Operating expense ratio: Protect profitability and your financial fitness

Rising farm input costs or declining commodity prices may well pressure profit margins. As that happens, we recommend farm operations focus on efficiency, a task made easier by using the operating expense ratio (OER).

Operating expense ratio

The operating expense ratio measures an operation’s variable costs relative to that operation’s gross revenue.

OER = Total operating expenses / Gross revenue

Variable costs include daily operational expenses (labour, feed, crop protection, fuel, maintenance, insurance, repairs, and ag specialist fees, for example). Loan payments, depreciation, and capital improvements are excluded from operating expenses.

How it works

An OER of 60% indicates an operation spends 60% of its revenues on variable expenses. If an OER is too high, a farm may have higher expenses than it can be expected to cover with revenue. Possibly exposing a producer to financial challenges if market conditions worsen, an overly high OER also reduces the income available to cover fixed costs or build equity.

A note of caution

Neither the profitability nor the OERs for different sectors are directly comparable, because each OER reflects sector-specific patterns in costs and revenues. Instead, watch historical trends for your sector.

Average OER tells of sector profitability

Rising farm input costs apply pressure to sector profitability. The OER is one of the best ways to understand and manage a sector’s fluid relationship between operating expenses and revenues.

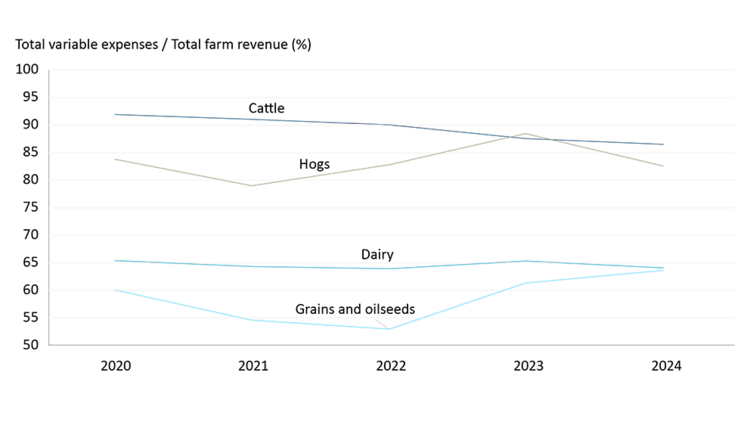

Figure 1 shows how varying patterns in revenues and costs have produced differences in the average OER for dairy, hogs, cattle, and grains and oilseeds farms*.

Figure 1: Cattle sector continues to show declines in average revenue-expenses spread

Source: FCC Portfolio data

Of the four, the cattle sector’s OER saw the most consistent improvement between 2020 and 2024. Producers, especially in the west, faced challenges with low feed supply in 2021 and 2022, which can impact variable expenses, but these improved into 2022 and 2023. Producers also saw strong prices for cattle in 2024 that are continuing in 2025, helping revenues and the OER. Following improvements in grains and oilseeds in 2022 on higher commodity prices, the ratio increased into 2023 and 2024, but still remains healthy, as commodity prices ease and expenses increased.

What does the future hold?

In periods when expenses grow more quickly than revenues, the OER is likely to increase, suggesting a declining profitability. That can become a bigger problem when it continues over several years. Efficiency measures - minimizing production costs using the right mix of farm inputs – are among the best tools producers can use to manage profitability.

The OER should be used in conjunction with other ratios to properly assess overall financial health. Work with your lender and accountant to determine the suggested ratios for your specific industry and be sure to understand them according to your own strategy and the risks facing your own operation.

*This analysis is based on data from FCC’s portfolio (2020 – 2024).

Are you comfortable using financial statements to better manage your operation? A good place to start is your accountant, an FCC Relationship Manager or the free online course series, Manage Your Farm Finances.

Article by: Amanda Norris, Senior Economist

Our debt service coverage ratio suggests rising debt isn’t necessarily a problem for Canadian producers. Here’s how you can harness its insights to manage your farm financial fitness.