Food and Beverage manufacturing in uncertain times: 2025 FCC Food and Beverage Report

The following information is from the 2025 FCC Food and Beverage Report, which highlights the opportunities and challenges for Canadian food manufacturers by sector. To get the big picture, read the full report.

Introduction

A quick glance at the financials of the food and beverage manufacturing sector suggests an uneventful year in 2024. Expenses and sales experienced less than a 1% shift, leaving only a slight improvement in profit margins.

However, this is far from the truth. Inflation started to retreat, the Bank of Canada began cutting interest rates, and tensions in the labour market eased. In 2024, cocoa prices skyrocketed, cattle prices remained elevated, and grain prices declined. The year ended with the announcement of a change in the U.S. leadership and the threat of tariffs.

It’s shaping up to be another eventful year in 2025. Trade disruptions will take centre stage for the sector as exports, sales and margins are pressured. Aside from trade disruptions, the sector will also have to grapple with the impacts of a slowing population on labour supply and the strength of consumer demand.

Per capita expenditure on food and beverages declined for the fourth consecutive year in 2024, due to household budget pressures. However, food and non-alcoholic beverages did show signs of recovery near the end of 2024. Alcohol continued to struggle.

How long trade disruptions persist and how the Canadian economy fares will determine the strength of consumer spending in 2025. Entering another year of uncertainty is nothing new for food and beverage manufacturers. The sector has proven that it is resilient and adaptable in challenging times.

Food and beverage manufacturing during uncertain economic times

Canada’s economy is set for another challenging year. The Bank of Canada recognized that its forecast for 2025 real GDP growth of 1.8% may be downgraded if the U.S. imposes tariffs on our exports. With the uncertainty of trade disruptions, a sharp economic slowdown, if not a recession, is a real possibility in 2025.

Historically, food and non-alcoholic beverage retail sales have fared better than other sectors during difficult economic times since they’re necessities. Even so, uncertain economic times do not bode well for consumer demand overall.

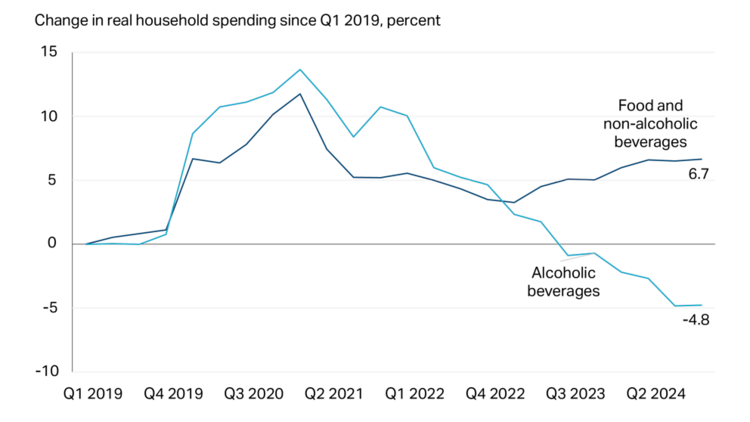

Canadian consumption of food and non-alcoholic beverages began to rebound in 2024. However, consumption of alcohol continues to decline (Figure 1). In 2025, consumers will continue to look for value in their food products and watch spending on premium or discretionary items.

Figure 1: Expenditure on food and non-alcoholic beverages rose in 2024, while alcohol fell again

Source: Statistics Canada

Opportunities and challenges in 2025

The focus in 2024 was on inflation. While it has slowed down, prices are still increasing (albeit at a slower pace) and the consumer remains under pressure. Price is an obvious factor when making food purchase decisions, but consumers also care about different attributes. Consumers are seeking products that resonate with them, whether it’s a specific health attribute or a benefit they want.

This is evident in the rising number of consumers following a specific diet, including high-protein, low-sugar, low-carbohydrate, gluten-free, vegan, or choosing a specific attribute such as traceable ingredients and convenience.

Food manufacturers are also preparing for the rise in consumers turning to pharmaceuticals to manage their appetite, especially in the U.S. According to a recent study by Cornell and Numerator, within six months of adoption, households with at least one GLP-1 user reduced spending on groceries by 5.5%. The results varied by category, but calorie-dense, processed items were the hardest hit.

Finally, a diverse Canadian population has prompted interest in a wider variety of food products, offering opportunities to food and beverage manufacturers to serve growing market segments. Innovation to leverage trends in food preferences, evolving demographics and connections to health will be a valuable way to differentiate a product and drive sales.

