The $12-billion trade shift: Canada’s opportunity to diversify food exports beyond the U.S.

The Canadian agriculture and food industry is a major player in global trade, known for its high-quality and sustainably produced food. Our close relationship with the United States, has been a substantial driver in expanding our trade flows. This strong economic partnership has historically benefited our agriculture and food sector, creating a mutually advantageous trade environment.

Recent U.S. tariffs have introduced uncertainty into that relationship, posing significant challenges for Canadian exporters and strain on producers. The concentration of Canadian exports to the U.S. underscores the sector’s vulnerability to the evolving trade policies of our southern neighbour and a strong need for diversification.

To that end, FCC has created this analysis which focuses on the significant opportunity for Canada to shift a total of $12 billion of Canadian food and beverage exports away from the U.S. market. Diversifying those exports can mitigate trade risks and enhance the resilience of Canada’s agriculture and food system against this and future shocks.

The proposed $12 billion diversification strategy represents approximately one third of Canada’s current food and beverage exports to the U.S. This would reduce U.S. market dependence in food and beverage exports to 50% of 2023 levels.

Our suggested approach to diversification is multifaceted:

Strengthening inter-provincial trade;

Leveraging existing free trade agreements; and

Establishing new international trading partnerships.

While these opportunities exist, we know as well as anyone that they would take time to implement. Regardless, our current economic challenges have focused Canadians like never before on how we can increase prosperity through new strategies and trading partners. We see this publication as a chance to deepen the discussion about how to tackle one of the most important challenges facing the country.

This research includes an analysis on products and markets which FCC believes are prime diversification targets. Our goal is to inform conversations about how Canadian producers might limit trade reliance on the United States.

Together, we can build a more resilient and globally competitive future for the Canadian food and beverage industry, and thus all Canadians.

Current state of agriculture and food trade reliance on the U.S.

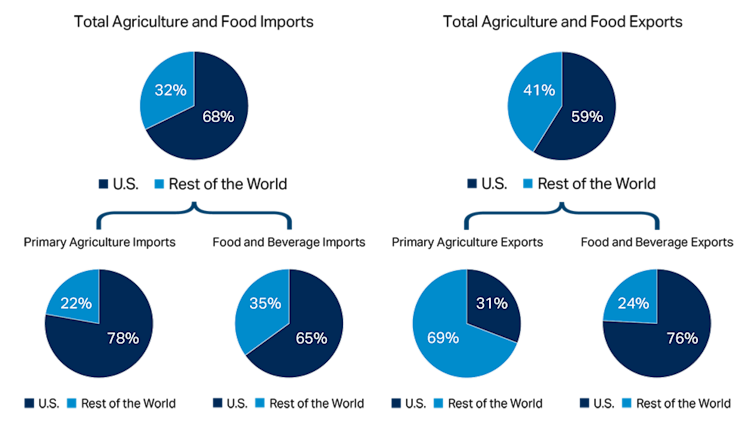

Canada’s agriculture and food system is heavily integrated with that of the U.S. In 2023, 68% of Canada’s agriculture and food imports came from the U.S., while 59% of the sector’s exports went south of the border (Figure 1). On the import side, 78% of primary agriculture and 65% of food and beverage came from the U.S. On the export side, only 31% of primary agricultural products were destined for U.S. markets, compared to 76% in the food and beverage category.

Figure 1: Canada’s agriculture and food import and export dependency on the U.S. in 2023

Sources: Comtrade, FCC calculation

Opportunities for Canada to diversify exports away from the U.S.

