2021 Grains, oilseeds and pulses outlook update: Huge production shortfalls compound tight supplies

This is the final quarterly update to our 2021 Outlook for major crops published in February. Our annual outlooks for dairy, cattle and hogs and broilers will be updated over the next three weeks.

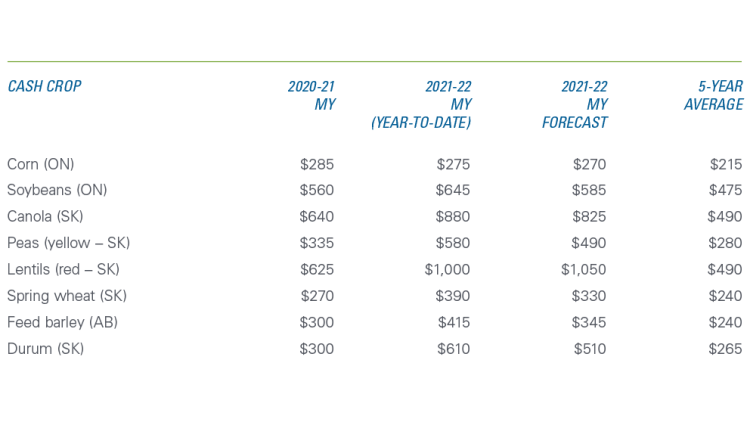

2021-22 Marketing Year (MY) prices are projected to be well above the most recent five-year average for all crops (Table 1). We expect they’ll fall off the current highs but will remain elevated. Poor 2021 yields in western Canada combined with already low stocks and sustained global demand to keep prices high.

Table 1: 2021-22 crop prices ($/tonne) up YoY and well ahead of 5-year average

Sources: Statistics Canada, AAFC, USDA, PDQ, CanFax, CME, MGEX and ICE Futures, and FCC calculations

Marketing Year for corn and soybeans: September 1 – August 31

Marketing Year for wheat, canola, barley, peas and lentils: August 1 – July 31

Brazilian production of corn and soybeans, each expected to be record-high this winter, has perhaps the biggest chance to lower prices. Good harvests would help ease pressure on the two crops’ currently low stocks.

In the meantime, tight global supplies of grains and oilseeds continue to support prices and profitability. In eastern Canada, average to above-average yields from the 2021 harvest coupled with strong crop prices are expected to result in positive margins for the remainder of the crop year. In the west, a devastating drought that reduced yields by more than 40% will pressure profitability. Nonetheless, margins for canola, red lentils and durum are trending positive, while spring wheat may fall below break-even.

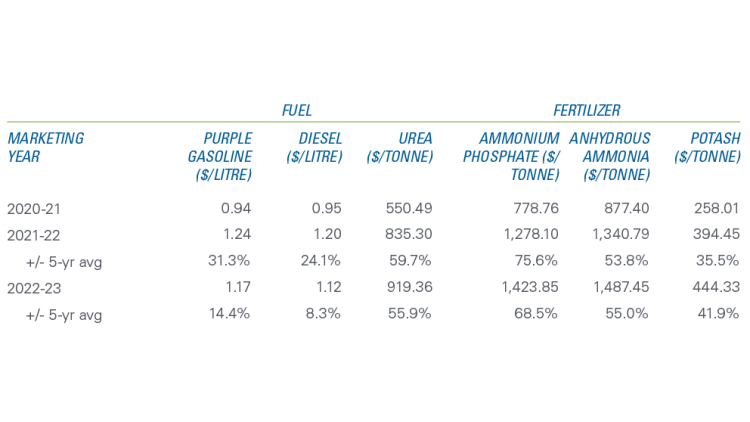

Pressures mount from rising input costs

Adding to profitability pressures are farm input prices that are expected to continue rising throughout the 2021-22 MY and into the 2022-23 MY (Table 2). The growth rates of surging fuel prices are forecasted to taper off in the 2022-23 MY, but purple gas will average 31.3% higher, and diesel will average 24.1% higher this year than the most recent five-year average (2016-17 – 2020-21). In comparison, between this crop year and next, fertilizer prices are expected to continue growing at their current pace (anhydrous ammonia, urea and phosphate) or could take another leap after a pause (potash).

