Despite remarkable greenhouse sales in 2020 – uncertainty lies in the year ahead

After the whirlwind that was 2020, the big question for Canada’s greenhouse sector is whether 2021, the International Year of Fruits and Vegetables, will follow suit. Overall greenhouse sales rose 9.4% last year, with the main star fruits and vegetables. In 2021 however, producers may face some significant headwinds. Rising costs and a higher loonie may prevent a year of similar sales growth.

COVID’s boost to greenhouse revenues

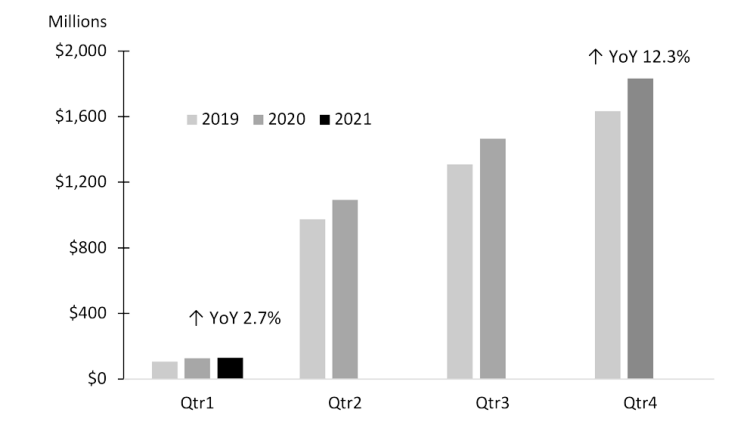

In a year marked by the pandemic, greenhouse fresh vegetable receipts rose at their fastest pace since 2012 and for the eighth consecutive year, up 12.3% to $1.8 billion in 2020 (Figure 1). That came after a good year in 2019 when sales rose 5.0% to $1.6 billion. Once COVID hit, the fast pivot to alternative consumer avenues such as curbside pickup and online shopping helped push farm cash receipts up a whopping 19.8% year-over-year in the first quarter of 2020. It was a harbinger of things to come in Q2 and Q3.

Figure 1: Greenhouse fresh vegetable cash receipts continue to rise

Source: Statistics Canada

With 23.9% growth in hectares between 2015 and 2020, greenhouse fruit and vegetable production capacity rose to 1,809 hectares last year. Production rose for peppers and cucumbers, two of the three fresh vegetables we produce on a large scale, while tomato production, the largest in terms of value and volume, dropped 3.2%. Tomatoes led in sales growth (12.1%), followed by cucumbers (+9.4%) and peppers (+7.3%), accounting for 92.5% of total sales.

The domestic market was hot, and so was the export market. The USDA noted U.S. exports of fresh vegetables to Canada fell 5% in 2020, the single largest decline in U.S. agriculture exports. At the same time, Canadian exports of fresh fruits and vegetables rose 10.4% year-over-year, despite a strengthening loonie. The YTD exchange rate relative to the USD is $US.80, 7.3% higher than the 2020 average. A stronger loonie makes imports more competitive against domestic products.

Profitability challenged by COVID’s impacts

Sector profitability was challenged in 2020, as COVID-led shutdowns stalled production when greenhouse employees faced quarantine or were hindered by cross-border travel. The sector, highly dependent on foreign temporary workers, shifted to slightly more permanent positions, with labour costs rising 7.5%. Overall costs also rose 7.5% last year, well above the 10-year average, based on increases in electricity and other costs.

This year’s Q1 year-over-year cash receipts growth isn’t as spectacular and reflects an outlook of cautious optimism for the rest of 2021. Should costs continue to rise again at the same pace, the growth in sales may not be enough to shield profit margins from some pressure. Industry initiatives to find efficiencies in energy use through LED lighting and improved ventilation systems can help. Adopting innovations such as robotic pickers will boost production in an era of labour supply diminished by a booming construction sector.

Further growth in greenhouse development will bump up against shipping delays of materials and rapidly escalating shipping and material costs until the current global construction boom slows down. But on the bright side, recent innovations which have increased the production of peppers (cultivars that respond to LED lighting) and introduced strawberries to greenhouse production can help diversify producers’ revenue streams.

It’s too early to say if the heightened consumer drive to eat local and fresh that is a hallmark of COVID will persist once major restrictions have loosened. But the pandemic spurred consumption patterns that benefit producers and retailers of fresh fruit and vegetables. As the year shapes up, such breakthroughs may become key.

Do you know how to protect your business in a period of potentially dwindling sales, growing costs and increased competition? Check out FCC’s Business Essentials series with advice on understanding your cost of production.

Sandra Behm, AACI, P.App, Senior Appraiser, Valuations

Martha Roberts

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.