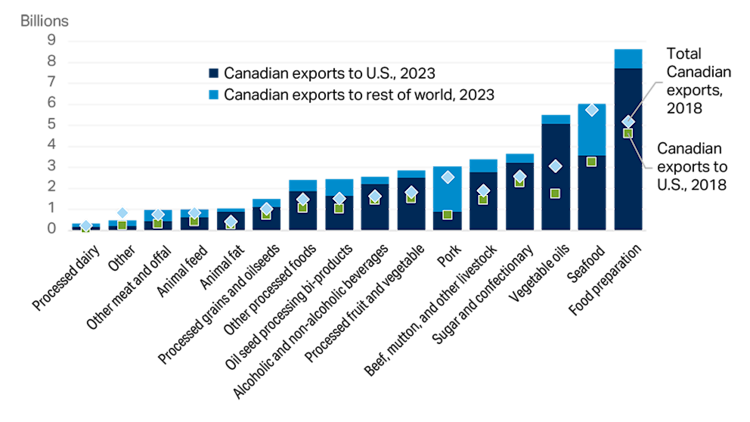

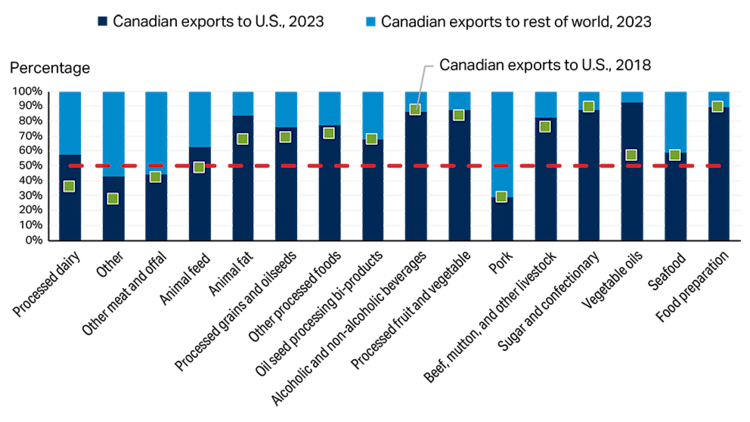

Figures 2 and 3 below illustrate Canada's food and beverage export reliance on the U.S. by commodity groups. These figures display both the trade value and percentage of trade value associated with the U.S. versus the rest of the world for the years 2023 (bars) and 2018 (markers). They illustrate that overall Canadian exports to both the U.S. and rest of the world increased over this five-year period, even as most categories saw increased reliance on the U.S.

Figure 2: Growth in food and beverage exports to the U.S. and other parts of the world – 2023 (bars) vs. 2018 (markers) export values

Sources: UN Comtrade, FCC calculations

Figure 3: Change in food and beverage export market share captured by the U.S. and other parts of the world – 2023 (bars) vs. 2018 (markers)

Sources: UN Comtrade, FCC calculations

Setting trade diversification targets

Canada’s food and beverage export reliance on the U.S. has been growing, increasing from 67% in 2018 to just over three quarters in 2023. Concurrently, the country’s global trade competitiveness has declined: Canada has fallen to seventh from fifth in global agriculture and food trade rankings over the last quarter century. So, there’s a need to both boost global trade competitiveness and diversify trade away from the U.S.

It’s important to note that there is no universal standard for trade diversification, or universally acceptable level of trade reliance on any given trading partner. Context and situational factors – such as geography, trade logistics and specific economic conditions – are important. Generally, over-reliance on any trading partner increases the risks associated with changing political and economic conditions within that partner country.

It’s also important to acknowledge the many factors that make Canada and the U.S. natural trading partners: our proximity, long and shared border, cultural similarities (in food preferences, nutritional guidelines, etc.) and similar regulatory environments – to name a few. We need to keep these factors in mind as we set realistic and attainable targets for greater trade independence from the U.S.