Table 2: Growth rate slows for fuel, but input prices continue to rise

Sources: Alberta Farm Inputs, World Bank, FCC calculations

+/- 5-yr avg is rolling average

Canadian producers aren’t alone in dealing with rapidly escalating costs. Numerous factors are keeping them high globally, perhaps most notably slowdowns in fertilizer exports from China, where an energy crisis looms. Because China supplies roughly 30% of global exports of urea, sulphate and phosphate, and with Europe’s energy crisis and continued global supply chain woes, the slowdowns have implications for 2022 seeding plans. Widescale moves to seed more crops that are less fertilizer-intensive could heap added pressure on crops already experiencing tight stocks (e.g., fewer corn acres and more soy or pulse acres).

Strength of global demand continues to deplete stocks

Global demand remains a bright spot in the outlook. But with a disappointing 2021 harvest now complete, the focus is on trends in usage.

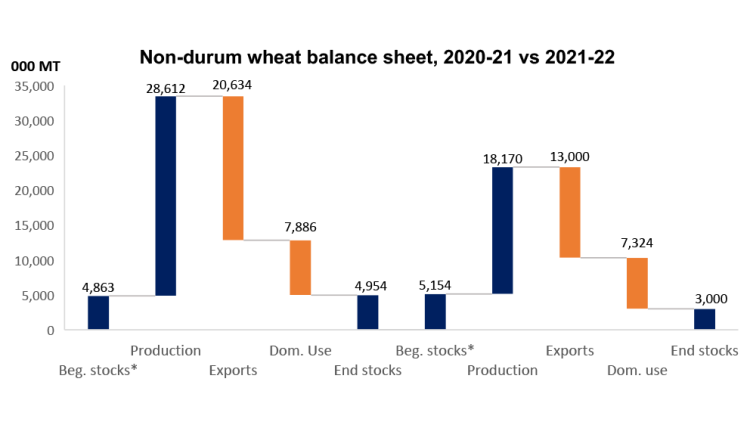

Wheat

Total Canadian non-durum wheat supply fell YoY in 2021 from an estimated 33.5 million metric tonnes (MMt.) to a projected 23.3 MMt. Wheat production (excluding durum) in 2021 was 36.5% lower YoY and 31% less than the last five-year average. With yields expected to have declined 43.4%, Canada’s overall durum production is forecasted to be cut almost in half (by 46%).

The shortfall in Canadian 2021 non-durum wheat production leads to ending stocks of 3,000 MMt. expected for the 2021-22 MY, the lowest on record (Figure 1). That accounts for a projected 37.0% decline in Canadian non-durum exports this year, prompted largely by limited supply.

Figure 1: Canada’s 2021-22 wheat ending stocks a projected record low

Source: Statistics Canada Table 32-10-0013-01 Supply and disposition of grains in Canada (x 1,000)

* Beginning stocks plus imports

The U.S. followed similar patterns, with spring wheat production declining YoY, winter wheat output up 24% YoY and all wheat closing stocks forecast to fall 31.3% YoY. According to the latest WASDE, global supplies have fallen marginally YoY, and with boosts to both usage and trade, 2021-22 ending stocks are estimated at 277.2 MMt.

