Meat product manufacturing: 2025 FCC Food and Beverage Report

The following information is from the 2025 FCC Food and Beverage Report, which highlights the opportunities and challenges for Canadian food manufacturers by sector. To get the big picture, read the full report.

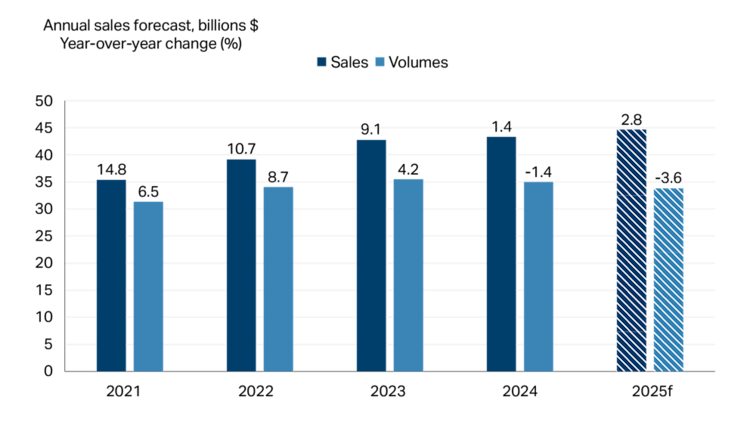

In 2024, the meat product manufacturing sector saw a sales growth of 1.4%, continuing a decade-long trend of consistent year-over-year increases (Figure 1). However, it was also the first year since 2020 that the industry experienced a decline in volumes (that is, sales adjusted for inflation), dropping by -1.4%. FCC Economics forecasts that prices will continue to drive sales into 2025. Sales are forecast to increase 2.8%, with volumes down -3.6%.

Figure 1: Sales for meat manufacturing steady on higher prices, volumes drop

Total sales and volumes (in $, billions) are on the vertical axis and shown by the height of each bar. The number above each bar is the year-over-year growth as a percent. Volumes are sales deflated by a price index (202001 = 100).

Sources: FCC Economics, Statistics Canada

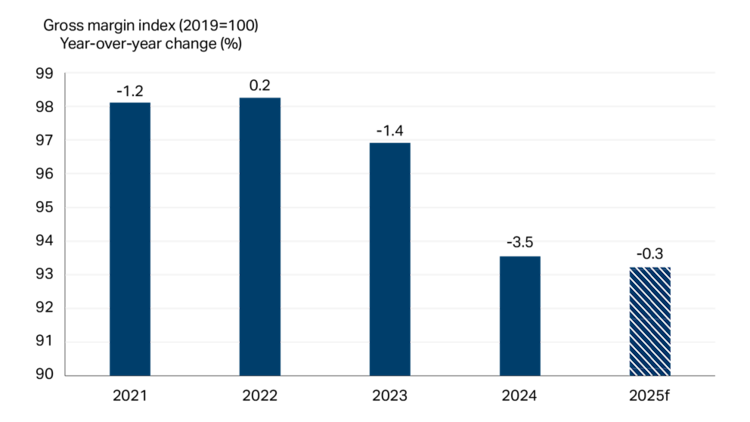

It’s expected that 2025 will be a challenging year for pork and beef manufacturers’ margins (Figure 2). Supplies of cattle will be tight, keeping input prices high for the sector’s key input. On the other hand, the hog supply is robust, but market demand for pork is uncertain. In addition, domestic demand for all meat is waning, and sales to China and the U.S. will face off against potential trade disruptions, including the looming voluntary country of origin labelling requirements.

Figure 2: Meat manufacturing margins to remain steady in 2025

Sources: Statistics Canada, FCC Economics

However, trade disruptions could lead to a different outcome. The impacts would be twofold, and how margins will turn out at the end of the year will depend on the magnitude of each change. If demand from the U.S. declines for live cattle and hogs, Canada would have an excess supply of animals. In this case, lower prices would prevail, helping manufacturers’ raw material costs. On the other hand, lower demand and prices from key export markets such as the U.S. and China would offset this gain to some degree.

Poultry processing faces a mixed outlook for 2025. There’s optimism for chicken processors as stocks start to deplete from a high in 2023 and chicken prices stabilize at the farm level. In addition, chicken prices at the grocery store increased more slowly than beef and pork in 2024, helping chicken stay price competitive with consumers. Canadian chicken demand remains strong, but demand for other poultry meats will continue to face headwinds in 2025. Finally, the poultry processing sector will see less impact from any global trade disruptions due to its limited exposure to this market.

