Debt-to-equity ratio: Leverage assets for farm financial fitness

With Canadian agriculture’s total debt outstanding now over C$166 billion, we can ask some important questions about the value those liabilities provide.

Taking on more debt to finance the purchase of assets allows a business to expand and grow. Paying off the debt is done with the additional revenues generated by properly deploying these assets. Reducing debt or seeing assets gain value over time are two ways to build equity or net worth. However, financing a large portion of the business growth through debt also exposes a business to financial risk. The debt-to-equity ratio, the topic explored in this post, can answer the question of the long-term value generated by liabilities.

Debt-to-equity ratio

The debt-to-equity ratio indicates the ability of shareholder equity to cover all outstanding debt.

DER = total liabilities / total shareholders’ equity

Total liabilities include both short- and long-term obligations. Total equity is defined as total assets minus total liabilities.

DE ratios can range broadly and still be considered healthy. Different levels of debt are required to take advantage of different sectors’ opportunities; what would be an ideal level of debt for one sector is less optimal for another. A low DER could indicate a mature operation that’s not seeking to expand or innovate. A high DER can indicate a highly leveraged business pursuing growth opportunities while being exposed to financial risk.

How it works

A low debt-to-equity ratio provides flexibility:

To extend terms on existing debt when profits and repayment capacity are tighter.

To borrow more money if an opportunity shows up.

Different leverage for different sectors

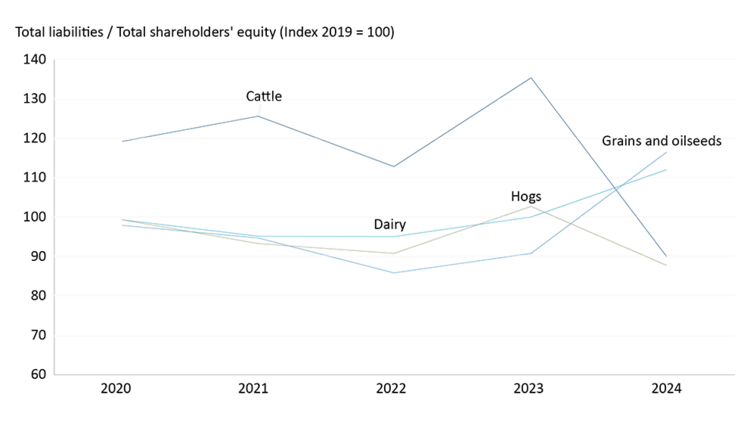

Figure 1 shows the average DER for dairy, hogs, cattle and grains and oilseeds between 2020 and 2024*. Each sector shows a healthy range of scores over a five-year period, reflecting its unique capital expansion needs and trends in revenues.

Figure 1: Leveraging assets with different returns to equity

Source: FCC Portfolio Data

With a more predictable income, dairy producers can carry higher debt to equity than other ag sectors. We’d expect the other three sectors shown here to have ratios lower than dairy’s: revenues for each of these sectors are more volatile and borrowing to fund assets and growth makes sense for these producers only during periods when such investment will offer profitable returns.

What does the future hold?

Highly leveraged farms are more likely to show more volatile rates of return on equity. The debt-to-equity ratio shows how leverage amplifies the return – whether in good times or bad. Emerging opportunities will have to be evaluated considering each operation’s exposure to financial risk.

As with each ratio we highlight throughout this series, DER is only one view of the financial health of Canadian agriculture. Using different ratios together fills out the big picture. As well, using the average DER as we’ve done here doesn’t begin to tell the whole story, as it reflects both operations with recent production investments and higher DER scores, and more mature operations carrying lower debt levels (and lower DER scores). Work with your lender and accountant to determine the suggested ratios for your specific industry and be sure to understand them according to your own strategy and the risks facing your own operation.

*This analysis is based on data from FCC’s portfolio (2020-2024).

Are you comfortable using financial statements to better manage your operation? A good place to start is your accountant, an FCC Relationship Manager or the free online course series, Manage Your Farm Finances.

Article by: Amanda Norris, Senior Economist