Canadian farm equipment sales to slow in 2024

New farm equipment sales are projected to be softer into 2024, as higher interest rates, elevated equipment prices and a decline in commodity prices impact purchasing decisions. However, the farm equipment fleet is showing signs of aging. This is a trend to monitor in 2024 and beyond as dealers may see increased demand for service and parts.

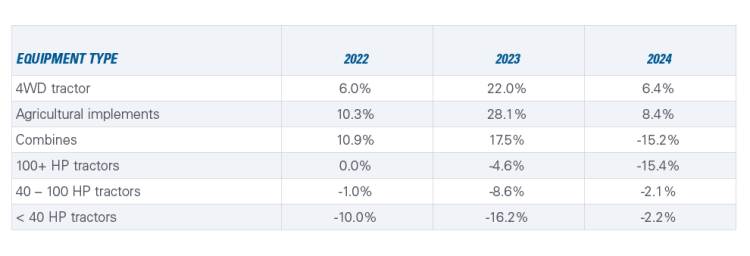

New farm equipment sale projections

New farm equipment unit sales are projected to record mixed performance for the remainder of 2023 and 2024 (Table 1). Strong sales in 2023 reflect the resolution of supply chain issues and record-high crop receipts in 2022 and the first half of 2023. 100+ horsepower and lower tractors are expected to have unit sales decline in 2024 as purchasing decisions reflect a more cautious environment due to challenges in the livestock sector due to the drought in western Canada and tighter revenues for hog and dairy sectors in eastern Canada. The slowing Canadian economy will also reduce demand for lower horsepower tractors. Canadian implement manufacturing dollar sales are expected to finish higher in 2023 due to price inflation on raw materials used in manufacturing. Both 4WD tractors and implement manufacturers (e.g., air drills) faced delivery issues and low inventory levels throughout 2023, which are driving part of the increase in our 2024 projections.

Table 1: Equipment sales growth

Sources: Association of Equipment Manufacturers, Statistics Canada, and FCC Calculations

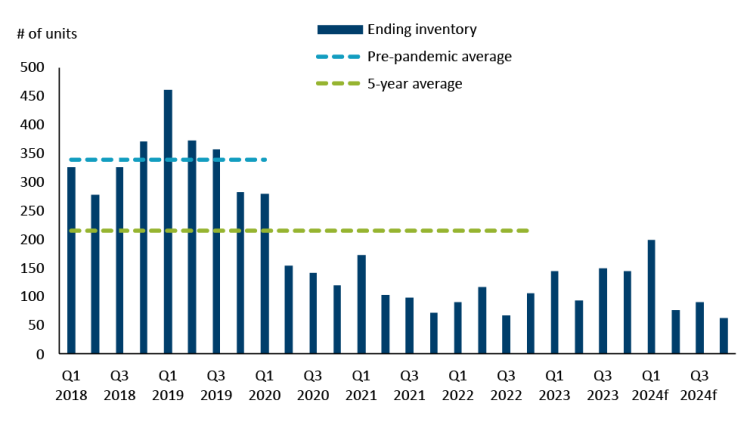

Equipment inventory levels have improved – 4WD tractors remain low

Inventory levels of new equipment rebounded in 2023 and are now in line with the 5-year average for most categories as sales slowed and manufacturers caught up on deliveries. However, 4WD tractor inventories are expected to remain low (Figure 1).

As new equipment sales slow, inventory levels will continue to increase, returning closer to pre-pandemic levels as manufacturers build new units. Manufacturers are unlikely to adjust production levels in the short term. Rising inventory levels of new equipment will spill over to the used equipment market.

Figure 1: Inventories of new 4WD tractor projected to remain low

Sources: Association of Equipment Manufacturers, FCC Economic forecast

Sales of used equipment this year for combines and 4WD tractors have already eased by approximately 20%. However, the number of used air drills sold continues to be strong, up 26% this year due to reduced deliveries of new manufactured units and subsequent trades over the previous few years.

Trends to monitor in 2024

1. Inflation and interest rates

Inflationary price pressures remain persistent despite recent economic weakness, meaning interest rates will likely stay higher for longer, which may alter equipment replacement cycles. That has impacted farm equipment sale trends as producers have delayed purchase decisions until interest rates stabilize or fall. Also, more cash has been utilized in purchase decisions due to strong profitability over the past few years.

