The world is hungry – have Canada’s food and beverage exports responded?

The global trade of agricultural raw commodities and food products has undergone major shifts over the last four years. Food insecurity is increasing, real incomes are falling, and what once seemed to be the promise of growing markets in the world’s developing countries fades with successive shocks. One of the largest threats to global food security was the pandemic, whose disruptions to global food security aren’t completely over yet. It rocked established global trade patterns as seemingly insatiable demand for goods left suppliers struggling to deliver products in chaotic supply chains. At the same time, Russia’s war against Ukraine, Chinese-U.S. tensions and other geopolitical conflicts altered traditional trade patterns into friend-shoring and onshoring trends. The world has come through what we hope is the worst of the pandemic stressed, ever more deeply divided along several fractious tangents and food insecure.

Overall growth characterizes 2023 processed food exports

Against this backdrop, how has the new global trade landscape played out for Canada? At first glance, we seem to be doing okay. Embroiled in a diplomatic struggle with India, our exports of raw pulses may escape from backlash there. In this case, it’s good to be the only reliable supplier of a major food staple (green lentils) that a giant population consumes daily. Russia imports virtually none of our food or beverages. China’s zero-COVID policy ended in 2022, allowing exports to pick up again.

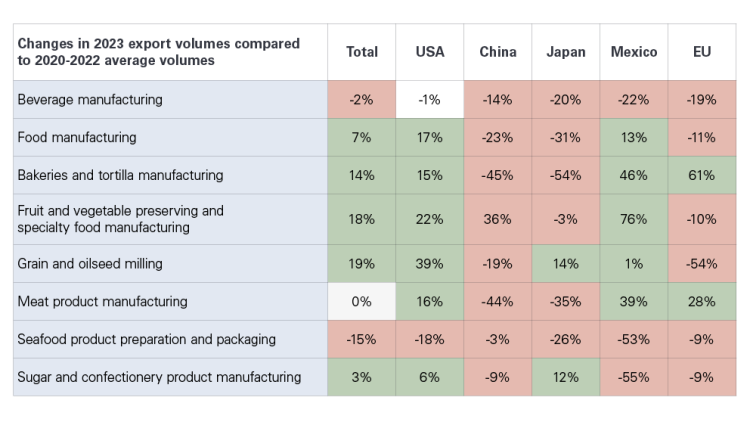

Compared to a pandemic average (2020 - 2022) of Canadian export volumes (nominal monthly export values/ Industrial Product Price Index deflator), our 2023 food exports have grown (Table 1).

The table shows changes in 2023 export volumes to date (January - August) compared to a pandemic volume average for each of the selected commodity codes, overall and to each major food market. Overall, food manufacturing exports grew 7% in 2023 compared to the 2020-2022 average. The U.S., China, Japan and Mexico are Canada's four largest single-country processed food importers. In 2023, they imported $29.2 billion (U.S.), $2.3 billion (China), $1.2 billion (Japan) and $900 million (Mexico). The 27 countries in the EU, taken together, round out the top five ($716 million).

Table 1: Canada’s food and beverage export volumes depend highly on the U.S.

Source: Statistics Canada, Trade Data Online and Industrial Product Price Index

Our exports to North American markets have generally gained compared to the average of 2020-2022 volumes, and exports to the U.S. are driving that growth. So far, in 2023, the U.S. has accounted for 80% of total Canadian food and beverage exports. Leading the way are our products from grain and oilseed milling (39%), fruit/vegetable/ specialty food manufacturing (22%), meat product manufacturing (16%) and bakeries and tortilla manufacturing (15%). The category of fruit/vegetable/ specialty food manufacturing increased a remarkable 76% in Mexico’s 2023 imports. Our exports to Mexico from bakeries and tortilla manufacturing also rose 46%, and meat product manufacturing rose 39%.

Exports to other major markets have tailed off. Exports to China and Japan have, for the most part, fallen from their pandemic highs. The same is true for countries in the European Union (EU-27). Both supply and demand forces are no doubt at work here.

Production deficits, supply chain issues curtail supply while inflationary pressures shrink demand

Overall, food manufacturing exports have grown based on strong North American demand. Exports are up 7% from the pandemic average, which may be an even better story if processed food exports during 2020 – 2022 were also up. Given the well-noted, pent-up consumer demand under global lockdowns and the fact that consumers were frequently limited to at-home dining, food manufacturing exports did well – and continue to do so.

The same can’t be said of beverages. The sector overall faces stout headwinds. Globally, patterns of alcohol consumption are changing, with beer sales, for one, having been crunched by the more recent offerings of cannabis, ciders, coolers and cocktails. In Canada, frosts devoured B.C.’s 2023 wine crop, limiting supply, and a rise in immigration is altering traditional alcohol consumption patterns. Our beverage exports to the States have so far stabilized in 2023 relative to the 2020-2022 average, but exports otherwise have fallen roughly 20% for the year to date in each major market.

Seafood product preparation and packaging is the only category with negative growth in the five selected markets. This is troubling, as it follows a period when the pandemic’s import restrictions constrained shipments. While Norwegian and Chilean suppliers are moving in and replacing Canadian products on U.S. shelves, several supply-side factors helped to decrease U.S. imports of our seafood. By April 2023, Canada’s exports of farmed, whole fish Atlantic salmon were down 32% year-over-year (YoY). It has hurt the sector, which exports up to 85% of its farmed/fished production.

Grain and oilseed milling has benefited from larger supplies in 2022 and 2023 compared to the drought-reduced 2021 crop. But our year-to-date exports to the EU are down by more than half this year. This category’s declines and falls in the other categories to the EU can reflect the enhanced inflationary pressures European countries face. Not only are their food costs increasing, but since Russia’s war against Ukraine has started, European energy costs have skyrocketed. Also, in 2023, exports to Asia going through western access points could have been limited by the strike at Vancouver’s port, with possible implications for China’s drop in imports of milled products.

Growth of meat manufacturing is flat, with exports to North America and Europe offsetting declining exports to China and Japan. Japanese imports have fallen by one-third, and Chinese exports have fallen by 44%. That comes after the huge increases in meat exports to China in 2020 and 2021 – a result of their struggles with African Swine Fever and a growing appetite for beef. In some good news for the hog sector, China has increased its YoY pork imports by 40% in the first eight months of 2023.

Sugar and confectionary product manufacturing suffered in 2023 from Quebec’s worst year in maple syrup production in five years. That produces export losses due to the production slowdowns.

Bottom line

Growth to the U.S. drives Canada’s overall growth in processed food exports. In 2023, the U.S. has so far accounted for 80% of total Canadian food and beverage exports.

In other words, our overall food exports go as our exports to the U.S. go. Being an important supplier to the single largest food market in the world shields us from some of the chaos occurring elsewhere. But such fortune is a double-edged sword. While it helps reduce some volatility associated with turbulent markets, it also highlights a noted lack of commitment to Canadian processed foods in other markets. For instance, it is perhaps the case that our food and beverage exports to European markets start to buckle under inflationary pressures, a trend that's more muted in the U.S.

We have tools at hand to improve our global reach. Canada has ten bilateral or multilateral free trade agreements currently in force with 45 countries, 27 of which are European, and is a party to two additional World Trade Organization agreements. However, many countries with whom we have agreements aren’t in our top 10 list of export markets. At least part of that is because they’re not big players in global agri-food markets. Until we can establish the same kind of excellent, long-term relationships in other parts of the world that we have with the U.S., it will be up to individual processors and distributors to manage their marketing risks.

Martha Roberts

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.