2021 Outlook for Canada's broiler sector

FCC Economics helps you make sense of the top economic trends and issues likely to affect your broiler operation in 2021. We consider the following to be influential drivers of profitability in 2021:

Rising feed costs

Strength in demand for chicken products

Global chicken trade and imports

Strength in the loonie

The pandemic made 2020 a volatile year for Canada’s broiler sector. Confinement measures and weaker demand led to production cuts. Total Canadian 2020 chicken production declined 1.9% from 2019, after growing nearly 4% annually for the past five years. The trend in 2020 revenues was anything but stable. During Q1 2020 (the pre-pandemic period), broiler revenue was up 9.1% compared to Q1 2019, setting a very optimistic tone for the year. Revenues in both the second and third quarters started to face pressures, respectively 0.7% higher and 5.4% lower YoY. Our estimate is for total broiler revenues to be about 0.5% higher in 2020.

Profitability in the broiler sector is expected to be positive in 2021, pulled by the economic recovery. But it will be a bumpy road as COVID-19 infections continue to spread and rising feed costs pressure profit margins in the first half of the year. Profitability is expected to increase in the second half of 2021 as vaccine rollouts lead to re-opening the foodservice and hospitality industries. In short, the volatile environment of 2020 may not subside until much later this year.

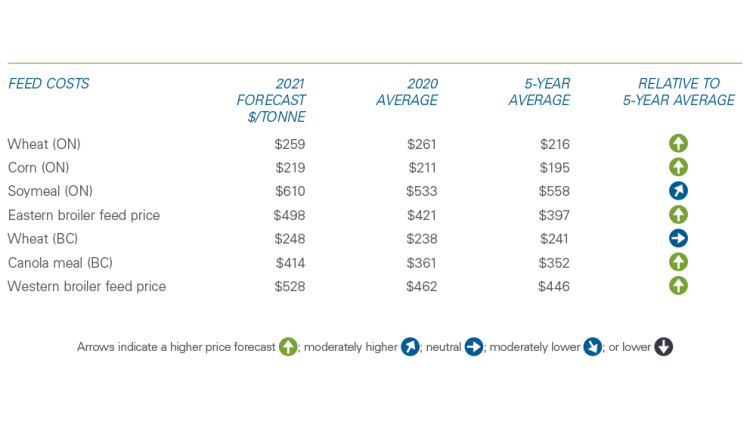

Higher feed cost costs will pressure margins for livestock operations in 2021 (Table 1). China’s increased appetite for feed grains and unfavourable weather conditions in 2020 have pushed feed costs higher.

Table 1: Feed costs trending higher in 2021

Sources: Statistics Canada, USDA, Chicken Farmers of Ontario, British Columbia Chicken Marketing Board, CME Futures and FCC calculations.

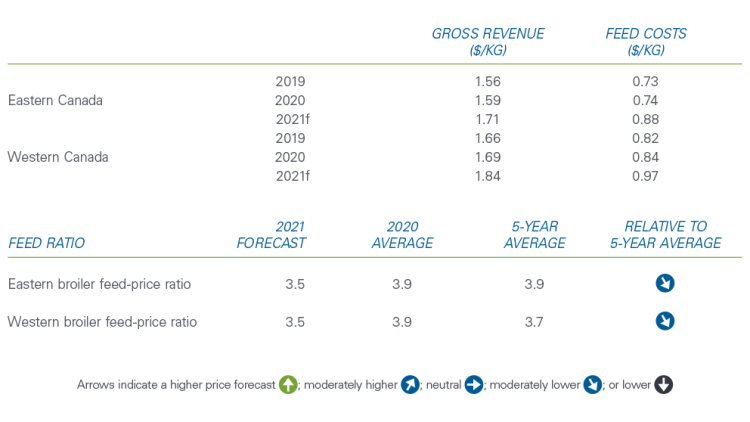

Expectations of rising feed prices mean a declining broiler to feed price ratio (defined as the farm-gate price divided by a feed price per kg and a feed conversion ratio). Our revenue and feed cost forecasts indicate continued profitability on a per kg basis (Table 2), but total revenue will depend on overall production levels. Feed costs are reflected in the broiler pricing formula, but they can rise faster than the price formula for an individual grower’s operation.

Table 2: Estimates of broiler revenue and feed costs

Sources: Calculations by FCC based upon Chicken Farmers of Ontario farm-gate minimum live price estimates, and British Columbia Chicken Marketing Board cost of production formulae comparison, CME futures, Statistics Canada and USDA.