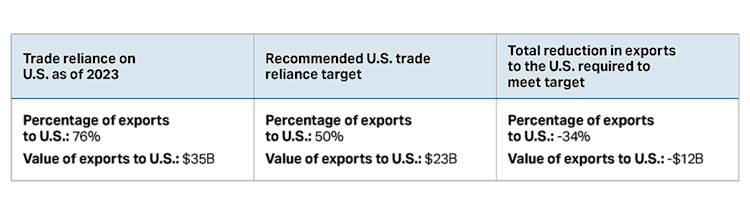

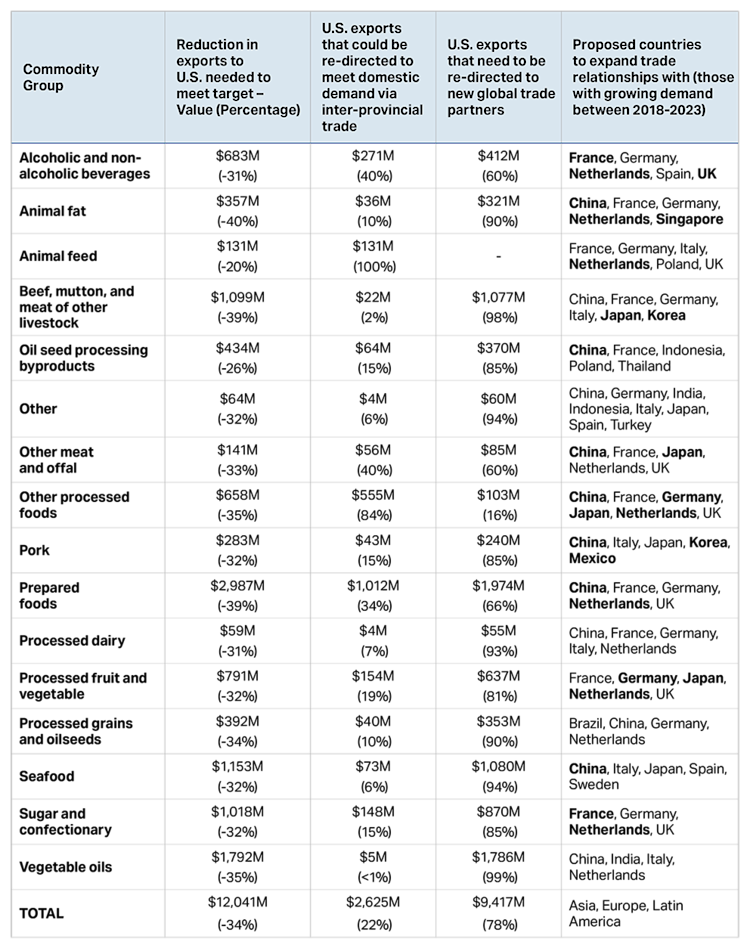

A straightforward target for diversification would be to reduce U.S. market dependence in food and beverage exports to 50%. This would be equivalent to shifting food and beverage exports away from the U.S. by a factor of $12 billion, or by 34% from a 2023 baseline (Table 1).

Table 1: Recommended trade diversification targets for Canada’s food and beverage sector

Sources: UN ComTrade, FCC calculations

We see two ways to meet a targeted 50% export reliance on the U.S.:

Strengthen inter-provincial trade so that sales to the U.S. can be redirected to meet domestic demand, substituting U.S. imports with Canadian products. This would have the added benefit of reducing both exports to, and imports from, the American market. We estimate that approximately $2.6 billion in current food and beverage exports to America could be redirected to meet Canadian demand. This calculation is based on a 50% U.S. import reliance target. We assume that at least half of the import reduction needed to meet this 50% target can be achieved by redirecting Canadian products previously exported to the U.S. to instead meet domestic demand previously filled by U.S. imports.

Strengthen and expand global trade relationships to grow Canadian food and beverage exports beyond the U.S. With inter-provincial trade accounting for $2.6 billion of the $12-billion shift, we estimate that approximately $9.4 billion in current food and beverage exports to the U.S. will need to be re-directed to other markets, such as high-value markets in Europe and rapidly expanding markets in Asia.

Figure 4 and the following discussion highlight how these two strategies are related and outline key recommendations for driving these strategies forward.

Figure 4: Strategies for achieving trade diversification targets

Source: FCC

Strategies for achieving trade diversity

Promote the “buy Canadian” movement to drive domestic demand for Canadian-made products. Boost domestic demand for Canadian food and beverage products through targeted marketing efforts.

Enhance Canada’s brand abroad. Grow demand for Canadian food and beverage products abroad through branding and marketing that signal the quality, safety and versatility of Canadian food.

Invest in the transportation and logistics infrastructure needed to boost inter-provincial trade. Canada is a vast country – to put it in perspective, a product travelling from one side of Europe to the other would still need to travel an additional 2,800 kilometers to match the distance between Canada’s eastern and western coasts. Infrastructure investments are needed to expand inter-provincial supply chains and improve the flow of food and beverage products across provinces.

Enhance competitiveness. Innovation, boosting the scale of processing and finding efficiencies can drive productivity gains that make food and beverage businesses more competitive. Expanding domestic value-added processing will help ensure that Canada’s food system captures a larger share of the food dollar (rather than exporting primary agriculture outputs to be processed elsewhere).

Diversify product offerings. Explore emerging and niche markets (for example, organic, plant-based proteins, cultural and specialty foods, and sustainably processed/packaged foods). This will open opportunities to explore new markets at home and abroad.

Explore new trade partnerships. Leverage existing trade agreements (there are currently 15 that already give Canada access to 51 countries and 66% of global GDP) and seek opportunities for new partnerships.

Trade diversification opportunities by commodity

Using recent trade data, we’ve identified U.S. trade reduction aims for different food and beverage commodity groups and evaluated the potential to achieve these goals via the two strategies identified above (Table 2). The 50% import and export reliance targets are aggregate goals, which not all sectors can (or should) contribute to in equal or even proportional amounts. Some commodity groups may need to set more ambitious objectives than others to achieve the aggregate $12-billion reduction in U.S.-bound exports. We considered the relative scale and importance of each commodity to Canada’s current food and beverage trade, current reliance on the U.S. and factors such as perishability. Setting realistic targets for each commodity group is essential to a successful diversification strategy.

