Weak grain and oilseed outlook to pressure harvest equipment sales

Coming off a strong 2023 the farm equipment market is set to take a breather this year. However, there will be pockets of strength, specifically 4WD tractors and corn headers. Demand for most harvest equipment will soften throughout the remainder of this year, due to elevated equipment prices, high interest rates, and tighter grain and oilseed profitability. This outlook highlights the harvest equipment sales opportunities and risks for primary producers, agricultural equipment dealers, manufacturers, and industry stakeholders.

Key observations

New combine sales are projected to decline 20% in 2024.

New combine inventories are projected to be above the 5-year average.

Used combines, headers and grain cart sales expected to soften, trending below the 5-year average.

Used combine inventory continues to outpace demand, prices expected to be pressured.

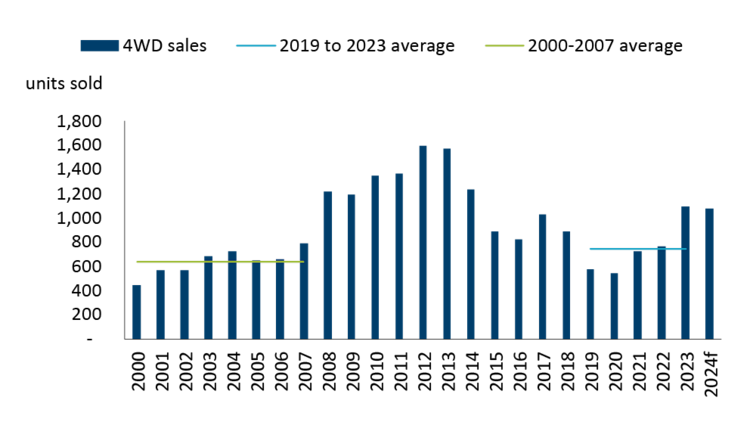

New 4WD tractor sales are projected to decline only 2% in 2024 but remain above the 5-year average.

New and used 4WD inventory are projected to remain low until end of the year.

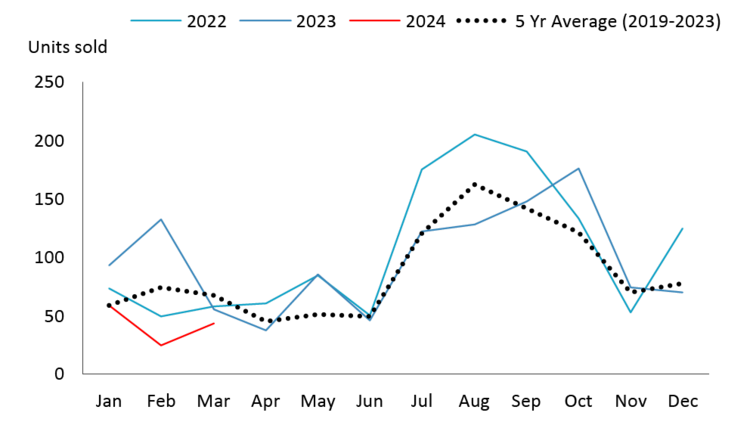

Combine market shifts to a buyers’ market. New combine sales grew 4.9% last year due to continued improvements in supply chains, along with strong profitability in 2022. New combine sales are projected to decline 20% this year and drop below the 5-year average due in part to declining grain and oilseed revenue and the strong sales from the previous year (Figure 1).

Figure 1: New combine sales will decline in 2024

Source: Association of Equipment Manufacturers, FCC calculations

The decline in new combine sales will lead to increased inventory levels that will be above the 5-year average. The used combine market was strong in 2022 as new orders were delayed from supply chain constraints following the pandemic. However, so far this year used combine sales have trended lower, inventories are increasing faster than demand and as a result it has now become a buyers’ market (Figure 2). Prices of used combines are expected to moderate further, particularly in the higher-class categories (e.g., Class 8+).

Figure 2: Used combine sales have trended lower and are expected to remain soft

Sources: Iron Solutions, FCC calculations

Complementary harvest equipment sales expected to slow

The number of combine header units sold increased last year with sales picking up in the July to October period, normally the busy season. However, as supply chains improved new models were delivered in 2023, resulting in multiple used models being traded for every new sale. We don’t anticipate the combine header market to be as strong this year as used sales through March 2024 were below last year and the 5-year average, similar to what is being observed in the used combine market. The exception is corn header sales which have been strong year-to-date relative to 2023, and we expect this trend to continue throughout the remainder of this year. The strength in this market is being supported by several years of good yields and profitability in Eastern Canada.

The grain cart market is also expected to trend like the used combine and header market as sales year-to-date are below the five-year average. The grain cart market had a strong year in 2022 with sales slightly lower in 2023, due to the drought in Western Canada. A softening in grain cart sales is largely driven by slower combine sales and expectations of another year of drought in Western Canada.

Strength in 4WD tractor market for now

High horsepower 4WD tractors are necessary to not only pull air drills but large grain carts as well. The 4WD tractor market is expected to stay strong with new sales expected to decline only -2% in 2024, after growing over 40% in 2023 (Figure 3). Market uncertainty and revenue pressures led to low sales in 2019 and 2020. Farms are now looking to upgrade their aging 4WD tractors. So even with inventory levels expected to improve by the end of the year, sale volumes are expected to trend above the 5-year average.

Figure 3: New 4WD sales expected to remain strong

Sources: AEM and FCC calculations

Trends to monitor

Canadian dollar and interest rates

Drought impact on equipment demand

The value of the Canadian dollar and interest rates are two macro-economic variables that have a direct impact on the farm equipment market. An appreciation of the Canadian dollar would help to offset higher prices on new equipment imported from the U.S. However, the Canadian dollar has been pressured by U.S. dollar strength (due to the U.S. Federal Reserve’s hawkishness), and the expectation is the latter should fade as the Fed cuts interest rates, allowing the Canadian currency to find some support later this year. FCC Economics expects the Bank of Canada to cut its overnight rate by 75 basis points this year with the first rate cut occurring in July. We’re projecting the overnight rate to fall further in 2025 before stabilizing around 3%. In terms of fixed rates, we expect rates to continue declining through the year as bond rates fall in synch with soft economic growth and declining inflation. Drought conditions in Canada particularly in the West continue to be on the radar for the 2024 crop. Depending on how moisture levels evolve over the coming weeks and months, demand for harvest equipment could be further impacted.

Bottom line

As seeding is now underway, there is plenty on the radar that could influence the harvest equipment market. Drought concerns, rising farm equipment prices, elevated interest rates and tighter farm profitability have farms placing a greater emphasis on their per acre equipment costs reducing demand for equipment. While the harvest equipment market has turned to a buyers’ market, there are pockets of strength and opportunities. Farms have an opportunity to work with all their partners including dealers, farm advisors, and financial institutions in finding the right piece of equipment that has the greatest profitability on a per acre basis. Farms have strong balance sheets coming into this year. This can support navigating a lean year of farm profits and making equipment investments for long-term efficiency gains.

Leigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.