2021 Dairy outlook update: Keeping an eye on crop conditions and imports

This is the second of three quarterly updates to our 2021 Outlook for Canada’s dairy sector published in January. Last week we updated our grains, oilseeds and pulses outlook, and in the next two weeks, we’ll update the outlooks for cattle and hogs and broilers.

Profitability projections have deteriorated for both the P5 and the Western Milk Pool (WMP). Farm milk revenues projections have dropped since our May outlook but are above our January forecasts. In April, milk revenues dipped below expectations, and we do not expect them to grow before the fall. High world grain prices and the hot and dry summer in Western Canada contribute to higher production costs.

Table 1 compares our January and August gross revenues forecasts. The feed cost indices show how feed cost forecasts have increased since our January forecasts.

Table 1: Estimates of average dairy revenues and feed cost indices

| January forecast for 2021 | Actual Q1-Q2 2021* | Forecast Q3-Q4 2021 | August forecast for 2021 | ||

|---|---|---|---|---|---|

| P5 | Gross revenues ($/hl) | 81.78 | 81.82 | 80.99 | 81.40 |

| Feed cost index | 100 | 106.6 | 108.5 | 106.6 | |

| WMP | Gross revenues ($/hl) | 82.69 | 83.23 | 82.96 | 83.09 |

| Feed cost index | 100 | 105.7 | 106.5 | 105.3 | |

* Data for June were not yet available and are forecasted.

Source: FCC feed cost projections are based on Statistics Canada table 18-10-0266. Gross revenues are calculated using data from the Government of Alberta, the Dairy Farmers of Ontario, Statistics Canada and USDA. The calculations for gross revenues do not include the butterfat premium and penalties for over-quota production.

Farm revenues declined in the spring from lower sales of milk for fluid consumption and cheese making. At that time, signals about future consumption were positive and in May, the P5 announced a series of additional incentive days for the months between June and November. However, lower than anticipated sales have forced the P5 to remove two incentive days for August and one for September. The outlook remains positive for the fall when we expect prices to recover, and the P5 has maintained the incentive days for October and November. WMP producers have a total of 10 incentive days between August and November.

In May, we forecasted a 6.0% growth in dairy cash receipts for 2021, driven by a 3.4% increase in the average milk price and a 2.5% increase in volumes. With the unexpected slowdown in the consumption of dairy products, we lowered our growth forecast for 2021 to 3.9%. We expect year-over-year growth above 8% in the second quarter due to production cuts during the same period in 2020 but slide to 4.5% and 1.8% in the third and fourth quarters.

Forecasting costs, especially for Western provinces, is difficult because of the volatility of grain prices and the hot and dry conditions in the West. The adverse weather can have localized impacts on pasture and crop conditions, and not all farmers will suffer the same financial consequences. Our cost forecasts capture conditions in global markets well but not in local markets, especially in thinner markets like hay. They’re therefore likely to underestimate the impacts of the dry summer on Western farmers’ production costs.

Cheese imports on the rise

The Canada-U.S. exchange rate has been going through significant swings recently. The currency pair began the year at 0.78 USD/CAD, climbed up to 0.83 USD/CAD in June and returned to 0.80 CAD/USD in July. We expect the exchange rate to finish the year at around 0.80 USD/CAD.

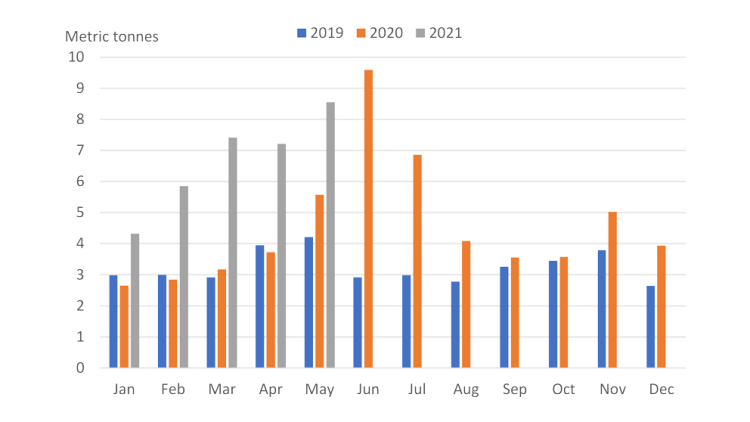

The surge of the Canadian dollar increased the competitiveness of U.S. dairy products on the Canadian market. Since CUSMA became effective in July 2020, we had not observed a major increase in imports of US dairy products. That changed with the rise of the loonie. Figure 1 shows that 2021 imports of cream and milk not concentrated from the United States have significantly exceeded those from the previous two years. Imports of cheese have also increased. About half the annual import quota permits for cheese under CUSMA were issued in the first half of 2021, signalling that the quota could be filled for the year.

Figure 1: Increase in the imports of milk and cream not concentrated from the United States in 2021

Source: Statistics Canada.

U.S. dairy prices

The U.S. non-fat dry milk price grew to a high of US$1.32/lb in May, exceeding its pre-pandemic level. For Q2, the U.S. non-fat dry milk price averaged US$1.27/lb, up US$0.12/lb from Q1. In its latest supply and demand estimates, USDA upped its forecast for the average 2021 U.S. non-fat dry milk price to US$1.25/lb in 2021, a 20% increase compared to its January forecast. Accordingly, Canada’s minimum price for class 4a milk, based on the U.S. non-fat dry milk price, has increased from $2.26/kg in January to $2.50/kg in June.

Reopening of food services

The third wave of COVID-19 slowed down the economic recovery in Q1 and Q2. With the distribution of vaccines and the gradual reopening of food services, we expect the demand for dairy products to slowly return to its pre-pandemic level. It will be interesting to see if the bundle of dairy products that consumers purchase will be the same as before the pandemic.

Check back for a regular update of this 2021 dairy outlook and for outlooks on grains, oilseeds and pulses, cattle and hogs, broilers, and food processing sectors.

Article by: Sébastien Pouliot, Principal Economist