Potential trade disruptions dampen strong cattle outlook

The cattle market continues to reach new highs. Canadian cattle operations after prolonged periods of drought and expensive feed ended last year optimistic about 2025. Cattle prices are record high, feed availability has increased and feed costs are easing.

Even with record high cattle prices and strong profitability, the Canadian beef herd in 2024 reached a three-decade low, while the number of replacement heifers was near an all-time low. The U.S. herd is in a similar situation as cow numbers declined through 2024, which were reflected in the January 1, 2025, beef herd estimate of 73.4 million head. We’re expecting a drop in the Canadian cattle herd as well.

As we outlined in our top trends to monitor in 2025, cow and heifer slaughter rates will need to decline below 47% of slaughters before we are likely to see any herd growth. We expect some easing of the number of heifers heading to slaughter but not enough to rebuild the herd. Overall, the small North American cattle herd is expected to continue driving prices, leading to yet another year of strong cow-calf profitability in 2025 (Table 1).

Table 1: Cattle prices projected to remain strong in 2025

Livestock prices | 2025 forecast | 2024 estimate | 5-year average |

|---|---|---|---|

Alberta fed steer $/cwt | 260 | 245 | 165 |

Alberta 550 lb steer $/cwt | 440 | 405 | 235 |

Alberta 850 lb steer $/cwt | 355 | 330 | 205 |

Ontario fed steer $/cwt | 260 | 240 | 165 |

Ontario 550 lb steer $/cwt | 395 | 375 | 215 |

Ontario 850 lb steer $/cwt | 335 | 325 | 205 |

While the supply and demand fundamentals create a positive outlook for cattle prices, uncertainty around potential trade barriers is being closely watched by the sector. Any tariffs applied to Canadian exports will impact the Canadian-U.S. livestock sector given the highly integrated North American market. Canada exports 17% of its total cattle production, with Canadian exports to the U.S. making up 99% of all exports. Of those cattle being sent to the U.S., 70% are destined for slaughter. Canada also imports feeder cattle to fatten until they are ready for slaughter. Over half of all Canadian slaughtered beef is exported with majority of it heading to the U.S. We also rely on some U.S. beef imports to meet Canadian demand. This interconnectedness between the two countries means tariffs or any other trade barriers will significantly disrupt cattle operations on both sides of the border.

Proposed tariffs are expected to pressure Canadian cattle prices

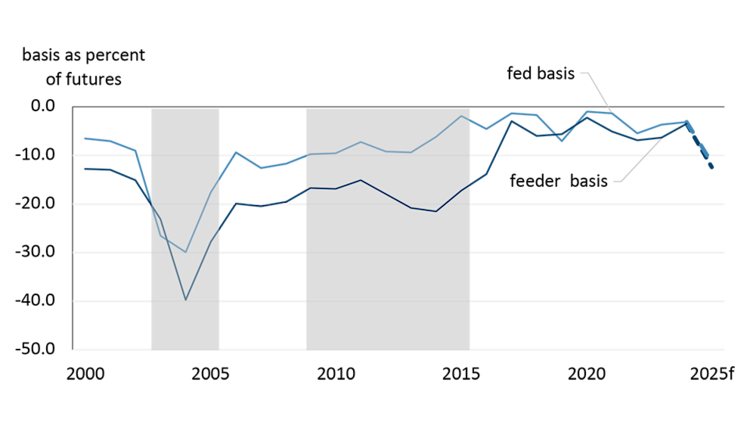

Canadian fed cattle prices and feeder cattle prices follow trends of both live cattle and feeder cattle futures, both priced in U.S. dollars. The difference between the Canadian cash price and the futures prices is known as the basis (cash price – futures price = basis). If tariffs are introduced, then basis levels are likely to widen as the costs induced by tariffs will be passed from buyers to sellers.

