Staying financially strong when interest rates rise

Canadian farm debt has steadily increased as operations have made significant investment in farmland, buildings, and equipment to improve overall productivity and efficiency. Overall debt grew 42% over the last five years and it increased 5.8% in 2020. With asset values growing 4.6% on average nationally in 2020 (and 26% over the last five years), debt climbed at a faster pace than asset value increases.

Historically low interest rates have facilitated much of these investments over the past 10 years. A rising interest rate environment could result in significant financial pressures on an operation if they are unable to adjust.

Canadian agriculture remains financially strong

The financial health of the agriculture industry can be assessed using multiple financial ratios. The debt-to-asset ratio measures the ability for an operation to meet long-term financial obligations and is calculated by dividing total liabilities of the farm sector by total assets. The debt-to-asset ratio for Canadian agriculture was 0.17 in 2020. That means Canadian producers were financing $0.17 of every dollar of assets with debt. The debt to asset ratio is at its highest point since 2009 although it still is in a healthy range overall below.

Figure 1: Canadian agriculture’s debt-to-asset ratio has been increasing

Source: Statistics Canada

It is important to note that the financial picture at the farm level can be significantly different than at the aggregated industry level. The are several factors that will influence the debt-to-asset ratio of an operation. Operations that recently financed an expansion will have a much higher debt-to-asset ratio. It is important to monitor your debt-to-asset ratio because it brings flexibility to ensure that a business can borrow more if an investment opportunity arises or profitability challenges occur.

Rising interest rates can hamper financial strength–but to what extent?

Debt repayment obligations may rise at times when farm income is flat/declining and/or interest rates increase. Operations that carry debt on their lines of credit or variable-rate loans will see their interest expenses rise. One way to look at the sensitivity of an operation’s tolerance for interest rate increases is the Debt-Service Coverage Ratio (DSCR = debt service capacity/debt service requirements). This ratio is calculated by dividing net operating income (or earnings before interest, depreciation, and amortization) by an operation’s annual debt service payments. It measures the cash available to pay off debt obligations in that same period.

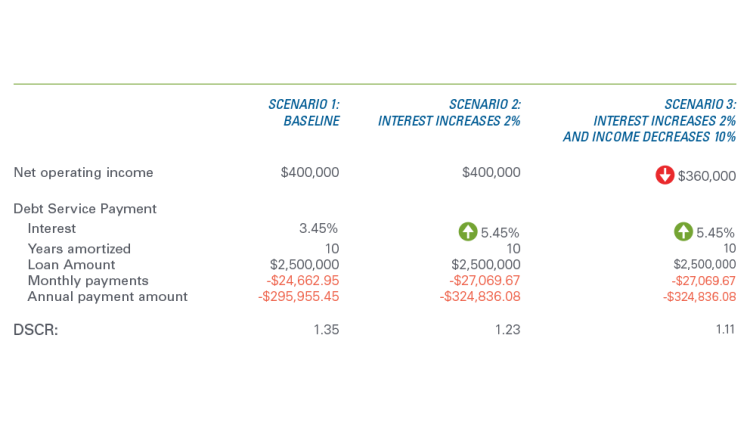

Let’s consider an example: an operation has net operating income of $400,000 and a loan amount of $2,500,000 amortized over a ten-year period. When evaluated at a 3.45% interest rate (current prime rate plus 1% at the end of 2021), the DSCR is 1.35 (see the table below). A 2% increase in the interest rate would lower the DSCR to 1.23, indicating a greater drain on net income.

Interest rates are not the only source of risk to consider. A decline in revenues available to service debt will impact a producer’s financial strength. A 10% decrease in net operating income coupled with a 2% increase in the interest rate would decrease the DCSR to 1.11 – indicating a tight repayment capacity.

A DSCR lower than 1 means insufficient funds to meet debt obligations. Conversely, a DSCR higher than 1.25 leaves room to meet unexpected changes in the financial or economic environment.

Rising interest rates and income decline impacts on the debt-service coverage ratio

Source: Statistics Canada

Producers can’t control where interest rates may go but should focus management decisions to better face unfavourable movements in rates or income. Focus on strategies that control costs, raise revenues and productivity, and use tools such as the 5 per cent rule to strive for small improvements that can quickly add up.

Justin Shepherd

Senior Economist

Justin Shepherd is a Senior Economist at FCC. He joined the team in 2021, specializing in monitoring agricultural production and analyzing global supply and demand trends. In addition to his speaking engagements on agriculture and economics, Justin is a regular contributor to the FCC Economics blog.

He grew up on a mixed farm in Saskatchewan and remains active in the family operation. Justin holds a master of applied economics and management from Cornell University and a bachelor of agribusiness from the University of Saskatchewan.