8 ways to improve farm profitability

Small cost savings and revenue gains can have a compounding effect on your farm’s profitability. Financial experts Lance Stockbrugger, a Saskatchewan farmer and chartered accountant, and Eric Micheels, associate professor in the University of Saskatchewan’s department of agriculture and resource economics, share eight tips for improving your farm’s bottom line.

1. Find what works best

For Stockbrugger, generating your own data through on-farm experimentation is a good way to identify cost-saving opportunities – for example, trialling the use of a new input or the lack of an input in part of a field.

“Every farm is a little bit different. Doing what works for you is important, and can save you money,” he says.

Don’t spend aimlessly. Every cost matters, no matter what you’re spending it on.

2. Every cost matters

Stockbrugger says lower profitability is often a result of farmers paying too much attention to gross revenue, and not enough to controlling costs. This is even though controlling costs effectively can lead to significantly better margins, even when gross revenues don’t improve.

3. Machinery has a best-before date... but do you need it?

Knowing when machinery has reached its best-before date is another factor.

While no one likes making payments on machinery, the cost of repairs – and the downtime resulting from breakdowns – can be enormously costly. Stockbrugger says farmers need a good understanding of equipment’s depreciation, potential repair costs, field capabilities, and other characteristics to help determine whether acquiring new equipment makes practical and financial sense.

“That’s one of the hardest ones. We like keeping equipment, especially when it’s paid off,” Stockbrugger says. He adds that capitalizing on lower interest rates and interest-free periods on equipment purchases can help reduce financial pressure.

At the same time, Micheels cautions against unnecessary capital purchases, including machinery.

“Just because we can buy it, doesn’t mean we should,” Micheels says. “Ensure the investments being made are for the long-term health of the business. If we’re upgrading the equipment complement before we have adequate working capital in place, and so on, we may want to rethink that capital allocation.”

4. Pay attention to taxes

Proactively paying income tax, too, supports a good long-term business strategy.

“Paying tax as you go, but not overpaying, is a good long-term strategy,” Stockbrugger says. “You can pay taxes when the business is profitable, because if you don’t, you’ll start making poor decisions based on income tax. That will cost you.

Paying taxes is, after all, a sign of business success, Micheels points out. He says it’s important to work with good financial advisors since they can help reduce tax burdens where appropriate.

5. Know your strengths; hire your weaknesses

Stockbrugger encourages farmers and ranchers to “pick what they’re good at,” and avoid trying to do everything themselves.

“If you like marketing but not agronomy, hire an agronomist. If you’re good at agronomy, then higher a marketer. Focus on what you enjoy doing because you’ll do a good job of it,” he says. “Build relationships with suppliers and customers. It helps you get ahead. We have to be in business together. If we can make money together, we’re going to go a lot further.”

6. Know what you want

Starting with a clear goal in mind is a critical element for maintaining and improving profitability, Micheels says.

“It goes back to what we learn in 4-H about goal setting: Let’s be specific about it, and when we want to achieve it. I think then we can look at determining what the levers are we can work on to get us there,” Micheels says.

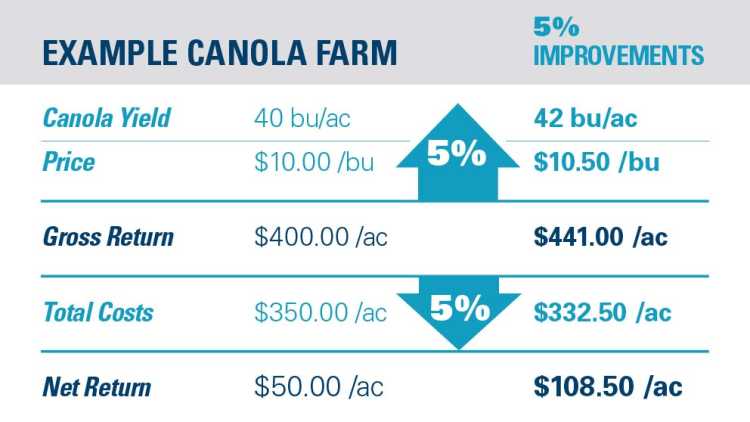

He cites the advantages of working with the 5% rule, where a 5% increase in yield, combined with a 5% reduction in costs, and a 5% increase in marketing, results in a multifold increase to overall profitability.

7. Manage risk

Taking a “portfolio approach” to new ideas is helpful, similar to an investment portfolio that combines different investments across different areas and levels of risk. Trying a new crop variety on a small scale alongside a variety you know does well on your farm, for example, is a safer way to expand diversity.

“Where you can, try things on a smaller scale to see if they will work for you,” Micheels says. “You can allocate more resources to that if you find they do work for you.”

8. Track, benchmark and share

Keep accurate, detailed records and share them with others on your team. Having other members of the business, family or advisors review records might highlight opportunities that were overlooked. Reviewing past data helps inform where you have been, where you might be going, and if you’re on track to achieve identified goals.

“Good record keeping is paramount. We still have to say it,” Micheels says, adding that benchmarking, both with yourself and with peers in similar businesses, can be very valuable.

He says national and regional benchmarks would help farmers determine how they are doing compared to their peers.

“That might help move everybody ahead, or provide you with some guidance or incentive to catch up to where the leaders in the industry are. Even your own individual benchmarking – asking how you have done over the last number of years – can be helpful.”

Individually, small cost savings may not have much impact on your farm’s profitability. Combined, though, the small savings can add up to something more significant and increase your farm’s success.

From a AgriSuccess article.

Knowing your cost of production and your cash flow needs are essential elements of a good marketing plan.