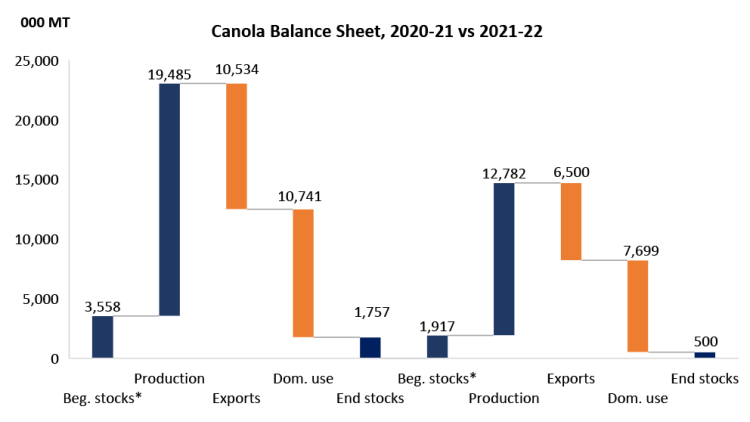

Canola

The tight canola carry-out going into the 2020-21 crop year was further tightened by near-record exports and a record domestic crush throughout the year. AAFC projects 2021 canola production at a 13-year low and yields, the lowest since 2003-04.

With the big drop in 2021 production, a 36.2% decline in total supplies is expected for the 2021-22 MY. That raises interesting questions about exports vs. domestic usage.

The projected 21-22 canola balance sheet (Figure 2) shows how high canola prices and weak or negative canola crushing margins could lead domestic crushers to cut back demand. The question is by how much. Domestic usage could be stronger than projected in Figure 2 if the average 2021-22 canola price stays under the projection in Table 1 (above).

Figure 2: Canada’s 2021-22 canola ending stocks a projected record low

Source: Statistics Canada Table 32-10-0013-01 Supply and disposition of grains in Canada (x 1,000)

* Beginning stocks plus imports

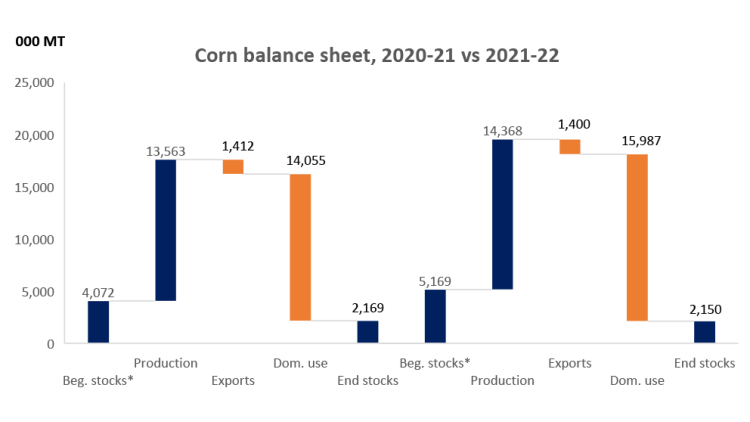

Corn and barley offset each other in feed markets

Despite a 10% gain in seeded area, 38.2% yield losses shrunk 2021’s projected barley production by 33.5% YoY and 23% from the last five-year average. It’s a story of opposites for corn. In spite of lower harvested acres, Canadian corn production benefited from Eastern growing conditions and is 6% higher YoY to a record high. Western feed grains’ limited availability has resulted in much higher corn imports to the region and, together with production, have produced a record corn supply. But even with that, 2021-22 Canadian ending stocks are expected to be 28% lower than the previous five-year average (Figure 3).

Figure 3: Canada’s 2021-22 projected record corn supply to be swallowed in greater domestic use

Source: Statistics Canada Table 32-10-0013-01 Supply and disposition of grains in Canada (x 1,000)

* Beginning stocks plus imports

Bottom line

Excellent support for prices from strong, sustained global demand and continued pressures in stocks will underpin Canadian profitability in grains and oilseeds as we close out 2021. However, for some Western producers, a disastrous harvest will curtail the opportunities open to others. Adding spite to foul, the spectre of input costs rising even higher than current looms large and will require good business planning and risk mitigation strategies in the next year.

Martha Roberts

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.