Trends to watch in 2021

1. Feed prices and diet reformulation

Climate change is expected to remain a top trend to monitor in 2021 regarding global crop production. The strength in demand for grains and oilseeds from China driven by the rebuild of the hog herd combined with South America’s crop sizes are two factors to monitor. Watch for our grains and oilseeds 2021 outlook in early February. U.S. soymeal futures have climbed significantly since last September and have room to grow given the tight balance between available supply and demand. Reformulating broiler feed may be valuable to explore (subject to constraints around feed conversion and palatability).

2. Strength in demand for chicken products

The industry implemented necessary production cuts at the onset of the pandemic, followed by additional cuts more recently as the second wave of COVID-19 infections spreads. Canadian chicken meat production in 2020 was trending above 2019 until April. Production dropped at or below the 5-year average from June through August, only slightly exceeding 2019 amounts in December (Figure 1).

Figure 1: 2020 Canadian chicken production trends lower for most of the year

Sources: AAFC Poultry and Egg statistics, FCC Calculations.

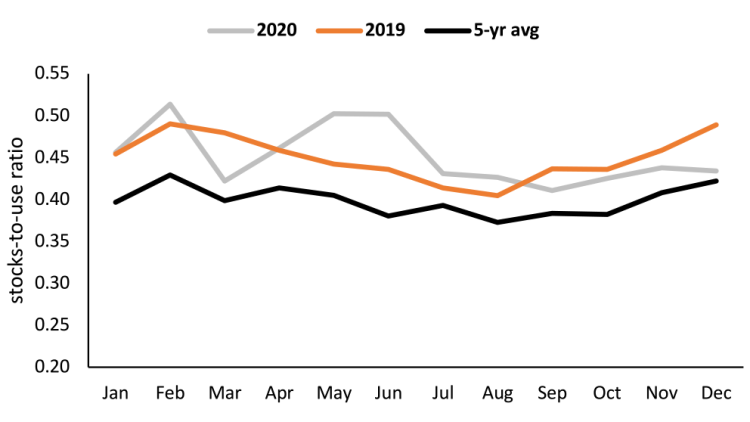

Production cuts reduced revenue in 2020; however, they were necessary and timely to prevent prices from steeper declines and further revenue losses (Figure 2). The chicken frozen stocks-to-use ratio in 2020 increased early in the pandemic (April – June). But following production controls, the ratio dropped back to the prior year level (July to current). The chicken frozen stocks-to-use ratio will be important to monitor how it will influence future production levels.

Figure 2: Chicken frozen stocks-to-use ratio to guide production growth

Sources: Statistics Canada and FCC Calculations.

Lower consumer income typically weakens demand for proteins and shifts food purchases to the most affordable meat. The pandemic has led to high unemployment levels and reduced hours worked for a subset of households – and this reduced disposable income in the third quarter. Retail beef and pork prices at the outset of the pandemic rose, making chicken more competitive at the grocery store. Red meat price increases have since subsided, and chicken may lose in 2021 some of the retail price edge it has had over red meat.

3. Global chicken trade

The Canada-U.S.-Mexico Trade Agreement (CUSMA) came into force on July 1, 2020, resulting in changes in tariff rate quota (TRQ) applied to chicken meat imports. A new CUSMA TRQ is applied on imports of U.S. chicken meat. The market access level for 2020 (July – December) was set at 23.5 million kgs and 49 million kgs for 2021. Also, U.S. exporters have access to 39.8 million kgs through WTO rules. NAFTA granted U.S. exporters access equal to 7.5% of the previous year’s Canadian production. The relative size of U.S. market access in 2021 percentage terms for 2021 will depend on domestic production trends. USDA-FAS projects Canadian chicken meat imports to increase 1.6%.

Imports are dependent on the global and U.S. chicken market and the value of the Canadian dollar. The pandemic would have had a larger impact on the global poultry sector had it not been for the African Swine Fever’s impact on China’s hog herd. Total U.S. exports are estimated to have grown 4% in 2020 due to strong demand from China. Chinese chicken demand is expected to ease in 2021, as China’s domestic hog herd is rebuilt. Rising feed costs are expected to keep U.S. chicken production growth below 1%, while U.S. exports are expected to be flat in 2021.

4. Exchange rate near US$0.80 – strong loonie or weak USD?

We expect the Canadian dollar to remain in the US$0.75 - $0.80 range in 2021. Its current strength is more about the weakness in the U.S. greenback than strength in any of its underlying drivers. In the medium to long term, COVID-19 vaccines coupled with government stimulus in Canada and the U.S. will support economic growth and global trade, raising the demand for the USD. This should keep a lid on possible increases in the loonie if oil prices remain in the current range.

The Canadian broiler sector will be in recovery mode in 2021 after COVID-19 disrupted demand from the foodservice sector. Rising feed costs will be an important component to watch through 2021.

Check back on our blog for a regular update of this 2021 broiler outlook and outlooks for the grain and oilseed, hog/cattle, dairy, and food processing sectors.

Leigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.