Table 2: U.S. export reduction targets by commodity group – potential for inter-provincial vs. international trade growth (2023 trade data used as baseline)

Note: Bolded countries are those for which both overall demand and demand for Canadian imports increased between 2018 and 2023.

Sources: UN ComTrade, FCC calculations

We set these targets in two stages. First, we compared import and export reliance objectives to identify the potential to boost inter-provincial trade by substituting goods previously imported from the U.S. with goods previously exported to the U.S. In other words, we suggest re-directing Canadian exports to meet domestic demand via more robust inter-provincial trade. This strategy has the double benefit of reducing both import and export reliance on the U.S.

Secondly, after determining how much of our export diversification target could be achieved by boosting inter-provincial trade, we then identified opportunities to diversify the remaining exports away from the U.S. to other potential global trading partners. For each commodity group we looked at, we identified key countries with growing markets for those goods (based on trade data from 2018 and 2023), where diversification efforts would be best focused. Table 3 illustrates this process for two commodity groups with very different targets and recommendations: animal feed and vegetable oils.

Table 3: Breakdown of U.S. export and import reliance targets and strategies for export diversification for animal feed and vegetable oils

Commodity group | Animal feed | Vegetable oils |

|---|---|---|

2023 export reliance on U.S. | $644M (63%) | $5,101M (92%) |

U.S. export reliance target | $513M (50%) | $3,310M (60%) |

Reduction in exports to U.S. needed to reach export reliance target | -$131M (-20%) | -$1,792M (35%) |

2023 import reliance on U.S. | $1,513M (87%) | $544M (51%) |

U.S. import reliance target | $1,131M (65%) | $533M (50%) |

Reduction in imports from the U.S. needed to reach import reliance target | -$382M (-25%) | -$11M (2%) |

Exports to U.S. that could be re-directed to meet domestic demand via inter-provincial trade | -$131M (100%) | -$5M (<1%) |

Exports to the U.S. that need to be re-directed to other global trading partners | $0 (0%) | -$1,786M (99%) |

Sources: UN ComTrade, FCC calculations

Animal feed

Exports

In 2023, 63% of Canada’s animal feed exports were U.S.-bound. We recommend a reliance target of 50% for this commodity group. Achieving this target will require reducing cross-border animal feed exports by $131 million or 20% from the 2023 baseline.

Imports

Animal feed imports from the U.S. were $1.5 billion in 2023, amounting to 87% of total imports in this category. Given such a high degree of import reliance on the U.S., we set a reliance target of 65%. Achieving this target will require reducing animal feed imports from south of the border by $382 million (or 25% from the 2023 baseline).

Summary

The reduction in imports needed to meet our reliance target is significantly greater than the reduction in exports needed to meet the export reliance target of 50% – $382 million versus $131 million, respectively. We assume that half of the import reduction needed to meet the import reliance target can come from boosting inter-provincial trade.

This means we could replace up to $191 million in imports from the U.S. with Canadian products. It follows that the full $131 million reduction in exports needed could be achieved by re-directing these sales to fill domestic demand previously filled by imports from the U.S. In other words, the strategy of boosting inter-provincial trade is sufficient for meeting the export reliance goal.

Vegetable oils

Exports

Vegetable oils have a much higher export reliance on the U.S. than other food and beverage categories. In 2023, 92% of Canada’s vegetable oil exports were to the U.S. We set a reliance target of 60%, which will require a reduction of 35% in southbound exports, worth $1.79 billion.

Imports

The potential to re-direct exports to meet domestic demand currently filled by products imported from the U.S. is limited since our reliance on imports is 51%. Meeting the target of 50% will, therefore, require reducing vegetable oil imports from the U.S. by approximately $11 million (or just 2% compared to the 2023 baseline).

Summary

The reduction in exports to the U.S. needed to meet our export reliance target of 60% will be far greater than what can be accomplished through inter-provincial trade – $1.79 billion versus $11 million, respectively. Therefore, the primary means of achieving this target would be through the re-direction of exports. Canada would need to re-direct $1.79 billion in exports from the U.S. to other global markets.

