Supply chain disruptions create challenges for crop input suppliers

Rising energy costs, supply chain disruptions, and production shortfalls are creating uncertainty for the crop input supply chain. Farm input wholesalers and retail distributors face several challenges securing commercial seed and herbicide supplies for spring 2022. Fertilizer prices have doubled from a year ago and continue to rise. Amid the market turmoil, what are the trends to watch leading up to next crop year?

High energy costs and export restrictions reducing global fertilizer supplies

Rising energy prices globally have pushed manufacturing costs for fertilizer higher in 2021, resulting in lower global production and restrictions on exports. China is the largest producer and exporter of fertilizer globally, supplying roughly 10% of global urea and 30% of global phosphate. It has implemented export restrictions to ensure adequate domestic supplies. Russia, the fourth-largest producer of nitrogen fertilizers, is also planning a 6-month restriction on export quotas for nitrogen and phosphate fertilizers to increase domestic supplies beginning December 1.

Rising energy costs, notably the fivefold increase in European natural gas prices, have forced high-cost manufacturing jurisdictions to shut down or curtail fertilizer production. This has resulted in a 10% reduction in global ammonia capacity. Lower European production creates opportunities for North American exports and supports higher prices, with ammonia fertilizer prices doubling in the past year. North American manufacturers are expected to boost fertilizer production to replenish North American supplies for spring seeding. However, fertilizer prices are expected to remain elevated as export demand remains strong.

Domestic fertilizer demand remains strong

Over the past two years, strong grain and oilseed prices have led to increases in North American demand for fertilizers through a combination of higher application rates and shifts of marginal land into crop production. Dry conditions, particularly in western Canada is believed to have resulted in reduced fertilizer applications this fall. Despite the reduced applications, Canadian fertilizer inventories fell across most categories as strong demand supported increased exports to the U.S. Demand in spring 2022 is expected to be strong.

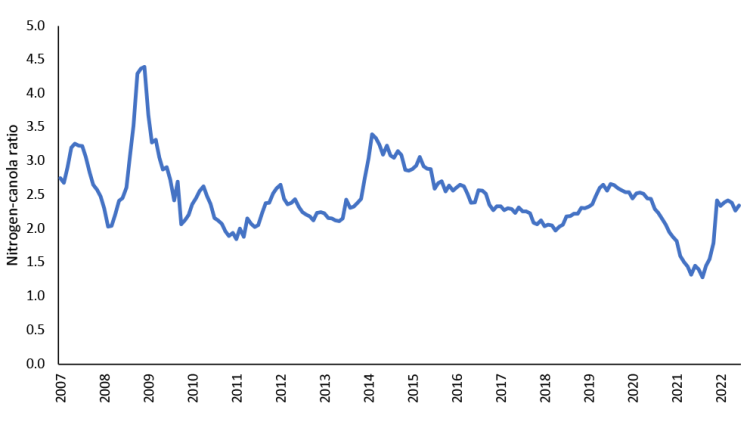

Fertilizer affordability, calculated by the price of fertilizer divided by the crop price, has recently declined due to global supply constraints. The higher the ratio, the less affordable fertilizer becomes relative to the crop. Strong canola prices have lessened the impact of high fertilizer prices as the ratio remains below the peak of 2008 and more recent 2014 levels (Figure 1).

Figure 1: Fertilizer affordability index – nitrogen-canola price ratio

Sources: Alberta farm input prices, ICE futures, FCC calculations.

FCC Economics is projecting fertilizer prices to rise 60% in 2022. In response to rising prices, producers may re-evaluate their seeding intentions or reduce application rates. In western Canada, higher fertilizer residuals caused by the drought may result in reduced application rates.

Potential disruptions to agriculture chemicals and seed supplies

Further complicating seeding decisions in 2022 will be the tight supply of herbicides and seeds. China’s energy crisis has reduced yellow phosphorus production, a key ingredient in the chemical manufacturing of glufosinate and glyphosate. These herbicides are widely used across Canada. China’s energy shortage is expected to continue in the short term, meaning disruptions will likely persist as there are few alternative suppliers. China’s overall influence on the agriculture chemical market is especially important, accounting for nearly 70% of total global glyphosate production and other active ingredients used in chemical manufacturing in North America.

