Q1 2023 Macroeconomic snapshot: BoC pauses policy rate hikes

Outlook

The Bank of Canada (BoC) elected not to increase its policy rate in March amid declining inflation; however, additional intervention may still be required to get inflation to 2%. Elevated inflation and interest rates are expected to slow consumer spending and business investments. The U.S. Federal Reserve is expected to continue raising its policy rate, which could lead to a lower CAD if the BoC extends its pause. A global economic slowdown has resulted in lower growth in Canadian ag and food export volume.

GDP

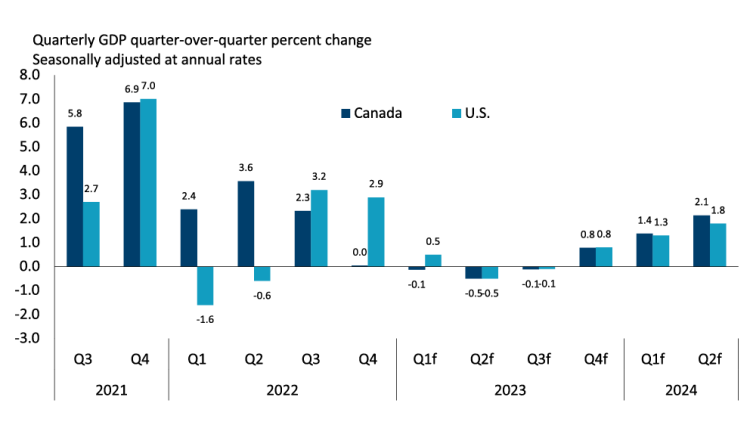

The Canadian economy showed further signs of weakness in Q4, with GDP growth stalling at 0% (Figure 1). Household spending prevented GDP from falling below 0%, rising 0.5% in Q4 after falling in Q3. Exported good prices deflated 1.7%, and volume growth was weak in Q4, resulting in export growth edging lower from 2.6% in Q3 to 0.2% in Q4. Declines in business, inventory and residential investments dragged down GDP. Overall, GDP grew by 3.4% in 2022. GDP growth is expected to be 0.2% in 2023, with three-quarters of near-zero growth. Forecasts for the U.S. are similar.

Figure 1. GDP growth is projected to slow in early 2023

Sources: FCC Economics, Bloomberg

Central Bank Policy and Bond Markets

Bank of Canada overnight rate

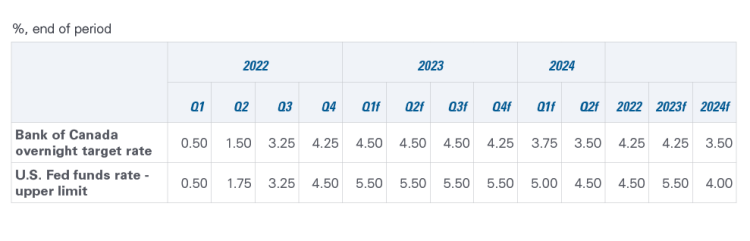

On March 8, the BoC held its overnight rate at 4.50%. FCC Economics expects the BoC to keep its rate at that level for most of the year (Table 1). January headline inflation declined from 6.3% to 5.9%, which is promising. If the current trend continues, further BoC policy rate increases will be unlikely. However, a continually tight labour market could fuel robust consumer spending and make the path toward 2% difficult without further intervention. We will get a better gauge of the influence of higher interest rates on inflation over the next few months.

Table 1. No more BoC rate hikes are expected if inflation continues on trend

Sources: FCC Economics, Bank of Canada, The Federal Reserve

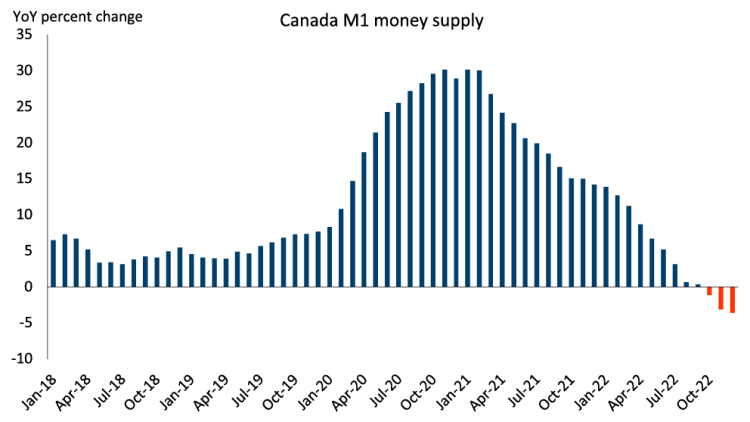

The BoC has continued quantitative tightening (QT) in unison with increasing its policy rate, and it remains a policy tool at its disposal to help lower inflation. By letting its bond holdings expire and taking payment on them, the bank is decreasing the amount of money in the economy (Figure 2). This puts upward pressure on bond yields and reduces how much of the reserves banks have available to lend, which can lead to an increase in borrowing rates. The degree of change in the money supply is worth monitoring. It fell a record 3.6% in December.