A case study: Strategies for achieving trade diversification in baked goods

In 2023, prepared foods made up 19% of Canadian food and beverage exports ($8.6 billion), making it the largest commodity category by trade value. Ninety percent of these goods went to the U.S. This commodity category presents a strong opportunity for furthering Canada’s export market diversification, as prepared foods can travel longer distances without the same risk of spoilage compared with other food items.

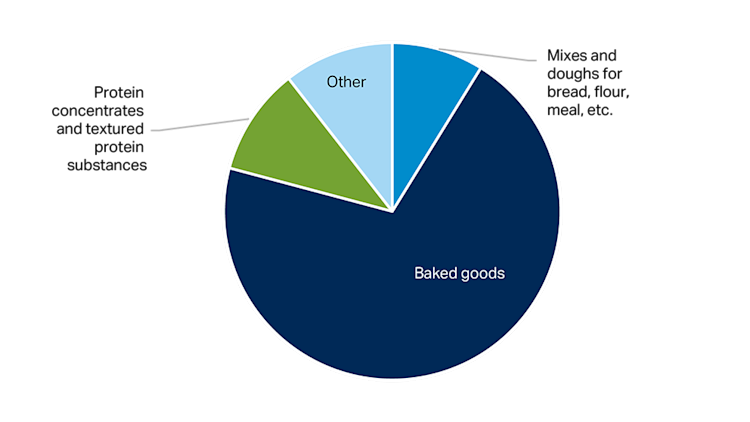

Baked goods accounted for 61% of Canadian prepared food exports in 2023 and represent 70% of the U.S. export reduction needed to achieve our overall trade diversification target for prepared foods (Figure 5). In 2023, 95% of baked goods exported from Canada were sent to the U.S.

Figure 5: Commodity contributions to trade diversification target set for prepared foods

Sources: UN ComTrade, FCC calculations

Several factors make baked goods a prime category for trade diversification. In addition to being able to ship them longer distances than other food products, there's a growing global market for these products. Total exports of baked goods increased by 50% between 2018 and 2023, an increase of over $17.9 billion. As of 2023, Canada captured just under 10% of the global export market in this category, leaving significant room for growth.

We estimate that approximately 10% of the proposed reduction in exports to the U.S. could be achieved by boosting inter-provincial trade and substituting imports from the U.S. with Canadian-made goods. This would have the added benefit of reducing both export and import dependency on the U.S., while supporting domestic production. The remaining 90% of reduction in U.S.-bound exports will need to come from diversification of international trade (Table 4).

Table 4: U.S. export reduction target for baked goods – potential for inter-provincial vs. international trade growth

Total exports to U.S. 2023 – Value (Percentage) | $5,034M (95%) |

Target level of exports to U.S. – Value (Percentage) | $2,933M (55%) |

Reduction in exports to U.S. needed to meet target – Value (Percentage) | -$2,101M (42%) |

U.S. exports that could be re-directed to meet domestic demand via inter-provincial trade | $218M (10%) |

U.S. exports that need to be re-directed to new global trade partners | $1,882M (90%) |

Proposed countries to expand trade relationships with | Belgium, France, Germany, Italy, Netherlands, UK |

Note: Bolded countries are those for which both overall demand and demand for Canadian imports increased between 2018 and 2023.

Sources: UN ComTrade, FCC calculations

Between 2018 and 2023, Canadian exports of baked goods grew by 86%, reflective of growing markets overseas, while the proportion of baked good exports destined for the American market stayed relatively constant. We’ve identified six countries that hold the most potential for Canadian export expansion, based on their growing demand for baked goods in recent years (using trade data for 2018 and 2023).

Encouragingly, all the countries listed are ones with which Canada has existing trade agreements. The Netherlands and the United Kingdom specifically have demonstrated a growing demand for Canadian baked goods between 2018 and 2023 and represent a significant opportunity for growth. Similarities in the culinary cultures of Canada and the countries listed will also help to reduce branding and marketing-related costs associated with promoting Canadian baked goods.

Moving forward in the face of uncertainty: Diversifying trade for a more resilient food system

The evolving global trade landscape represents a significant opportunity for the Canadian food and beverage industry – and thus, the country as a whole. That is, to build a more resilient food system by expanding inter-provincial trade and growing export markets beyond the United States.

This shift will require a collective effort from stakeholders across the food and beverage value chain. There is a pressing need to invest in infrastructure, scale up operations, foster innovation and explore new markets, both within Canada and abroad.

Together, we can transform current trade challenges into opportunity – and lead the way to a resilient and prosperous future for the Canadian food and beverage sector.

Report by: Bethany Lipka, Business Intelligence Analyst and Isaac Kwarteng, Senior Economist