How beef-on-dairy is changing Canada’s beef supply

By their nature, the dairy and beef sectors have always been intertwined to some extent. That relationship, however, is changing as more ‘beef-on-dairy’ calves (that is, calves of dairy cows bred with beef sire genetics) are born. The shift is creating opportunities across the beef supply chain all the way through to processors. Challenges exist, though, including an increased reliance on beef-on-dairy calves to supply Canadian feedlots at a time of a contracting North American beef cattle herd. Any sudden increase in the demand for milk could result in a further reduction of an already tight amount of available beef. As the use of dairy breeding strategies continues to evolve, so too will the sector’s contribution to the supply of beef available to consumers.

Science is changing breeding strategies

The power of science will continue to transform the dairy industry, with implications well beyond the dairy farm. Advancements in breeding technology along with an increased use of genomics has triggered a significant rise in the on-farm adoption of sexed semen. Traditionally, when a dairy cow or heifer was bred, whether or not they had a female calf was a coin-flip, and producers would cross their fingers that future milk-producing females would be born, especially with their top producing animals. With the introduction of sexed semen, that coin flip has turned into a near certain (~95%) chance that the sex of choice would be born.

This left producers in a unique situation. Say a producer required 100 replacement heifers for their operation. In the past, approximately 200 cows/heifers would need to be bred to get that 100 replacements (ignoring loss rates). Now, with an all-but-certain outcome, only 105 cows/heifers would need to be bred to generate the replacements. The other 95 cows/heifers, though, still need to be bred to produce milk. What, then, does a producer do with these animals?

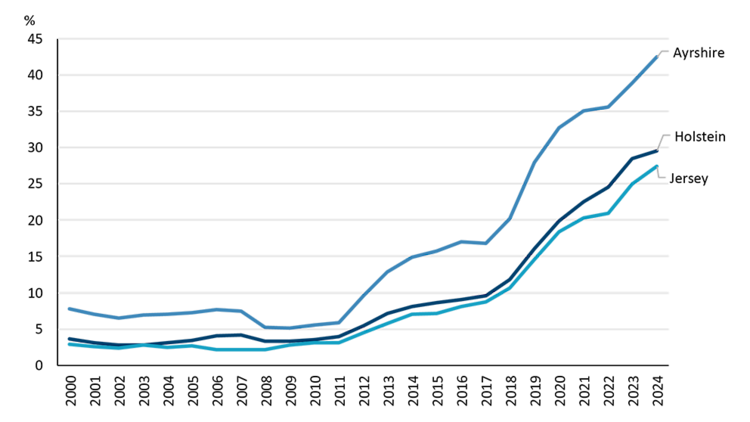

Enter beef genetics. More and more producers are taking their mid-tier cows and breeding them to different beef sires (Figure 1). For example, the percentage of Holsteins bred using beef semen grew from 3.4% in 2005 to 29.5% in 2024. We need not speak to the benefits of utilizing this technology from a herd management perspective; rather, we focus on the economic implications of this shift.

Figure 1: Estimated proportion of beef-on-dairy breeding in Canada by breed

Source: Lactanet (reprinted with permission)

Dairy sector already contributes to the Canadian beef supply

The volume of beef produced in Canada has been volatile in the last decade. Beef production increased from 2015 to 2022 before declining in the last couple of years (Figure 2). Higher carcass weights have helped offset the decline in the total volume of cattle being slaughtered. High carcass weights can be expected in the near-term with record high feeder/fed cattle prices and low feed grain prices creating the optimal incentive for producers and feedlot operators to fatten animals. Packers, too, are looking for cattle where they can and are no longer discounting heavier priced animals for the moment.

Figure 2: Canada’s beef production, 2010-2024

Source: Statistics Canada

The dairy sector contributes beef two ways: culled cows, or calves that are fattened for slaughter. The contribution from culled cows has been steady for the last 15 years with Canada’s dairy cow herd and cull rates also being stable during that time. The contribution from the beef-on-dairy calves is newer and more nuanced to calculate. One important note, however, is that dairy calves have always contributed to the beef supply chain, whether or not they were Holsteins or beef-on-dairy crossbred calves.

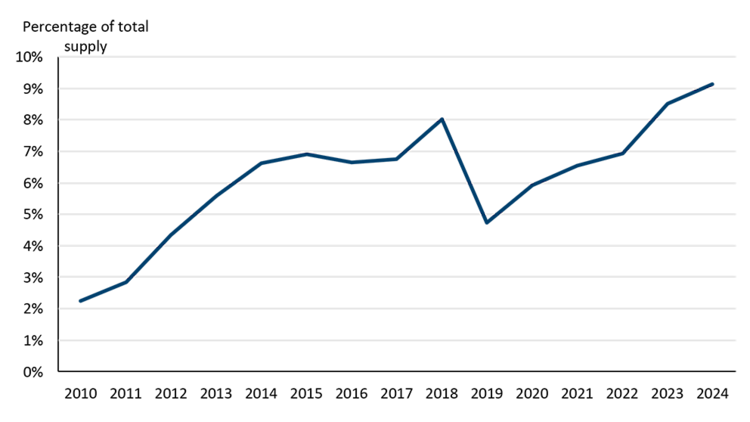

Beef-on-dairy’s contribution to the total Canadian beef supply has grown from approximately 2% in 2010 to over 9% in 2024 (Figure 3), coinciding with the increased use of sexed semen. Of note, this contribution has risen in each of the last two years in part due to declining beef supply i.e., the denominator in our calculation. Simply put, beef-on-dairy has become an increasingly important component of Canada’s total beef supply.

