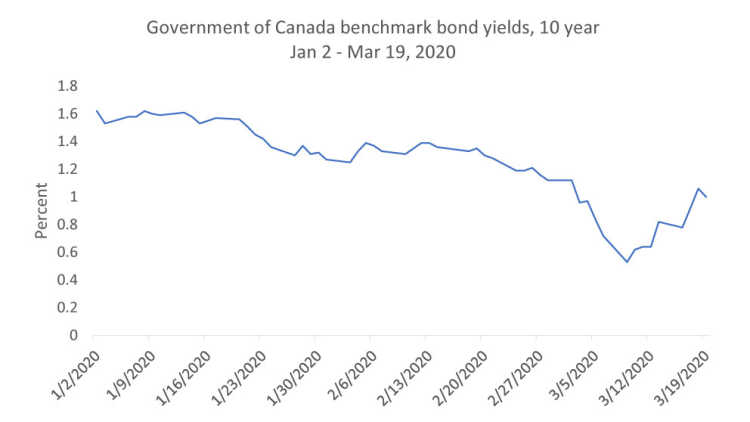

Long-term fixed rates are usually higher than variable rates. But these borrowing costs won’t climb as variable rates might over the term of the loan. Fixed rates are based on long-term bond yields, which tend to be less volatile than short-term rates. But as major shocks erode current estimates of inflation and interest rate adjustments over time, the value of investments in bonds also erodes. That’s why yields have declined from 1.53 on January 2 to .78 on March 16 for the 10-year government bonds.

Figure 1: Yields fall on 10-year bonds as economic threat looms

Source: Bank of Canada

Extra measures needed to boost Canadian households and businesses

Interest rates are among the tools central banks most often use to mitigate unforeseen changes to their economies. In extraordinary times, they also have several unconventional tools to jumpstart the economy. Here are a few happening in Canada, the U.S. and elsewhere.

Buying Treasuries and mortgage-backed securities: Used broadly in the 2008 crisis and otherwise known as quantitative easing, these purchases by central banks inject liquidity (increase the supply of money) into the financial system and the broader economy. Asset purchases (demand) push bond yields lower, encouraging greater lending and investment. Bond yields may also be pushed higher in response to an expected increase in the supply of Treasuries as government stimulus packages are rolled-out. Remember – it’s always about demand and supply.

Buying commercial paper: The purchases (typically by banks, wealthy investors or large institutions) of debt for the financing of short-term liabilities (wages, operational expenses, etc.). Issuing commercial paper can help businesses such as huge retailers or manufacturers finance activities when revenues that are expected to grow eventually may not yet be available to pay current expenses.

Government coordinating with BoC to ease pressure

Canada’s Office of the Superintendent of Financial Institutions (OFSI): Under normal economic conditions, an FI is required to keep a specified percentage of assets out of circulation to safeguard against the risks they take. OSFI is loosening these requirements by lowering the buffer from 2.25% to 1%, to increase the money available for lending.

Also, the BoC is coordinating action with other central banks to provide some of the world’s largest banks with cheaper access to funds in U.S. dollars. The USD is a “safe-haven” currency – a safe, reliable investment relative to other currencies in periods of high uncertainty. Giving banks around the world cheaper access to funds in USD helps to calm fears of currency instability and deepens liquidity everywhere.

What’s next?

Whatever comes, FCC stands with you. On Wednesday, March 18, the Prime Minister included FCC in his announcement about Canada’s COVID-19 Economic Response Plan. We’re taking steps to ensure producers, agribusinesses and food processors continue to have access to necessary capital at this challenging time. More details will be shared in the days ahead.

For now, know that we are well-positioned to support the agriculture and food industry.

Connect with us

By phone: Call our Customer Service Centre at 1-800-332-3301 or your local FCC contact.

Online: Many transactional needs can be easily handled via our Online Services portal at FCC.ca.

By appointment: Call your local office and request an appointment. Where it is necessary to meet face to face, you’ll be asked a few screening questions as recommended by the Public Health Agency of Canada before a meeting can be confirmed.

If this or any situation is impacting your mental health, please don’t hesitate to seek help. If you’re in crisis, please visit your local emergency department or call 911 immediately.

Martha Roberts

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.