Profitability challenges abound for livestock operations and input suppliers

Strong global demand for feed grains, COVID-19 shutdowns, supply chain disruptions, flooding and drought were just some of the major challenges livestock input suppliers and producers faced in 2021. The tight feed grain supply in western Canada combined with the smallest Canadian hay crop since 1950 has forced the livestock industry to get creative with rations, increasing demand for supplements and feed additives. Large increases in prices of lumber and metal have led to higher prices for building materials, causing producers to re-evaluate investments. Recent patterns in livestock input prices are indicative of future trends in profitability.

Higher feed costs lowering overall producer margins

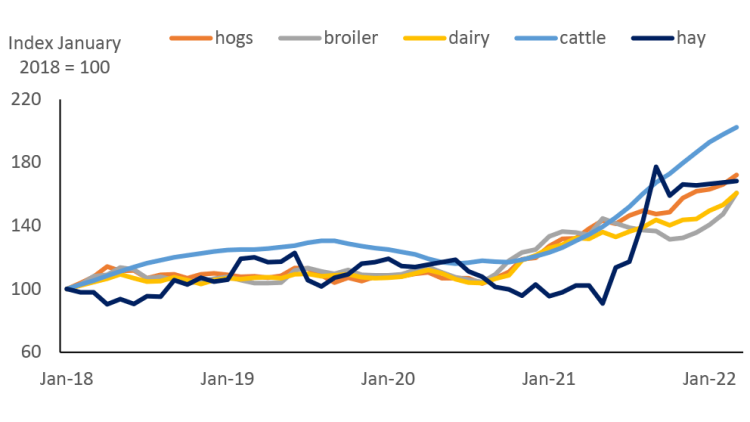

Despite record corn yields in eastern Canada, the decline of 35% in overall Canadian barley production created major challenges for feed mills to source domestic feed grains. According to AAFC, in response, corn imports from the U.S. into western Canada are expected to reach a record level of four million tonnes for the 2021/22 crop year. Tight global feedstocks and elevated market uncertainty due to the ongoing war in Ukraine have generated questions about the availability and cost of feed grains moving forward. The net impact is that ration costs have risen over 50% since mid-2020, and western hay prices have increased 80% (Figure 1).

Figure 1: Rising feed grain prices have pushed up livestock feed ration costs

Source: Chicken Farmers of Ontario, Canadian Dairy Cost study, Alberta farm input prices, and FCC calculations.

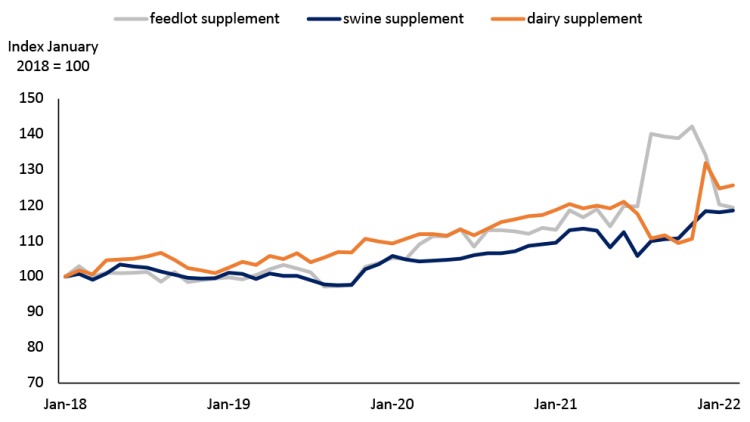

In response to the high feed costs and the challenge of lower feed quality, demand for feed supplements into rations has increased. According to Alberta farm input data, stronger demand led to a moderate average price increase for supplements of 3.5% in February 2022 (Figure 2). Supplements have allowed livestock operations to use lower quality feed, stretch feed supplies and budgets while maintaining livestock dietary requirements. Note that the YoY price increase does not fully capture the impact of dry conditions in the Prairies. Feedlot supplement prices rose 17% in August 2021 over the previous month as poor pasture conditions forced ranchers to move calves early.

Figure 2: Feed supplements trending higher for all livestock sectors

Source: Alberta Farm Input Prices, FCC calculations.

Supply chain challenges have created significant price volatility for building supplies and equipment

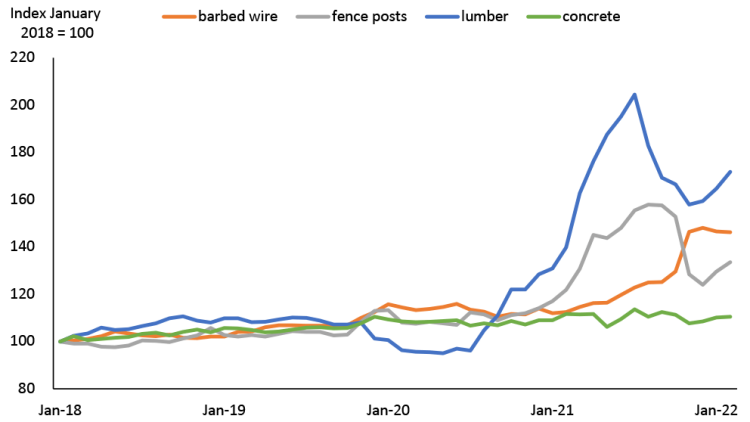

Building material prices have been another challenge for the livestock sector. Over the past year, lumber and steel markets have experienced significant shifts, creating wild swings in prices for fencing and equipment (Figure 3). Lumber prices doubled in the summer of 2021 and were 23% higher YoY in February 2022. Barbed wire is up 30%, fence posts and rebar are up 10%, while concrete is down 1%. Rising lumber and steel costs have impacted construction costs of new barns and farm buildings.

Round balers are only up 3% as baler demand dropped due to last year’s drought. However, prices on barbed wire and fence posts had a huge run-up through 2021 due to high lumber and steel prices. Investment opportunities are likely to soften through the next 12 months. Higher interest rates are making infrastructure investments more expensive, while supply chain challenges continue to add significant costs to machinery and equipment. Livestock producers may delay investments due to tighter margins over the past 3 years.

Figure 3: Building, fencing supplies and equipment

Source: Alberta Farm Input Prices, FCC calculations.

What should livestock input suppliers expect for the remainder of 2022

Livestock input suppliers have navigated a very volatile market in 2021, which has resulted in large shifts in producers’ costs and investment opportunities. Large 2022 crops in North America would bring some relief to feed grain prices and help to improve overall margins in the livestock sector. Nonetheless, feed grain prices are expected to remain historically high and margins to be tight, limiting opportunities for livestock input suppliers to pass on additional costs.

In addition, the clouds over the profitability outlook are not likely to lead to a significant expansion of livestock numbers in Canada. Market opportunities for input suppliers are likely to trend sideways or decrease due to lower inventories of cattle and hogs. Conversely, dairy and poultry market opportunities are expected to expand as demand for foodservices rebounds. The spread of Avian flu adds uncertainty to the outlook for poultry operations in 2022.

Over the next three weeks, updates to our 2022 outlooks for grain, oilseed and pulse, dairy and cattle and hog sectors to provide additional insights into profitability expectations.

Leigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.