The 2022 availability of herbicides and other chemicals is expected to be like the 2021 growing season. Retailers may once again have to ration availability and sales as they balance their inventories to ensure all customers have access for immediate use.

Preliminary reports indicate the drought in western Canada also reduced the size of last year’s seed crop, limiting 2022 supplies. Off-season production in South America may influence spring availability. Overall, producers may need to adjust seeding rates and or adjust seeding plans to accommodate any disruptions to seed availability.

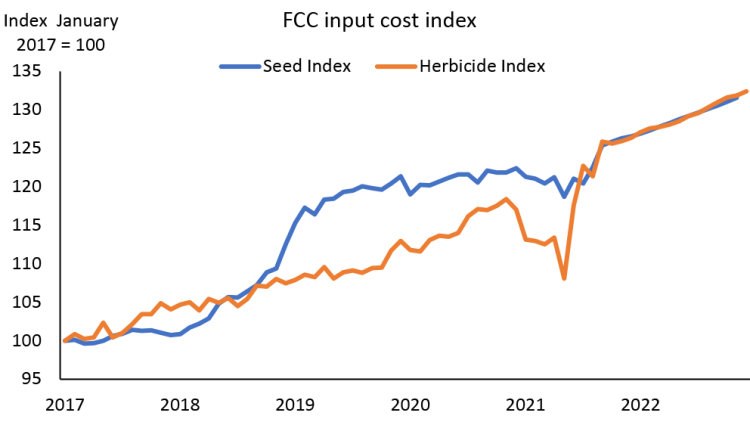

FCC Economics is forecasting herbicides prices to increase 9% on average and seed prices to increase 6% in 2022, well above trend line averages of 3% - 5% (Figure 2).

Figure 2: Seed and herbicide prices trending higher

Sources: Alberta farm input prices and FCC calculations.

Key trends to monitor in 2022

China and Russia

China’s blue skies policy aimed at curbing industrial manufacturing output to reduce smog for the winter Olympics has impacted commodities, including fertilizer. Following the Olympic Games in February 2022, all eyes will be on China ramping up production of agriculture-related chemicals and fertilizer. That may not come soon enough, considering spring fertilizer application starts in March 2022 in corn-growing regions of North America.

Russia’s potential influence cannot be neglected. First, Russia is a major player in the global fertilizer market. Second, Russia is linked to EU fertilizer production as they supply approximately 35% of the region’s natural gas. On the other hand, Russia is the global leader in wheat exports. Should they introduce further export restrictions on wheat, they would push wheat and other commodity prices higher. This could potentially ease fertilizer-crop price ratios. Chinese and Russian export restrictions are expected to last into the first half of 2022.

Energy prices

Current futures indicate energy prices will peak in December 2021/January 2022. Price trends will depend on inventory levels and how much demand there is throughout the winter. Winter weather forecasts point to La Niña developing, bringing colder than normal temperatures, further reducing energy supplies and support higher prices.

U.S. 2022 planting decisions: corn versus soybeans

The USDA released its preliminary 2022 acreage estimates as part of the long-term baseline projections. They anticipate U.S. corn at 92.0 million acres, soybeans at 87.5 million acres and wheat at 49.0 million acres for 2022. U.S. farmers’ planting decisions for the smaller crops also matter, given tight global supplies. Based on the current affordability index, prices for nitrogen-intensive crops like corn could shift acres unless corn prices trend higher to find the right balance. The USDA’s prospective plantings report will be released on March 31, 2022.

Bottom line

A battle for acres will be evident in 2022. A lot will depend on how the fertilizer-to-crop price ratios evolve closer to seeding, along with any supply disruptions for seeds and chemicals. Supplies remain tight for most commodities; crop prices may have to go higher for the market to dictate the right mix of acres in 2022. Normal growing conditions and trendline yields would generate a profitable 2022 for Canadian producer despite rising farm input prices.

Leigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.