2023 weather and production challenges limited growth in fruit land values

Fresh fruit is an essential part of Canada’s agricultural industry, contributing 2.5% to total Canadian crop receipts. Regionally, fruit's importance is more significant: In Atlantic Canada, fruit contributed 9.1% to crop receipts, and in BC, fruit contributed nearly 19%. Supplementary to our 2023 Farmland Values Report, our analysis aims to highlight trends in land values for the production of blueberries, apple orchards, cherry/tender fruit orchards, and vineyards.

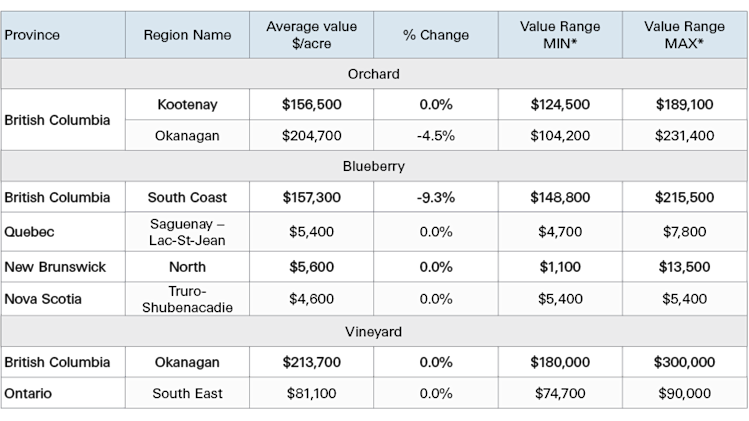

We report trends in average price per acre and value ranges for the 5th and 95th percentile values in production areas with sufficient sales data to produce reliable estimates (Table 1). Fruit production occurs in other areas within each province. However, we do not publish land value estimates for those areas because of limited sales activity.

Table 1: FCC reference Value per acre for Orchards, Blueberries and Vineyards

Source: FCC Calculations

*The value range represents 90% of the sales in each area and excludes the top and bottom 5%

British Columbia

The agricultural sector in the Okanagan Valley is currently facing significant weather-related challenges. Recent frost events have resulted in an estimated complete loss of grape and tender fruit crops, and the outlook for cherries remains uncertain, with less than half of the typical crop anticipated. In contrast, apples, known for their resilience, appear to have weathered the frost better than most.

Some acreages have changed hands; however, these deals were all agreed upon prior to the extreme cold event in early 2024. Land values have softened and are expected to stabilize to a new normal once the extent of the crop damage is known.

It’s important to note that the impact of weather damage varies considerably across different valleys and fruit varietals, adding another layer of complexity to the situation; there is hope that some pockets may be less affected, but for now, it is too early to tell.

We’re reporting no change this year in the average orchard land values in the Kootenay region, while orchards in the Okanagan region recorded a decline of 4.5%. Vineyards' average values also remain unchanged compared to last year.

Little to no damage is expected to this year’s blueberry crop. The South Coast region acreages recorded a strong rise in values, which peaked in early 2022. Then, they held steady with minimal sales activity as interest rates rose and have since come down from peak levels. Land values appear to have softened, along with a noticeable slowdown in open-handed bidding. Our analysis shows that average land values of blueberry operations declined 9.3% in the South Coast region in 2023.

Ontario

Orchard and tender fruit growers, most of whom are in Niagara, are witnessing a period of robust crop quality and strong fruit prices. Land sales are often happening locally between farmers or long-standing rental tenants. This exchange ensures the land remains productive and within the farming community; however, it limits transparency in the transaction details.

Grape growers have been faced with a series of climatic and economic challenges. The winter of 2022 was particularly harsh, leading to a difficult crop year. The aftermath is still visible, with acres of vineyards requiring replanting. Some producers are moving to alternate fruit production, like pears, and others have young vines that have yet to bear fruit —all of which are consequences of the devastating frosts—despite these setbacks, the 2023 season brought forth strong crops with a substantial harvest and a mild winter that has set the stage for a full crop this year.