Market insights: Making the cut at home and abroad

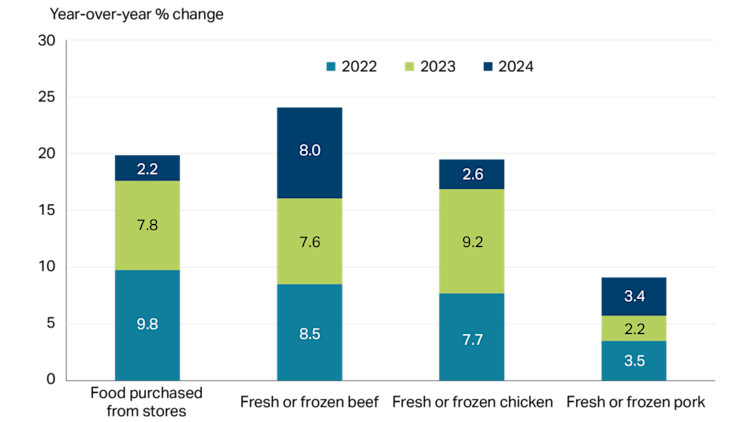

Approximately 70% of meat manufacturing sales are earned in Canada, and price plays a role in what type of meat Canadians are purchasing. Beef prices at the grocery store rose the fastest over the past three years, followed by chicken and pork, and faster than the overall food category (Figure 3).

The FCC Economics demand index measures both demand, what consumers prefer to buy, and consumption, what consumers actually buy. According to the index, in 2024 consumers demand and consumption of beef, pork and chicken declined compared to 2023.

Figure 3: Chicken becomes more price competitive in 2024 as beef and pork prices rise

Source: Statistics Canada

Even with rising prices, meat remains a staple in the shopping carts of Canadians, representing the largest expenditure category for food products. This is both due to its generally higher prices compared to other categories but also the long-standing desire to include meat in diets.

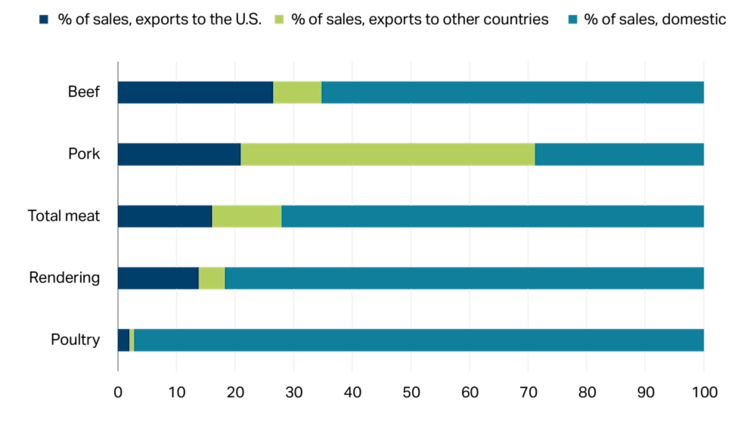

Exports accounted for the remaining 30% of meat manufacturing sales in 2024 (Figure 4). The pork sector relies the most on exports compared to other meats. Nearly half of all exports flow to China and the U.S., with the other half going to growing markets such as Japan, Mexico, Philippines and South Korea. The situation in poultry is in stark contrast to beef and pork, relying almost exclusively on domestic markets for sales. In 2025, pork and beef manufacturers should increase focus on the markets outside of the U.S. for export opportunities given the increased likelihood of trade disruptions. Poultry should capitalize on strong appetite among Canadians for chicken and its price competitiveness against beef.

Figure 4: Meat manufacturing sales by location

Sources: Statistics Canada, FCC Economics

Other trends to watch

Plant-based protein products aren’t growing as fast as projected in recent years. A segment of consumers regard these products as having an inferior taste, highly processed and costing more. Brands will need to revisit strategies to match products with consumer preferences better.

The USDA issued their final ruling on voluntary country of origin labelling (vCOOL) for beef and pork products. Starting January 1, 2026, beef and pork must be sourced from cattle and hogs born and raised in the U.S. to be labelled “Product of USA”. This could raise the cost of doing business for U.S. buyers and Canadian exporters, resulting in negative profitability impacts for Canadian producers.

Diseases pose a significant risk across the sector, generating volatility and challenging margins if large-scale outbreaks occur. Avian influenza and African swine fever are top of mind for 2025.

Strong demand for dairy cattle will continue to pressure available cattle for meat manufacturing.