Fixed vs variable loans in a rate-cutting era

Last summer, we wrote a blog analyzing the costs and benefits of taking out a fixed or variable-rate loan. With the Bank of Canada (BoC) set to begin cutting interest rates soon, we reconduct the assessment considering today’s economic environment and different forward-looking scenarios.

Our hypothetical loans

As was the case last summer, the starting point for this analysis is two hypothetical loans – one fixed-rate, and one variable-rate. To complete the analysis, we needed to make some assumptions common to both:

The mortgage amount is $500,000

The terms of the loans are five years (five years being the most common term at FCC, regardless of interest rate type).

Amortization is 25 years

Payments are monthly

Both are closed

We do not make assumptions about the individual borrower’s creditworthiness

For the variable-rate loan, the borrowing rate is prime plus 1.0%

For the fixed-rate loan, the borrowing rate is the five-year Government of Canada bond yield plus 2.5%.

With our assumptions set, we can look at cash flow under different scenarios.

Our different economic scenarios

For our fixed rate loan, we use a rate of 6.25%. This is assuming a five-year government bond yield of 3.75% plus a spread of 2.5%. For our variable rate loan, we do not know with certainty what the path of variable rates – more specifically, the overnight rate set by the BoC – will be over the next five years. Here we rely on Moody’s Analytics for some guidance. Moody’s Analytics provides us with forecasts of where the overnight rate could move under different scenarios. Each scenario has a different probability of occurring.

Baseline scenario. This is the most likely scenario according to Moody’s. Under this scenario, the BoC cuts the overnight rate three times in 2024 given slowing inflation and weak GDP growth.

Upside scenario. Under this scenario, current geopolitical conflicts ease and/or end, and the supply side of the economy expands strongly. This supply side expansion offsets inflationary pressures, allowing the BoC to still lower the overnight rate in the latter half of 2024 (though at a more gradual pace than the baseline scenario).

Downside scenario. Under this scenario, current geopolitical conflicts worsen. The pullback in global trade deals a blow to the export-dependent Canadian economy. Consumer and business sentiment declines, causing inflationary pressures to slow. The BoC begins cutting rates almost immediately as the prospect of a recession are imminent.

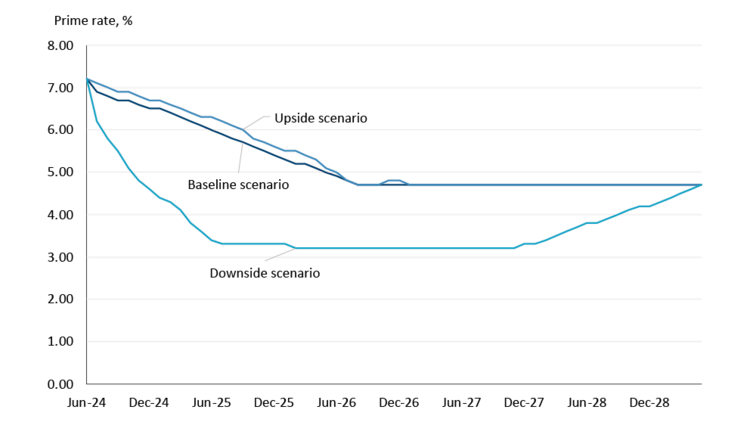

The path of the overnight rate in the baseline and upside scenarios are similar, though again, the pace of cuts is more gradual in the upside scenario. In both these scenarios, by mid-2026 the BoC stops cutting rates once the rate hits 2.5%. The situation is quite different in the downside scenario: the overnight rate is cut in half by the end of 2024 (from 5.0% to 2.5%) and is further lowered in 2025 as the Canadian economy enters a recession. As the economy recovers, the BoC starts increasing the overnight rate. Movements in the overnight rate correspondingly cause movements in the prime rate (Figure 1).

Figure 1: Prime rate projections under various economic scenarios

Source: Moody’s Analytics

Our results

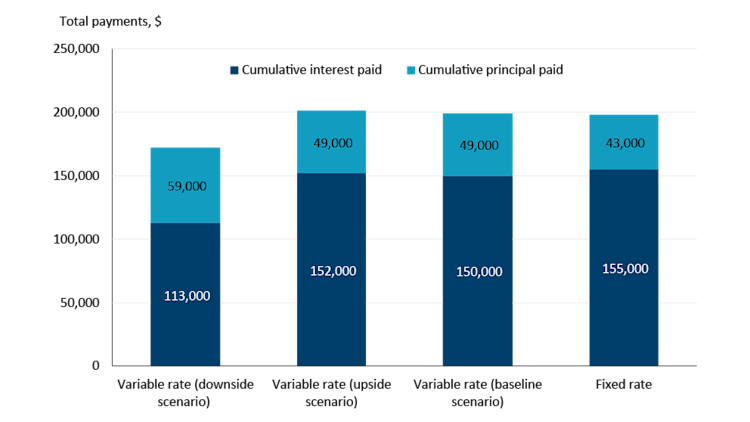

With respect to cumulative (total) payments over the five-year period, there is little difference between taking out a fixed-rate loan or a variable-rate loan under the baseline and upside scenarios. However, under the downside scenario – where the overnight and prime rates fall significantly to offset a recession – the borrower saves nearly $25,000 in payments if they opt for a variable-rate loan. Not only is there less total payments but more principal is paid down under the downside scenario.