Looking back, our analysis shows that vineyards' land values in the province's southeast region were flat in 2023 (0% change).

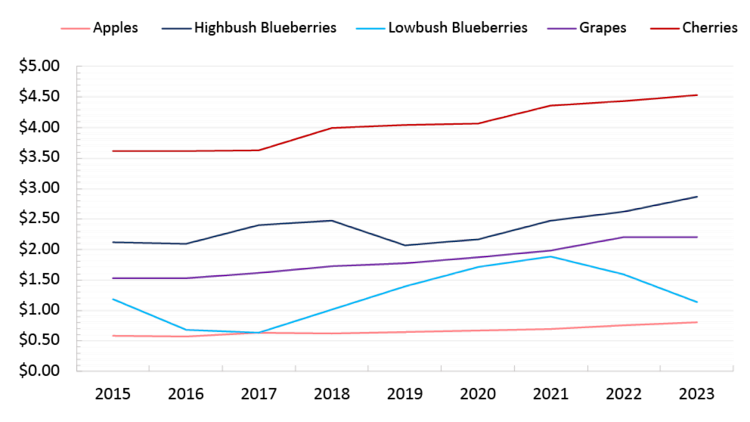

Fruit prices have generally increased over the last eight years (Figure 1). However, this does not capture the increase in input costs that growers have faced in the past two years, which has challenged profitability.

Figure 1: Canadian average prices per kilogram for apples, highbush and lowbush blueberries, grapes and cherries

Sources: Statistics Canada and FCC Calculations

Quebec

Some orchard regions were affected by the mid-May freeze. However, 2023 remained an excellent year for apple production. Despite the wet conditions, the quality of the apples remained high. Last harvest’s yield estimates were lower than the 5-year average, albeit not a cause for concern; the Quebec apple market is considered stable.

The region of Saguenay-Lac-Saint-Jean recorded its second-best blueberry harvest ever in 2023. The growing season had optimal weather, and although the market prices are not at the peak of what we have seen, they are offset by the sheer volume of fruit produced, with some growers producing nearly double the yield. After strong gains in 2022, land values remain stable with no change this year.

The Quebec wine industry faced a season of trials and triumphs. The early warmth of the season prompted an enthusiastic bud break, signalling a promising start. However, a cold snap over several nights threatened the delicate new growth. The impact of which was mitigated by effective control measures producers had in place, resulting in a relatively low loss, estimated at 5 to 15%. In the end, the crop quality exceeded expectations.

Nova Scotia

Few established orchards have traded hands; rather than sell, established players opt to expand their existing orchards by planting their bare land holdings. This trend is occurring against a backdrop of rising land prices.

The recent area expansion in climate-controlled atmospheric storage has been a boon for local storage capacity, ensuring ample harvest space. While storability has increased, processability has decreased with the recent closure of the local juice plant. This has left lower-quality apples, often called drop or juice apples, without a nearby processing home, forcing growers to consider the financial viability of collecting and transporting these apples to Quebec.

Blueberry farmers were faced with a hot and wet climate, which drastically shortened the harvest window and crop prices were disappointing. The adverse conditions led to low yields, with many berries rotting and the expected quality issues that come with these conditions; this starkly contrasted with the bumper crop in 2022. Last February’s polar vortex saw temperatures plummet for four days straight, and area vineyards have been bracing ever since. Originally, crop losses were estimated to be 50-100%; however, as time goes on, producers are cautiously optimistic that vine mortality may be less than initially expected. Crop damage assessment will continue throughout the season. Nova Scotia and New Brunswick recorded no change in blueberry land values from last year.

Stone fruit producers have suffered from a lack of production for several years due to harsh winters and early budding. The past mild winter was a welcomed friend.

Bottom line

The fruit industry is an important part of Canadian agriculture. The trend we observed for fruit land values through 2023 was stable to softening. If we look back to our 2022 report, substantial increases were reported in all sectors, which suggests that land values might be taking a much-needed pause.

Article by: Megan Mailloux AACI, P.App, Data Analyst, and Corbin Chau, Data Analyst