Figure 2. The amount of money flowing through the economy has shrunk

Source: Bank of Canada

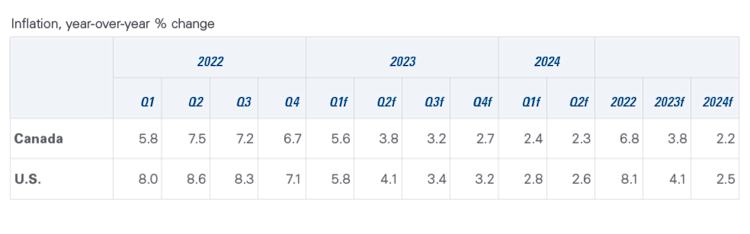

Given current trends and the BoC’s policies, we anticipate headline inflation will decline towards 3% by July, with 2% coming in 2024. Reaching 2% inflation over the next 12 to 16 months is not guaranteed. Core inflation, which better tracks the breadth of inflation, has not fallen at the same pace as headline inflation. This is a major reason we believe the BoC will keep its policy rate above 4% into 2024.

Reducing food inflation will go a long way toward reducing headline inflation, as it was responsible for 29% of the headline number in January, rising 10.4% YoY. Given the current trends, we expect food inflation to stay closer to 10% for the next few months. In the best-case scenario, it’s around 6% in June; worst case, we remain above 10%.

Table 2. Headline inflation is forecasted to decline further in 2023

Sources: Bloomberg, Statistics Canada, FCC Economics

The U.S. Federal Reserve (Fed) has continued its aggressive stance in increasing its policy rate. We expect it will increase rates above 5% while keeping an accommodative stance towards its balance sheet.

The U.S. Government is facing a potential debt default in June. We are not pricing in default into our forecasts as we believe the U.S. debt ceiling will ultimately be raised. A default would be detrimental to the U.S. economy, with immediate spillovers to Canada.

Fixed rates

Short-term bond yields have increased in 2023 on better-than-expected economic data from the U.S. and Canada and a weaker decline in core inflation relative to the headline number. We expect long-term fixed rates to decline in the second half of 2023 into 2024 once we see that inflation is truly returning towards 2% (Table 3). Short-term rates will continue to be tied to the BoC’s policy rate outlook and be higher than longer-term yields as the global economic slowdown weights on longer-term yields. Any increase in inflation expectations will likely be met with an increase in fixed rates. Nonetheless, rates are expected to remain elevated versus the 2016-2021 average.

Table 3. Long-term rates are expected to decrease in the second half of 2023

Sources: Statistics Canada (historical), Major financial institution consensus (forecast)

Exchange rates and foreign market commentary

USD per CAD

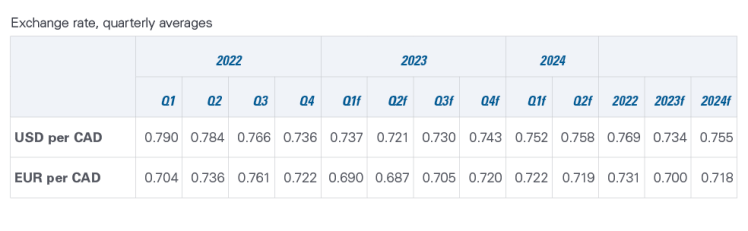

The market is pricing in a less aggressive future to rate hikes in Canada compared to their U.S. counterparts, and inflation in the U.S. is proving to be more persistent. This divergence leads to a lower CAD because investors will get a higher return in the U.S. We expect to see some further weakening of the CAD over the next couple of months, assuming current monetary policy expectations play out. Oil prices continue to be lower compared to 2022, and we see some upside heading into 2024 (Table 4).

EUR per CAD

The European Central Bank (ECB) raised its deposit rate from 2.00% to 2.50% in February, the highest level since 2008. The deposit rate is expected to increase a further 0.50% in mid-March. Inflation in the Eurozone has been decreasing on lower energy prices, falling to 8.5% in January from 9.2% in December. An aggressive ECB and lower inflation expectations have resulted in the CAD parring all 2022 gains. We expect the loonie to stabilize in 2023 around the 70c range before rising into 2024.

Table 4. CAD is projected to be weaker in the first half of 2023

Sources: FCC Economics, Statistics Canada

Kyle Burak

Senior Data Scientist

Kyle joined FCC in 2020 and is a Senior Data Scientist, specializing in monitoring and analyzing FCC’s agri-food and agribusiness portfolio, industry health, and providing industry risk analysis. Prior to FCC, he worked in the procurement and marketing department of a Canadian food retailer. He holds a master of economics from the University of Victoria.