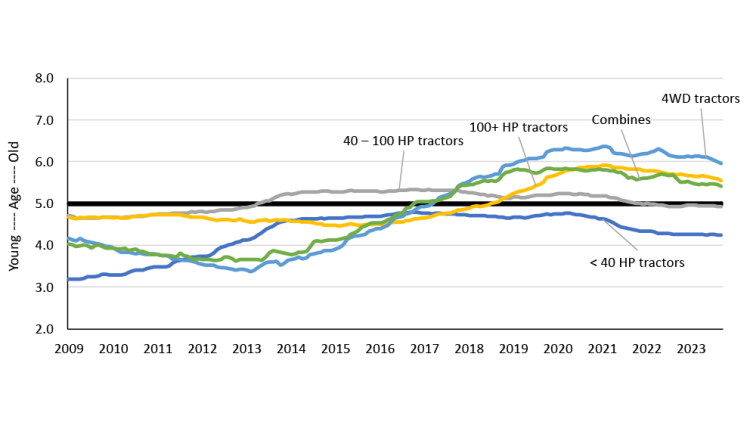

2. The age of Canadian farm equipment

As replacement cycles lengthen, sales will slow, and inventory levels will increase. However, a major trend is the age of the equipment fleet. The strong sales during the 2008 – 2014 period are early indications that the 4WD tractor, 100+ HP tractor and combine fleet is starting to age when looking at the rolling average of 5-year sales relative to 10-years on new equipment to estimate the replacement cycle age (Figure 2).

Figure 2: Proxy age of new farm equipment replacement cycle

Sources: AEM and FCC calculations on new equipment sale trends

While replacement cycles can be altered, and older equipment can be serviced and overhauled, a slowdown in new equipment sales could be short-lived. Sales could improve in the second half of 2024 and beyond if interest rates decline and producers move to upgrade their aging fleet. One factor producers must also balance in their decision-making is the additional repair costs of older equipment and efficiency gains in newer models.

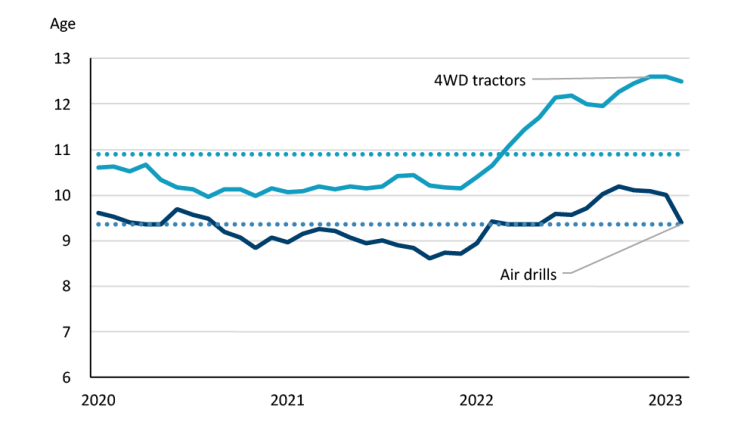

The average age of used equipment has also trended higher for both 4WD tractors and air drills compared to the past several years (Figure 3). The close sales relationship between 4WD tractors and air drills is less prevalent due to tight inventory levels and reduced trades of newer units. However, recent stronger trades of air drills have started to reverse this trend. The disconnect between the ages of 4WD tractors and seeding units will be interesting to watch in 2024. The wildcard remains whether the increased 4WD sale projections and producer replacement decisions will reverse the divergent trend with the age of air drills.

Figure 3: 12-month rolling average age of used equipment sales

Sources: Iron Solutions and FCC calculations

3. Commodity prices and farm revenue

Farm revenue is the main driver of equipment sales. While commodity prices have come down from their 2022 highs, record-high crop receipts in 2022 and the first half of 2023 have placed many Canadian farmers in a strong financial position to absorb rising interest rates and equipment prices. While the drought in western Canada means overall reduced production, there are regions where the crop was better than expected and will support the cash flow of producers.

Bottom line

The 2024 farm equipment market will be characterized by softer sales, rising equipment replacement cycle and inventory levels for most equipment categories, and the producers’ strategies for equipment replacement. These market characteristics will influence equipment dealers’ revenues as an aging fleet brings an opportunity to sell both new models and used machines as well as sell parts and provide service that maintains the older fleet.

Leigh Anderson

Senior Economist

Leigh Anderson is a Senior Economist at FCC. His focus areas include farm equipment and crop input analysis. Having grown up on a mixed grain and cattle farm in Saskatchewan, he also provides insights and monitoring of Canada’s grain, oilseed and livestock sectors.

Leigh came to FCC in 2015, joining the Economics team. Previously, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a master’s degree in agricultural economics from the University of Saskatchewan.