Past trade restrictions from the U.S. can provide guidance as to possible price impacts of tariffs. The presence of bovine spongiform encephalopathy (BSE) in Canada from 2003-2005 and mandatory country of origin labelling (mCOOL) from 2009-2015 illustrate how wide basis levels could get (Figure 1). We estimate Canadian cattle prices could decline 5 – 10% with 25% tariffs applied at the U.S. border. For example, our feeder 850 lb price forecast would decline to a $320 - $340 per cwt range. As wide as basis levels could get, expressed as a percentage of future prices in Canadian dollars the impact won’t be as severe as experienced during BSE. Nonetheless any trade restriction will reduce Canadian cash prices. However, if tariffs are short-lived the impact will be smaller.

Figure 1: Canadian fed cattle and feeder basis levels expected to widen

Source: CME futures, Statistics Canada, FCC calculations

Furthermore, the impact of tariffs on the Canadian cattle supply chain will vary based upon supply and demand fundamentals, exposure to the U.S. market and the length of time tariffs are in place. At the cow-calf level, the impact will be seen in a wider basis as cattle bids decline to offset the increased risk of exporting to the U.S. Feedlots, especially those involved in exporting to the U.S., face uncertainty regarding whether potential tariffs will still be in place or escalated by the time feeder calves are finished and ready for slaughter. U.S. packers are likely to adjust their bids and volumes of purchases of Canadian cattle. For Canadian meat processors, export sales of boxed beef to the U.S. will also face risks and will likely be discounted as a result to compete in the U.S. market.

Overall, given current healthy margins, the cow-calf sector is better positioned to cushion the blow from potential U.S. tariffs, although profitability will likely be reduced. The feedlot sector, which is poised to see improved profitability this year, would be at risk of recording lower returns depending on the magnitude and duration of the tariffs. The complexity of the tariff's impact depends on how different players in the supply chain respond to mitigate their risks.

For instance, U.S. and Canadian beef packers may adjust their strategies. The cattle sector is currently taking a wait-and-see approach, limiting new sales of cattle to the U.S. to mitigate the downside risk of tariffs being in place by the time cattle are ready for slaughter. They are staying current on marketings while being cautious about placements into feedlots. Imports of feeders are likely to slow as fewer feeders are exported and feedlots turn to domestic supplies.

While potential U.S. tariffs are the largest factor impacting our cattle outlook this year, there are other trends to monitor as well.

Trends to monitor in 2025

1. Consumer demand

The beef consumer has been resilient. How long will consumers continue to purchase beef at record high prices? Do beef consumers have a tipping point and how is their consumption behaviour impacted by prices of competing meat proteins? If consumers back away, then we can expect cattle prices to reach their limits. Until we see consumer demand start to drop off, cattle markets will continue to stay strong.

2. Value of the Canadian dollar

The Canadian dollar will have an impact on the value of cattle and feed costs. Any depreciation in the Canadian dollar will provide a boost to cattle prices received by farmers but may also boost costs of feed grains. We estimate that a 1% depreciation of the dollar increases cattle farm cash receipts by about 0.6%.

3. Voluntary Country of Origin Labelling (vCOOL)

Further complicating the outlook for exports of cattle to the U.S. is the vCOOL requirement that will be coming into effect on January 1, 2026. The rule requires animals to be born, raised, slaughtered, and processed in the U.S. to be labeled “Product of USA” (currently, companies in the U.S. are allowed to import Canadian animals, raise and/or slaughter them, and use a “Product of USA” label). While January 2026 may seem like a long way away, feeder placement decisions will be felt much sooner as some calves head to the feedlot up to nine months prior to when they will be ready for slaughter. This policy, while voluntary, could result in weaker demand for Canadian cattle heading south and widen basis levels here in Canada. U.S. slaughter plants will begin adjusting procurement of cattle to gear up for the changes. As we progress through 2025, more U.S. beef slaughter plants are expected to implement changes.

Bottom line

The Canadian cattle sector is poised for another year of strong prices and increasing profitability driven by strong market fundamentals (including the small herd size) and strong demand. The outlook is however clouded by potential U.S. tariffs and other looming trade disruptions.

Leigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.