Figure 2: Cumulative (total) payments under our different scenarios

Values rounded to the nearest thousand for simplicity.

Sources: Moody’s Analytics, FCC Economics

Worst case scenario

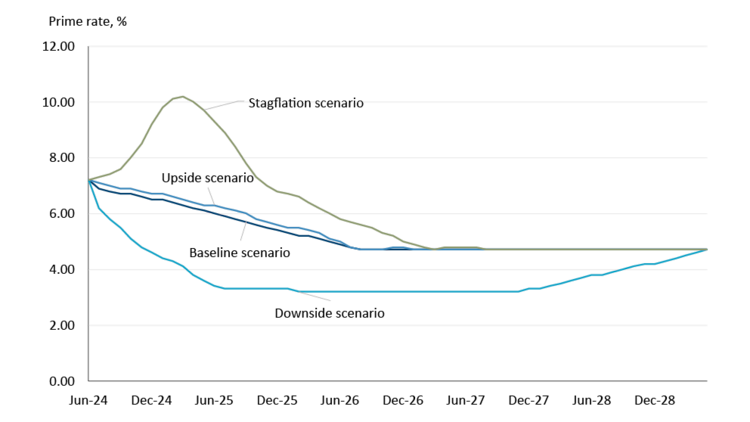

Moody’s has only one scenario where the prime rate increases – the ‘stagflation’ scenario. This is a scenario where unforeseen additional inflationary pressures arise from several sources: geopolitical conflicts escalate, supply chain constraints return, layoffs and productivity losses raise costs, and oil prices climb higher. As broad price pressures raise core inflation, the BoC raises rates very quickly, inducing a recession.

Figure 3: Prime rate projections under various economic scenarios including the stagflation scenario

Source: Moody’s Analytics

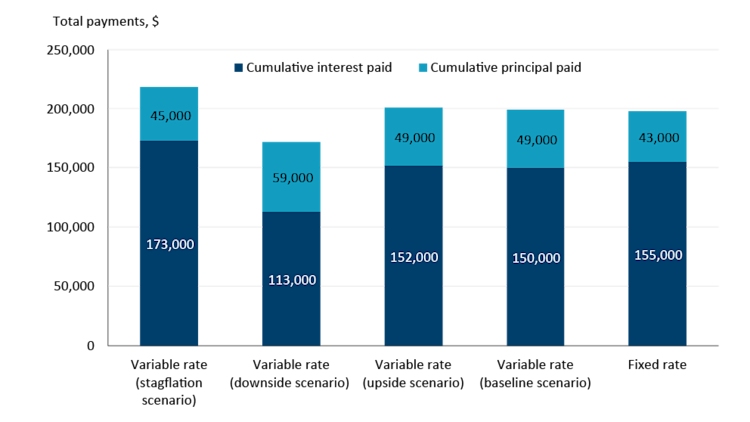

Under this scenario, total payments are anywhere from $17,000 to $46,000 higher than all other scenarios. It’s worth noting that more principal is paid under this scenario when compared to taking out a fixed-rate loan (by $2,000) but that’s a result of the additional $20,000 in payments over the five-year period; less principal is paid down compared to the variable rate loans under the baseline, upside, and downside scenarios.

Figure 4. Cumulative (total) payments under our different scenarios, including the stagflation scenario

Values rounded to the nearest thousand for simplicity.

Sources: Moody’s Analytics, FCC Economics

Bottom line

This analysis does not constitute advice. It is meant to be illustrative and to highlight the unique interest rate environment we find ourselves in today.

The downside scenario may result in savings on debt-servicing, but we do not attempt to forecast how other items that impact profitability (supply, demand, trade and prices of ag commodities) would play out under this or any other scenario. Again, debt servicing is just one piece of the profitability puzzle. FCC Economics does not see the overnight rate falling below 2.5% (the estimated neutral rate of interest) barring some major recessionary event such as the one Moody’s describes in their downside scenario.

Communication with your lender is incredibly important as there are so many different factors to consider when choosing between a fixed and variable rate. This includes, but is not limited to, the timing of capital investments (loans being paid off, when new investments will be required); product features, including prepayment limits and fees; cash flow and structure of existing debt, including existing floating debt exposure; and one’s own risk tolerance. Conducting scenario analysis as we’ve done above can help operators understand their risk exposure within different economic environments.

Further reading and resources about factors that influence interest rates:

Senior Economist

Graeme Crosbie is a senior economist at FCC. His focus areas include macroeconomic analysis and insights and monitoring and analyzing Canada’s food and beverage industries. Having grown up on a dairy farm in southern Saskatchewan, he occasionally comments on the health of the dairy industry in Canada.

Graeme has been at FCC since 2013, spending most of that time in risk management. Graeme holds a master of science in financial economics from Cardiff University and is a CFA charter holder.