Our projections for 2025

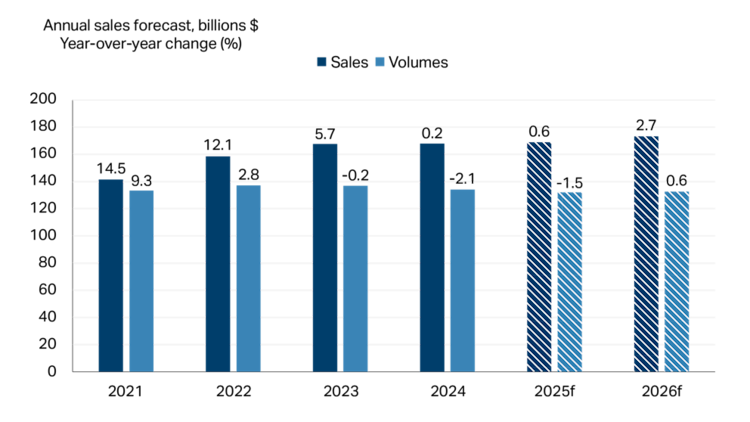

FCC Economics forecasts that food and beverage sales will increase 0.6% in 2025, from $167.8 billion to $168.8 billion. The sector continues to face an adjustment to volumes (that is, sales adjusted for inflation) following two years of strong growth in 2021 and 2022. Volumes remain above 2019 levels but are projected to drop -1.5% in 2025. Looking further to 2026, the trend looks positive for the sector with current sales projections up 2.7% and volumes up 0.6% over 2025 levels (Figure 2).

Figure 2: Slow growth for food and beverage manufacturing in 2025

Total sales and volumes (in $, billions) are on the vertical axis and shown by the height of each bar. The number above each bar is the year-over-year growth as a percent. Volumes are sales deflated by a price index (202001=100).

Sources: FCC Economics, Statistics Canada

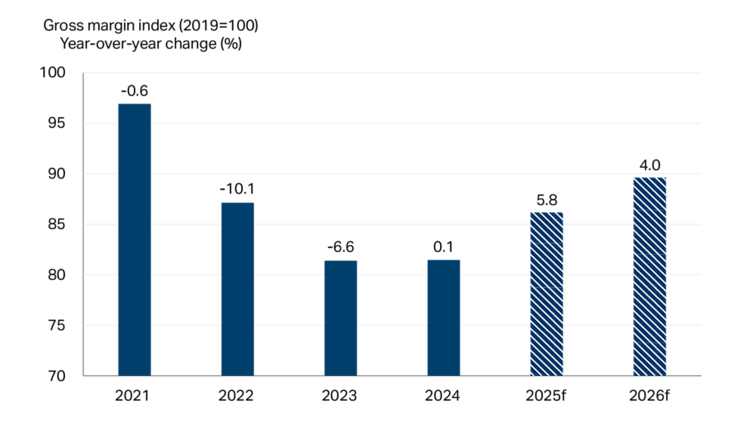

Gross margins for the food and beverage manufacturing sector will remain below 2019 levels, but margins will vary by sub-sector. The forecasted decline in raw material costs offset the increased cost to wages and benefits for food and beverage manufacturing. Although labour market pressures continue to ease, Canada’s labour pool is aging, keeping pressure on wages. Combined with a small uptick in sales, margins are forecast to improve again in 2025 (+5.8%) and 2026 (+4.0%) (Figure 3).

Figure 3: Food and beverage manufacturing gross margins forecast to grow in 2025 and 2026

Sources: FCC Economics, Statistics Canada

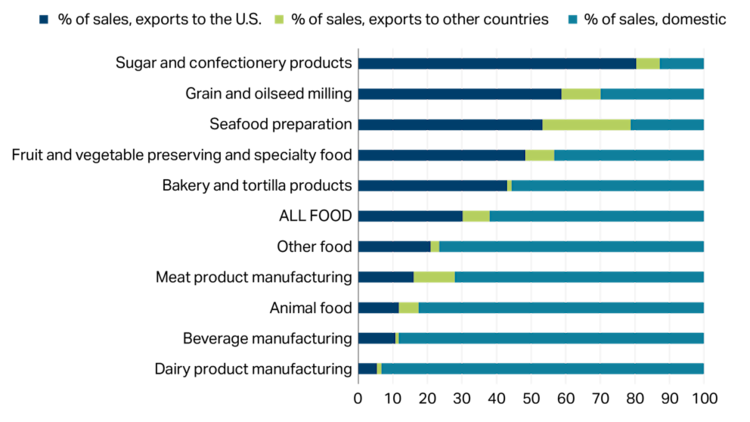

While the food and beverage sector faces many factors outside of its control, the biggest uncertainty heading into 2025 is the impact of trade disruptions on margins. Trade disruptions that impact the movement of food and beverage products will likely lower sales and exports, increase costs, and ultimately reduce margins. The impacts will be felt disproportionately by businesses whose sales are highly dependent on exports (Figure 4) and for those with a weaker financial position going into the year.

Figure 4: Reliance on U.S. export market varies across sub-sector

Sources: FCC Economics, Statistics Canada

As such, food and beverage manufacturers would do well to prepare for the challenges ahead by strengthening their balance sheets, investing in processes and equipment to boost productivity, introducing product innovations, and seeking diversification towards non-U.S. markets.