Fixed vs. variable rate – what’s the right choice?

Should I take out a variable-rate loan, or lock in a fixed rate? It’s a question lenders get every day, and it’s a question with no one-size-fits-all answer.

Every operation is unique: cost of capital, current and future capital investment requirements, cash flow and structure of debt are all different. Every business owner also has their own distinct risk tolerance.

In this blog post we define the differences between fixed- and variable-rate loans and analyze what it means for borrowing in this uncertain economic environment.

How are these two rates determined?

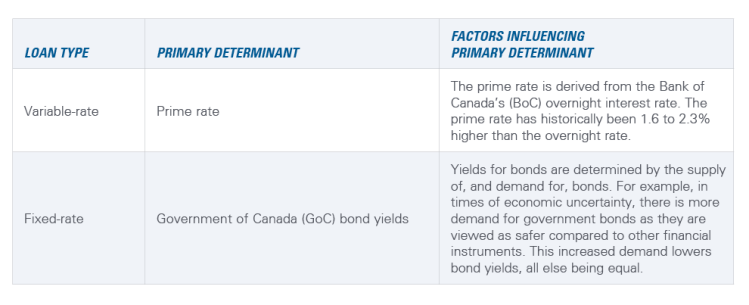

Before diving into our analysis, let’s clarify the largest determining factors of the two different types of loan products.

Table 1: Understanding economic drivers of variable- and fixed-rate loans

Our hypothetical loans

The starting point for this analysis is two hypothetical loans – one fixed-rate, and one variable-rate. To complete the analysis, we needed to make some assumptions common to both:

The mortgage amount is $500,000

The terms of the loans are five years (five years being the most common term at FCC, regardless of interest rate type)

Amortization is 25 years

Payments are monthly

Both are closed

We do not make assumptions about the individual borrower’s creditworthiness

For the variable-rate loan, the borrowing rate is prime plus 1.0%

For the fixed-rate loan, the borrowing rate is the five-year GoC yield plus 2.5%

With our assumptions set, we can look at cash flow under different scenarios at different points in time.

The historical assessment

The period from 2002 to 2007 was the last time we saw significant movement in the prime rate in both directions – first up, then down, then up again. Assuming we took out a five-year variable-rate loan in February 2002, this movement in the prime rate impacts our monthly payment amounts by about $600 per month (Figure 1).

Figure 1: Prime rate gyrated between 2002 and 2007, impacting monthly payments on our variable-rate loan

Sources: Statistics Canada, FCC Calculations

Contrast that with a five-year fixed-rate loan. In February 2002, the rate on this loan would have been 7.15%, with monthly payments of $3,581 – higher than the payments in all periods of the variable-rate loan above, even the period where prime increased to 6.0% at the end of the term. Over the course of five years, the difference in monthly payment amounts accumulates, and by the end of the term, going with the variable rate generates $28,000 in monthly payment savings (Figure 2).

Figure 2: Going variable in 2002 would have resulted in significant savings

The dollar amounts above the bars indicate the difference (increase) in annual payments by choosing a fixed- over variable-rate loan.

Sources: Statistics Canada, FCC Calculations

The forward-looking assessment

Of course, the analysis above was conducted with the benefit of hindsight. We do not know with certainty what direction interest rates will go over the next five years, but we can use economic modelling tools to provide some quantitative direction.

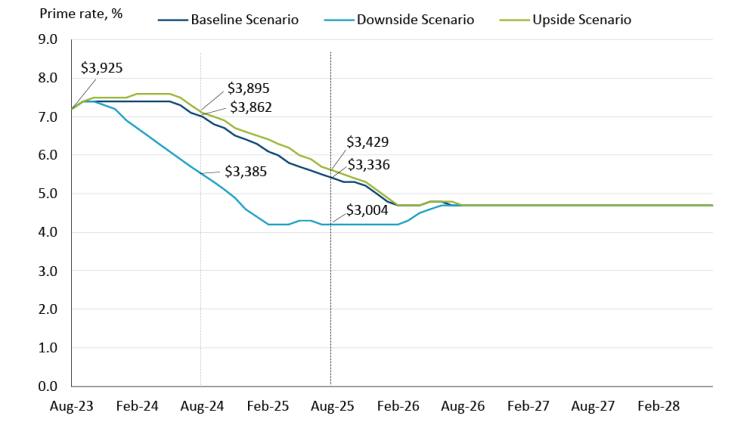

Moody’s Analytics provides us with forecasts of where the prime rate could go over the next five years under different scenarios. Each scenario has a different probability of occurring.

Baseline scenario. This is the most likely scenario according to Moody’s. Under this scenario, the BoC is close to the peak of its current tightening cycle and slowly begins cutting their overnight rate in mid-2024.

Upside scenario. Under this scenario, GDP growth is slightly stronger than expected and the BoC must increase the overnight rate a couple more times before slowly cutting the overnight rate in mid-2024.

