Q4 Macroeconomic snapshot: Food inflation more persistent than anticipated

The FCC Quarterly Economic and Financial Market update reviews the global and Canadian economic environment so that businesses can make well-informed decisions. Relevant topics for Q4 include the pace of economic recovery, overall inflationary pressures and ongoing supply-chain challenges. But one of the most interesting trends to monitor is the pattern in food inflation.

In the second half of the year, food inflation has been rising in response to higher input costs and labour challenges (Figure 1).

Figure 1. Food inflation has gained steam in recent months

Source: Statistics Canada.

Challenging crop growing conditions in large portions of North America and Central Asia have contributed to tighter supplies and higher commodity prices. Low water levels on the Colorado River have forced water restrictions for 2022, impacting crop production. This could put further pressure on imported nut, fruit and vegetable prices in the new year. Livestock prices have also been trending higher than their 5-year average in 2021 as the reopening of the economy led to stronger meat demand.

Labour is a top concern throughout the Canadian economy and specifically for food manufacturing. More workers employed in food manufacturing than before COVID, but businesses still can’t keep up with demand, and unfilled orders are trending up 50% YoY. The latest job vacancy report from Q2 was at 5.2%, up from 3.9% during the same period in 2019 and up from 2.8% in 2016. Year-to-date average wages excluding OT are up 4.4%. Production per employee is at record highs; however, the increase in productivity has not offset the higher costs businesses face.

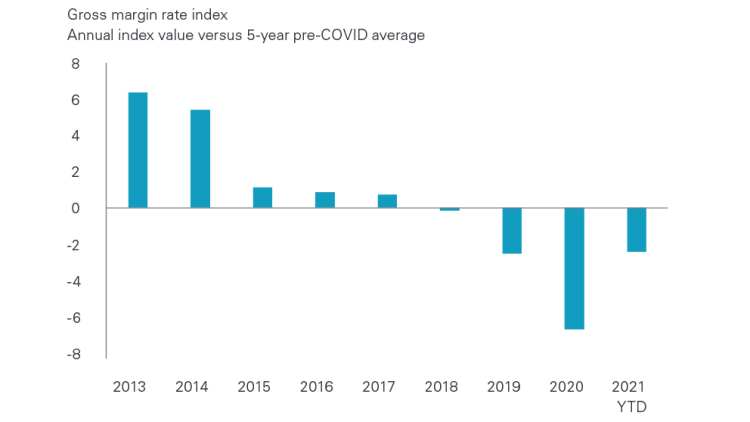

Food manufacturers have passed on a net price increase of over 8.1% YoY through three-quarters of the year, and manufacturing margins are now estimated to be back to 2019 levels. However, they remain below the 5-year average (Figure 2). With margins tight, manufacturers will look to pass on any additional costs.

Figure 2. Manufacturing margins remain below recent historical levels

Sources: FCC calculations, Statistics Canada.

However, there are a few bright spots. Reference prices for some grains, oilseeds and livestock have come down from their summer highs. The loonie has rallied recently, which has also offered relief to food inflation. Canadians rely on the supply of imported food, and the higher dollar softens the blow of higher commodity prices in some areas like fruit and vegetable products, breakfast cereals, sugar, snack foods and coffee.

We believe food inflation will remain elevated for the foreseeable future. As supply chain disruptions and labour challenges ease and the supply of agricultural commodities rebounds, we should record lower food inflation. The difficult question is around the timeline associated with a return to average inflationary pressures.

For a deeper dive into any of the above issues and other relevant economic insights, please read the full report.

Kyle Burak

Senior Data Scientist

Kyle joined FCC in 2020 and is a Senior Data Scientist, specializing in monitoring and analyzing FCC’s agri-food and agribusiness portfolio, industry health, and providing industry risk analysis. Prior to FCC, he worked in the procurement and marketing department of a Canadian food retailer. He holds a master of economics from the University of Victoria.