Affordability of farmland remains low despite higher revenues and lower interest rates

Demand for Canadian farmland remained strong in 2020 due to record-low interest rates and improved crop production revenues. According to the FCC Farmland Values Report, farmland values increased 5.4% in 2020.

Average farmland values have increased every year since 1993 and were more pronounced from 2011 to 2015. Since then, Canada has seen more moderate single-digit increases. But despite low interest rates and high farm revenues in 2020, affordability was at its second-lowest level in the last 20 years.

In this post, we look at the farmland values report findings through the lens of ownership costs.

Calculating farmland annual payment

Most farmland is purchased with a combination of equity and debt. And the affordability of farmland is a matter of land prices, financing costs and farm revenues.

Let’s assume we have a new land purchase with a down payment of 25% and a loan amortized over 25 years. The annual payment will be based on the loan interest rate.

To determine the farmland annual payment, we’ll use the effective average business interest rate (a weighted-average borrowing rate of bank and market interest rates), which averaged 2.7% in 2020. The formula for determining the farmland annual payment is:

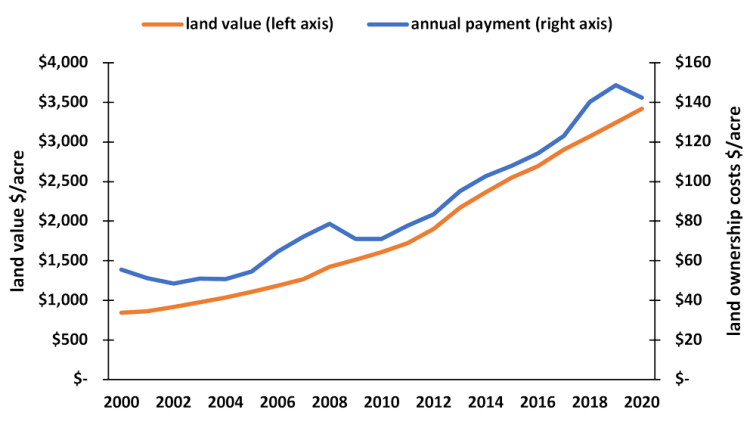

Farmland values and annual payment tend to evolve at the same pace (Figure 1) but differ as interest rates rise or fall. Despite rising land values in 2020, lower interest rates reduced payments. Average Canadian annual payments per acre declined 4.3% to $142/acre in 2020 despite land values increasing 5.4%.

Figure 1. Canadian average farmland values vs. the cost to purchase

Source: FCC calculations.

Measuring affordability

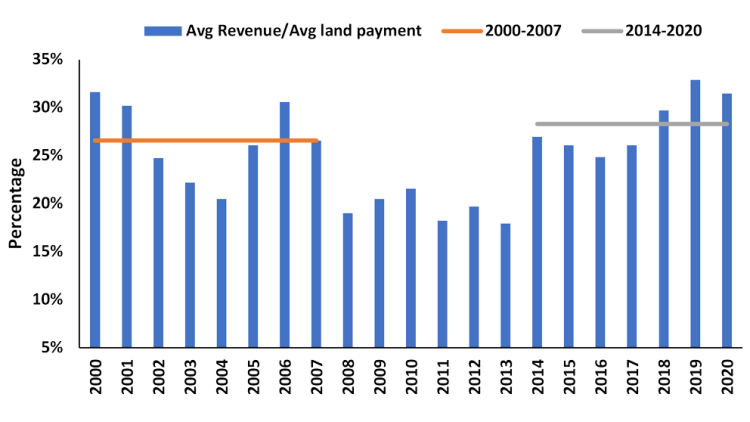

A measure of affordability is obtained by comparing land payments relative to gross revenues derived from crop production (Figure 2). We used average provincial yields and prices to measure revenues – a soybean-corn rotation in Eastern Canada, a canola-wheat rotation in Western Canada and a potato-wheat rotation in Atlantic Canada.

Figure 2. Canadian share of crop revenues allocated to average land payments

Source: FCC calculations.

Land payments as a percentage of crop revenue declined from 33% in 2019 to 32% in 2020 due to strong crop receipts and lower interest rates. This remains slightly higher than the 2014 to 2020 average of 29%. The 2008-2014 average share of crop revenues devoted to ownership costs was the lowest. That period also had some of the highest increases in farmland values, highlighting the strong annual returns in the grain and oilseed sector during this period. As crop revenues following 2014 showed stability, land values increased, resulting in affordability declining.

The trends are similar across all provinces, but the proportion of crop revenues to cover payments varies considerably. In Saskatchewan, the share of crop revenues (canola-wheat rotation) relative to average land payments was estimated at approximately 18% in 2020, down from 19% in 2019.

In Ontario, the share of crop revenues (soybean-corn rotation) is much higher at 66% in 2020. Ontario agriculture is diversified across many enterprise types, including horticulture and livestock sectors that compete for farmland. Also, farmland values vary considerably within Ontario, ranging from as low as $2,000/acre in Northern Ontario to as high as $32,900 in the Central West region. High valued land would require gross revenues of $4,200/acre to reach the national average of 32% of revenues covering payments.

Elevated payment/revenues ratios suggest that observing farmland purchases with a negative net cash flow is possible in the current environment. In this case, the ability to “subsidize” the purchase from other sources of revenues or other land will factor in the buyer’s decision.

Expected farmland value trends in 2021

The low interest rate environment and strong grain and oilseed prices will continue to drive strong demand in 2021. And tight availability will likely mean higher farmland values.

Monitor interest rates trends as the economy recovers. There are some early signs of rising yields for longer-term bonds. Understanding the influence of various rate and farm income scenarios on farmland payments is an essential component of a solid financial risk management plan.

Leigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.