Using working capital to manage financial risk

Working capital is your first line of defence against financial risk. It helps businesses smooth out unexpected fluctuations in customer demand, the inability to deliver products or lower prices.

Working capital is measured by subtracting current liabilities from current assets. If you sold all your crop inventory, market livestock (not breeding stock) and realized your accounts receivable, would you be able to pay off your outstanding bills, credit lines and principal due within the next year? Most operations can answer yes to this question. It’s also desirable for the current ratio be large enough to cover possible unexpected changes in market conditions.

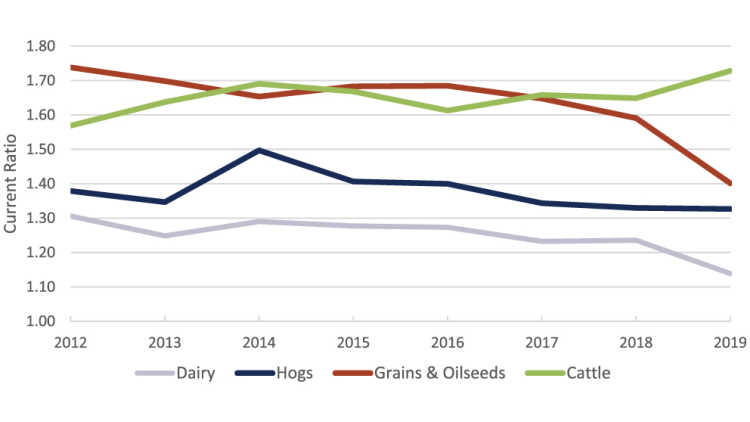

Figure 1 presents the average current ratios for four of Canada’s largest ag sectors - dairy, hogs, cattle, and grains and oilseeds. The ratios differ as they reflect each sector’s production cycles and risk profiles. Industries which sell product regularly throughout the year can handle a tighter working capital position.

Figure 1: Average current ratio: Dairy, hogs, cattle and grains & oils

Source: FCC Portfolio data

The COVID-19 crisis has shifted the profitability outlook of many sectors. If your working capital is deteriorating due to falling prices or the inability to market crops or livestock, here are actions you can take to avoid a cash crunch and protect your working capital position.

Defer principal repayment. Ideally, most businesses want to reduce debt than add it. But, if deferring principal payments now means avoiding payables piling up, this option may make sense. Interest rates on term debt are usually favourable relative to interest charged on accounts payable.

Extend amortizations to restructure existing debt. Are working capital issues a short-term challenge? If so, this option can provide working capital relief by lowering payments. Though it might not be helpful if your operation is carrying too much debt.

Term out capital expenditures. Has your business tiled land, purchased equipment or even bought a farm with cash over the last year? An option to improve working capital is taking debt against that asset. A portion of the cash spent is reinjected into the business, improving your working capital but increasing your long-term debt and repayment obligations.

Ideally, none of these actions are needed. If you have concerns about your cashflow over the next year, it makes sense to be proactive when it comes to protecting your working capital. Since most farm expenses are incurred before revenues, you may need to build up working capital before a financial pinch occurs. If you happen to be overly pessimistic and your cashflow is normal, you could use any deferred principal to reduce long term debt in a lump sum payment.

If your business is facing financial challenges due to a deteriorating short-term outlook, reach out to your financial institution to start the discussion as early as possible.

James Bryan

Senior Relationship Manager

James joined FCC as an Agricultural Economics Analyst in 2011 and is now a Senior Relationship Manager in Thornton, Ontario. He also runs a small farm operation with his family. James completed a BSc in Environmental Science and a Masters of Agricultural Economics at the University of Guelph.