Downside scenario. Under this scenario, GDP growth slows and then a recession occurs in 2024. The BoC, noticing the slowing growth, begins cutting rates in late 2023. Rate cuts throughout 2024 are more aggressive than under either the baseline or upside scenarios.

With a variable-rate loan, monthly payment amounts under these different scenarios change as the prime rate changes (Figure 3).

Figure 3: Prime rate projections under various economic scenarios

Sources: Moody’s Analytics, FCC Calculations

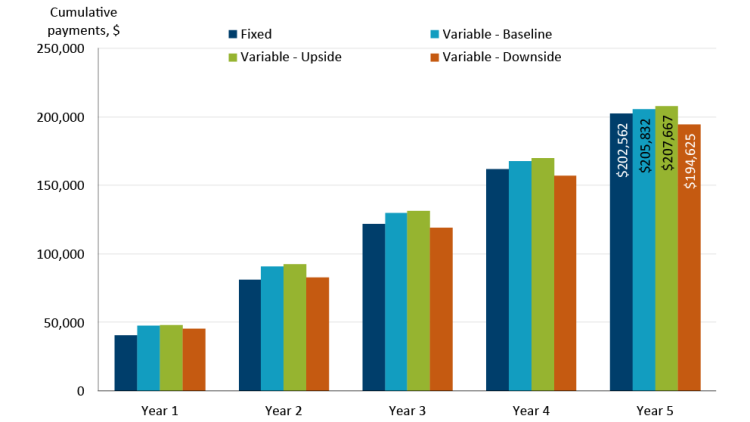

In this analysis, we use the five-year fixed rate of 6.5%. This results in monthly payments of $3,376. Over the entirety of the five-year term, going with a fixed rate is preferable to going with a variable rate in the baseline ($3,200 in savings) and the upside ($5,100 in savings) scenarios. However, going with a fixed rate under the downside scenario results in an additional $7,900 in payments. Only under the downside scenario — where the BoC cuts rates quicker and deeper — does it make financial sense to go with a variable rate with our hypothetical loan (Figure 4).

Figure 4: Going variable generates savings only under the downside scenario

Sources: Moody’s Analytics, FCC Calculations

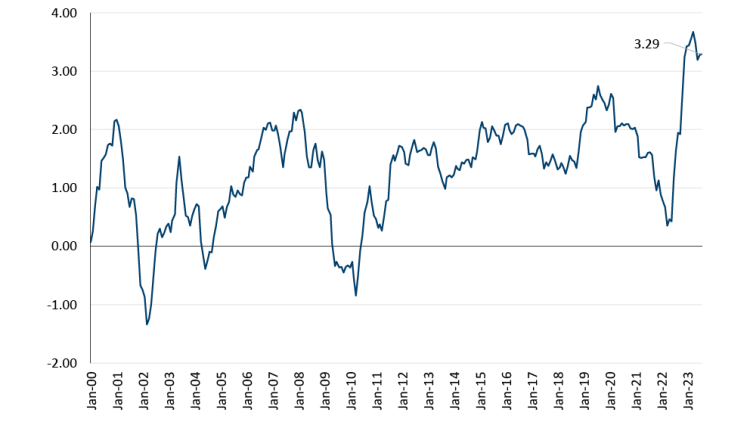

Why is the situation in 2023 so different from the one in 2002? As we’ve highlighted before, the yield curve is extremely inverted, meaning shorter-term rates are much higher than the yields on longer-term bonds. In fact, the prime rate has rarely been this much higher than the five-year GoC bond yield in the last 25 years (Figure 5).

Figure 5: The spread between the prime rate and the five-year GoC rate is currently wide

Source: Statistics Canada

Bottom line

This analysis does not constitute advice. It is meant to be illustrative and to highlight the unique interest rate environment we find ourselves in today.

Communication with your lender is incredibly important as there are so many different factors to consider when choosing between a fixed and variable rate. This includes, but is not limited to, the timing of capital investments (loans being paid off, when new investments will be required); product features, including prepayment limits and fees; cash flow and structure of existing debt, including existing floating debt exposure; and one’s own risk tolerance. Conducting scenario analysis as we’ve done above can help operators understand their risk exposure within different economic environments.

Further reading and resources about factors that influence interest rates:

Graeme Crosbie

Senior Economist

Graeme Crosbie is a Senior Economist at FCC. He focuses on macroeconomic analysis and insights, as well as monitoring and analyzing trends within the dairy and poultry sectors. With his expertise and experience in model development, he generates forecasts of the wider agriculture operating environment, helping FCC customers and staff monitor risks and identify opportunities.

Graeme has been at FCC since 2013, spending time in marketing and risk management before joining the economics team in 2021. He holds a master of science in financial economics from Cardiff University and is a CFA charter holder.