Follow the cow: A look at Canada’s beef supply chain (Part 2)

We ended last week’s post at the Ross family’s L-7 Land & Cattle ranch in the fall of 2017. NAFTA negotiations, which many had expected to have concluded that year, weren’t yet wrapped up, prompting speculation about future threats to industry integration. Ongoing negotiations would have little direct impact on Canada’s cattle sector, but they magnified uncertainty within financial markets, shifting the loonie.

The cycle of life

Recent investments in North American processing capacity had injected revenue into every stage in the supply chain early in 2017, prompting producers to market lighter-weight cattle. Rising feed costs also moved cattle faster through the chain.

Then the global red meat market that had been so upbeat in 2017 turned decidedly more uncertain in 2018. The 2017 calves were born at a time when the sector was enjoying a bull market, but by the time the cattle were delivered to Cargill between October 2018 and January 2019, the sector was facing several new setbacks.

Southwest Saskatchewan experienced another dry year in 2017, pushing feed costs higher and challenging efforts to grow the herd. The ranch’s forage production was halved and Chad’s feed costs doubled. Lacking the grass to sustain the herd, Chad and Brian bred fewer heifers, and culled the cow herd.

How feedlot operators make marketing decisions

Market trends often impact the timing for marketing cattle at a feedlot.

On the heels of the U.S.-China trade war, forecasts cooled for global economic growth – the engine driving global meat demand. Both China and Mexico bought less pork from the U.S. in 2018; creating a glut in North American red meat markets, the oversupply pressured prices. Beef prices fell from an average of CA$19.42/kg in 2017 to an average of CA$19.07/kg in 2018.

How market volatility impacts feedlot operators

Feedlot operators must remain flexible and adjust their marketing plans as market conditions fluctuate, especially in times of strong price volatility.

For the love of beef

As a possible contraction of the global market developed, a mature Canadian market continued to show strengthening per capita consumption growth.

The launch of Sustainable Beef is one way the Canadian cattle sector has responded to what some have argued is a waning consumer interest in beef. The entire supply chain has responded to changing preferences and concerns ranging from environmental sustainability to animal welfare with several initiatives, including the Verified Beef Production Plus program.

Photo courtesy of L-7 Land & Cattle

The calves born on the L-7 in 2017 were sent to Cargill’s High River plant between October 2018 and January 2019. The processor has committed their own sustainable beef program to the industry initiative. It costs the Rosses to participate in the program: they pay the fees for the independent, third-party auditor to ensure compliance, and they ensure their processing chutes meet program requirements, among other costs.

But the program was a good fit for them, Chad says, as they were already doing much of what are now the sustainability standards. There’s a short-term return through a premium paid back to the L-7, but it’s the long-term goal of giving consumers the beef they want that will ultimately pay the richest dividends. Simply put, consumers love beef.

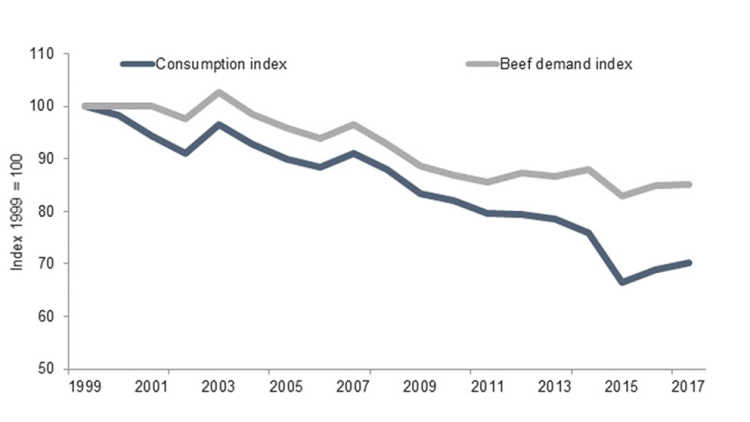

Canada’s per capita beef consumption has been falling over the long term (Figure 1), but Canadians still prefer it when given an equivalent option.

Figure 1: Canadians prefer beef

Source: Statistics Canada, FCC Ag Economics computation

Canadians buy more beef when disposable income grows and/or beef prices decline, as has happened since 2015. But beef “demand” – or consumers’ preference for beef relative to pork or poultry – has always remained stronger than consumption trends (or actual purchases of beef). This means that if consumers can afford to buy whatever meat they want, and if the prices of competing proteins remain constant, they’ll buy more beef over time.

Beef “demand” – or consumers’ preference for beef relative to pork or poultry – has always remained stronger than consumption trends.

Throughout the supply chain

What happens in far-off places matters locally. Along with every other Canadian cattle producer, the Ross family deals daily with the ramifications of changing food preferences in foreign markets, trade negotiations, and the value of the loonie. The industry’s response to conditions arising at home and abroad continues to evolve, ensuring a Canadian supply chain that can adapt and remain a world leader for years to come.

For more information on the L-7, Saskatchewan’s cattle industry or Canada’s beef supply chain, visit:

L-7 Land and Cattle on Facebook

The Saskatchewan Cattlemen’s Association

The Saskatchewan Cattle Feeders Association

Canada Beef

Canadian Beef Checkoff Agency

Simmental Cattle

Martha Roberts

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.