Q2 Macroeconomic snapshot: Higher interest rates deserve attention

The FCC Quarterly Economic and Financial Market update reviews the global and Canadian economic environment so that businesses can make well-informed decisions. Relevant topics for Q2 include the pace of economic recovery, inflationary pressures and shipping disruptions. But one of the most interesting trends to monitor is the pattern in interest rates.

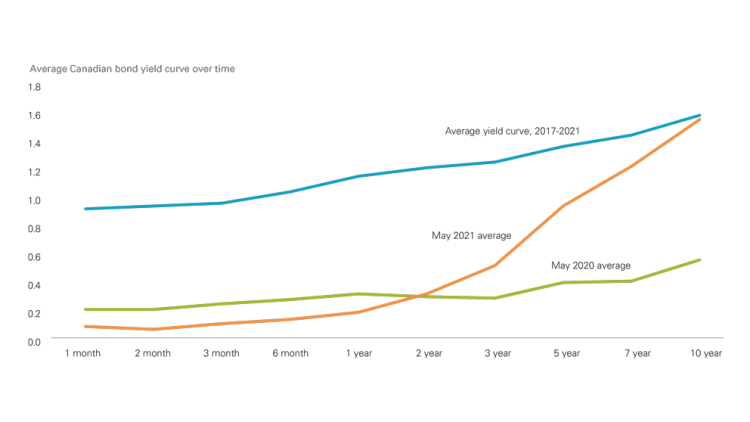

The Bank of Canada lowered its overnight rate at the outset of the pandemic to its effective lower bound at 0.25%. As a result, the prime rate came down to 2.45% from 3.95% in 2019. Lower overall rates have resulted in a 6.5% increase in total borrowing across the country. Long-term bond yields have increased in 2021 as the economic recovery gains traction and inflation ramps up (Figure 1) even as the Bank of Canada is committed to keeping its overnight rate at 0.25% into 2022.

Figure 1. Long-term government bonds yields remain low but have been increasing

Source: Statistics Canada.

To put increasing interest rates into perspective for a farm operation, consider financing new equipment at a cost of $1.5 million over 15 years at an interest rate of 2.5%. Your total interest paid over those 15 years would be $300,331, with monthly interest payments averaging $1,669. If the interest rate increased 1% to 3.50%, this would result in monthly interest payments of $2,390 and a total interest payment over the loan lifespan of $430,183. A 1% increase in the interest rate would result in an additional $129,852 in interest, a jump of 43% in total interests.

| Loan amount | Interest rate | Term (years) | Month payment | Total interest | Interest per month |

|---|---|---|---|---|---|

| 1,500,000 | 2.5% | 15 | $10,002 | $300,331 | 1,669 |

| 1,500,000 | 3.5% | 15 | $10,723 | $430,183 | 2,390 |

| increase of: | $721.40 | $129,852 | 43% |

What if interest rates jump again, say from 3.5% to 4.5%? This would result in total interests on the same loan amount increasing to $3,142 per month or $565,481 in total – a $135,299 increase in interest payments.

| Loan amount | Interest rate | Term (years) | Month payment | Total interest | Interest per month |

|---|---|---|---|---|---|

| $1,500,000 | 3.5% | 15 | $10,723 | $430,183 | 2,390 |

| $1,500,000 | 4.5% | 15 | $11,475 | $565,482 | 3,142 |

| increase of: | $135,299 | 31% | vs. 2.50% | $265,151 | 88% |

With the amount of additional debt generated in the economy over the past 14 months, operations need to be cautious of rate increases. Higher interest rates affect your working capital and your ability to service debt obligations. While current low short-term rates are attractive, it may be appealing to lock in long-term rates at the current low levels.

To better understand how changes to interest rates impact your businesses, use FCC’s interest calculator and reach out to an FCC office to discuss options.

Kyle Burak

Senior Data Scientist

Kyle joined FCC in 2020 and is a Senior Data Scientist, specializing in monitoring and analyzing FCC’s agri-food and agribusiness portfolio, industry health, and providing industry risk analysis. Prior to FCC, he worked in the procurement and marketing department of a Canadian food retailer. He holds a master of economics from the University of Victoria.