Figure 3: Beef-on-dairy contribution to Canada’s beef supply hit a record high in 2024

Sources: Statistics Canada, AAFC, Lactanet, FCC Economics

If milk demand grows, what does that mean for Canadian beef supply?

If demand for milk were to increase significantly, more cows will be required to meet that demand, barring some short-term increase in productivity. So, either culled cow rates will be lower (longer milking windows) and/or more sexed semen will be used on mid-range cows to produce heifers that will be retained for milk production in the future. Hypothetically, then, where a cow may have been bred using beef semen, that cow may now be bred using Holstein sexed semen to guarantee a heifer calf. The result is that a crossed calf doesn’t make its way into the beef supply chain.

To further illustrate, let’s assume a 10% increase in milk is required for 2027. Compared to 2024, that’s an increase of nearly one billion litres of milk. If the age of first calving is 25-26 months, that means heifers born and retained in 2025 will calve and produce milk in 2027. We then need an extra 96,940 cows by 2027 to support that milk production (assuming no change in the production of milk per cow). Assuming a 9% loss rate on heifers born, that then means we need 107,000 additional heifers today to meet the demand in two years time.

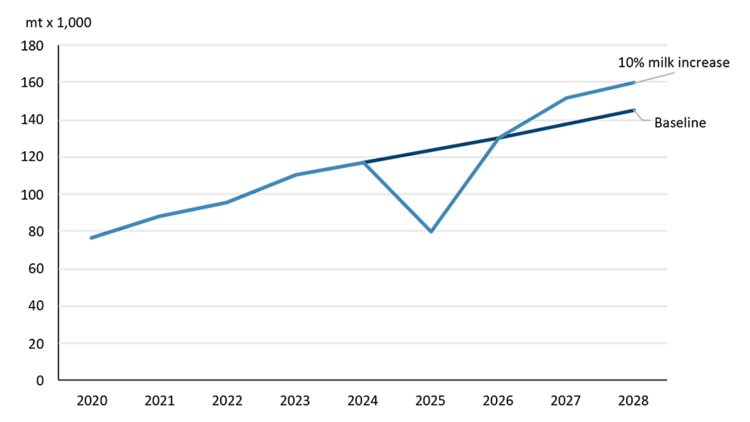

107,000 calves would be, at most, the number of beef-on-dairy calves that would need to be removed from the beef supply chain. If we further assume a perfect one-for-one swap, then all those calves would be taken out of the stock of beef-on-dairy calves in the beef supply chain.

Under this hypothetical scenario, the impacts to the supply of beef are visible. In 2025, there would be a decrease in beef-on-dairy contribution to the beef supply, a 35% reduction relative to the baseline. Overall, there would be an aggregate 3% reduction in beef available in 2025, all other things being equal. It’s a one-time shock though. As those heifers become fresh cows in 2027, the total dairy cow inventory increases; and as breeding cycles continue from that point on, more beef-on-dairy calves can theoretically re-enter the supply chain. By 2028, beef-on-dairy contribution to the beef supply chain is 10% above the baseline.

Figure 4: Beef production from beef-on-dairy calves under different scenarios

Sources: Statistics Canada, AAFC, Lactanet, FCC Economics

There are of course plenty of assumptions baked into these numbers. But directionally they tell a story about how changes in milk demand could impact beef supply in both the short and long term. We’re ignoring the role of US dairy and beef-on-dairy feeder imports in this analysis, which is also becoming a rising source of feeder cattle for Canadian feedlots.

The bottom line

The rise of beef-on-dairy crossbreeding has provided opportunities for producers, feedlot operators, and packers, including a year-round supply of calves. But if the demand for milk were to increase it would cause a further short-term beef supply crunch, pushing up already-elevated beef prices. While typically quite stable, consumption of some milk products is up so far this year, particularly for yogurt (8.0%), ice cream (6.3%), and butter (4.2%). Over the long-term, however, supply of beef could increase as more beef-on-dairy calves are produced via a larger dairy cow herd. One thing is clear: this a trend that is not abating anytime soon, and it’s growing importance in the supply of Canadian beef is noteworthy.

Graeme Crosbie

Senior Economist

Graeme Crosbie is a Senior Economist at FCC. He focuses on macroeconomic analysis and insights, as well as monitoring and analyzing trends within the dairy and poultry sectors. With his expertise and experience in model development, he generates forecasts of the wider agriculture operating environment, helping FCC customers and staff monitor risks and identify opportunities.

Graeme has been at FCC since 2013, spending time in marketing and risk management before joining the economics team in 2021. He holds a master of science in financial economics from Cardiff University and is a CFA charter holder.