2021 Grains, oilseeds, and pulses outlook update: Tight stocks and uncertain demand

This is the first of three quarterly updates to our 2021 Outlook for major crops published in February. Over the next four weeks, we’ll update the Outlooks for dairy, cattle and hogs and broilers.

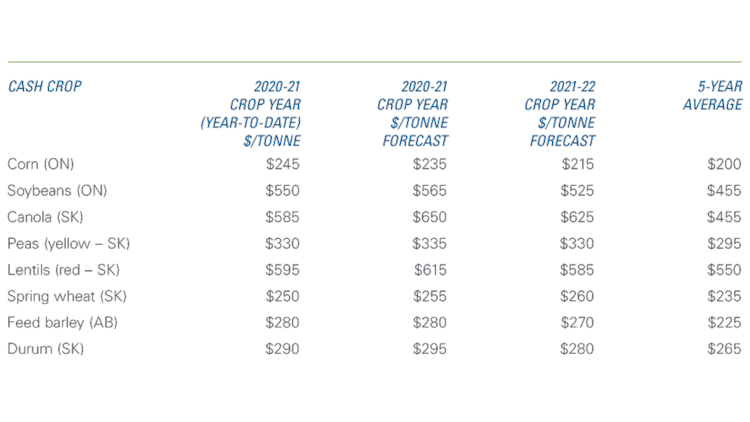

Our forecast for prices has generally improved since February. Average prices for old crop remain unchanged or are expected to rise. New crop prices for all crops are expected to remain above their 5-year average. With continued strength in prices, profitability for each crop is expected to stay positive throughout the outlook period.

Table 1: Old and new crop prices continue to exceed early expectations

Source: FCC calculations.

Tight stocks continue to dominate headlines

In February, we pointed to the roles that China and tight stocks would play in determining prices for pulses, wheat, corn, canola and soy in 2021. Each continues to exert a strong influence, with both grains and soy joining the general rally in commodities. The overall story in May is one of tight supplies and the uncertainty brought by shifting demand and price volatility.

Given a huge global 2020 crop, wheat became a relatively affordable staple in feed. In 2021, an estimated record global consumption continues to be led by China’s need for feed (and residual use), forecast at a record 40 million tons. The U.S. ending stocks continue to fall from their high in 2016-17 while global stocks are now projected down 4.5 million tons from the previous year’s record high and tightening for most major exporters. Moreover, the latest USDA Prospective Plantings report indicates a very low U.S. wheat planted area (estimated to be the fourth lowest-planted area since records began in 1919). Taken together, these estimates suggest a higher average farm price throughout 2021 than initially forecast. AAFC forecasts Canadian wheat acres to fall 6.9% year-over-year with declines noted for all three prairie provinces.

China’s appetite for feed a key driver of crop prices

Strengthening pulse markets continue with more strong demand from China. A possible large increase in U.S. acres may balance current low stocks, but the market still seems to be robust. Canadian area seeded to lentils is forecast to fall only slightly year-over-year with a 1.6% decrease in Saskatchewan offsetting a 9.0% gain in Alberta. Total acres of dry peas are forecast to fall 9.8% year-over-year.

The corn market faces the potential for extremely tight ending stocks for the new crop season. Asian purchases of corn in the first quarter of 2021 have increased more than fivefold from the previous year. Brazil’s corn prices have more than doubled in 12 months, with rapidly expanding usage for livestock feed, exports, and ethanol production. Dry conditions in parts of Brazil for their second corn crop and those expected in parts of the U.S. have also helped to boost prices. Corn acres in Canada are expected to grow 1.8%.

Prospects are also ripe for a tight global soybean market in late 2021. In March 2021, Brazil soybean exports were fully one-quarter above the year-over-year record. This may be coupled with projected U.S. soybean plantings well below both initial USDA projections and market expectations. China's record demand and falling supplies have pushed up soy prices over the last year and may yet keep them elevated. That strength, along with good yields in 2020, has helped boost expected Canadian soy acres 5.5% year-over-year, with Manitoba acres expected to grow 17.3% to 1.3 million acres in 2021.

Demand for oils continues to grow

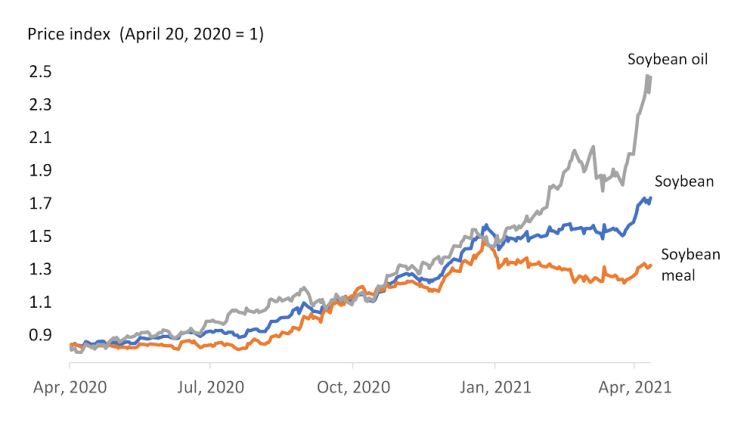

Right now, demand for soy oil is driving soy prices, while soymeal drops off as a casualty in the continuing story about China and African Swine Fever. China’s pork imports have recently skyrocketed, while their domestic pork prices have sunk as the market is glutted with pigs slaughtered because of ASF. Uncertainty in soymeal demand would normally curb soybean prices. But these remain elevated (Figure 1).

Figure 1: U.S. futures show rare delinking of soy prices from soymeal

Source: CME.

The global vegetable oil market is currently tight as demand for renewable and biodiesel is growing in South and North America while human food consumption remains robust.

In response to the resulting increased demand for oils, AAFC’s 2021 report on seeding intentions calls for a reversal of the declining trend in year-over-year Canadian canola acres. An expected 3.6% overall growth will be led by Saskatchewan with 4.4% more acres and Alberta with 7.8% more acres. Global rapeseed supplies aren’t forecasted to grow either, given the year’s low beginning stocks and despite estimates of increased production from the world’s top 4 producers.

Weather: perhaps the most important factor to monitor

Weather might be the most important driver for the next quarterly update. When stocks are tight, markets are more volatile, and the coming crop supplies can be expected to move markets one way or the other. Numerous major producing regions in North and South America, across Asia and Europe, can each bear significant influence on the prices Canadian producers receive should their harvests face weather impacts. Here at home, continued drought or excessive dryness is expected for the prairies and parts of the U.S. Midwest. On a higher note, a brief weather outlook shows a very early start to planting in Ontario’s corn and soy.

Martha Roberts

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.